Many of us may have experienced a long-term care event through a family member or friend and have personally seen how impactful it can be both emotionally and financially. For this reason, long-term care insurance is now at the center of many planning conversations. However, many high-net-worth individuals, who can potentially self-insure, tend to overlook the benefits long-term care insurance can provide. Even if funding a long-term care need is not a concern, there are other reasons it should be considered – liquidity and insuring your portfolio. While incurring the long-term care cost may not be an issue, what may be problematic is the timing of the event.

Celeste C. Moya

If you are turning age 65 today, you have almost a 70% chance of needing some type of long-term care services. And over the past few years, the cost of medical care has nearly doubled that of regular inflation.

Many of us may have experienced a long-term care event through a family member or friend and have personally seen how impactful it can be both emotionally and financially. For this reason, long-term care insurance is now at the center of many planning conversations.

However, many high net-worth individuals, who can potentially self-insure tend to overlook the benefits long-term care insurance can provide.

Even if funding a long-term care need is not a concern, there are other reasons it should be considered.

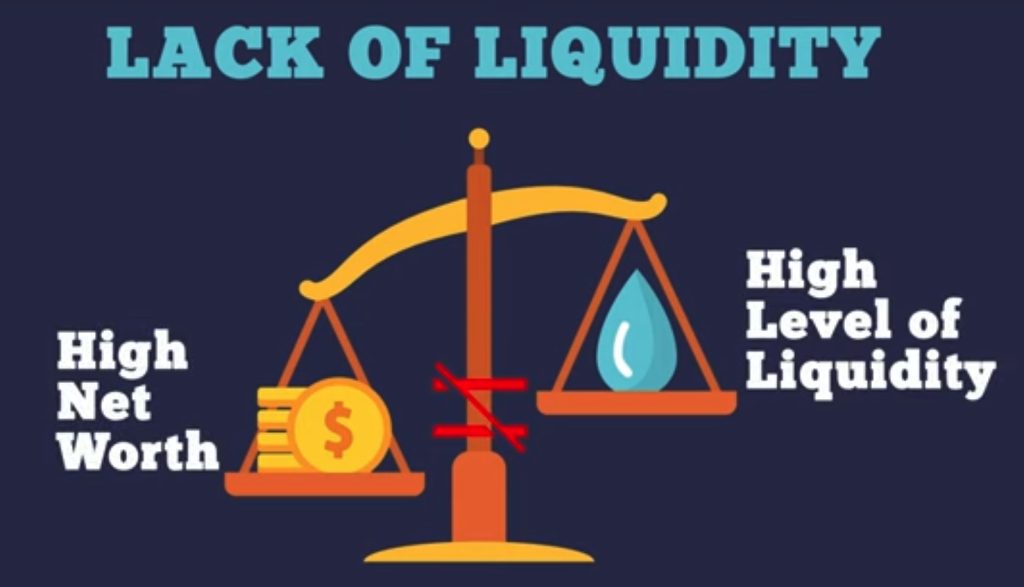

One reason could be a lack of liquidity. High-net-worth does not equate to a high level of liquidity. Liquidating assets may be expensive and could involve taking a loss or facing tax consequences, potentially jeopardizing their overall financial planning strategies. Therefore, the need for long-term care insurance may come down to liquidity, and not net worth.

One reason could be a lack of liquidity. High-net-worth does not equate to a high level of liquidity. Liquidating assets may be expensive and could involve taking a loss or facing tax consequences, potentially jeopardizing their overall financial planning strategies. Therefore, the need for long-term care insurance may come down to liquidity, and not net worth.

Another reason could be insuring their portfolio. While incurring the long-term care cost may not be an issue, what may be problematic is the timing of the event. If the need occurs during a market downturn, withdrawing funds for care could have a much more adverse and prolonged impact on their overall portfolio, especially if there is an extended health care event such as Alzheimer’s or other cognitive impairment. Additionally, cost of care may look very different for high-net-worth clients accustomed to elevated lifestyles, leading to increased risk to their portfolios. Instead, why not leverage an insurance company to absorb some of that risk while the market recovers, and in turn, preserve their portfolio from further deterioration?

Carolyn J. Smith

Celeste, what may come as a surprise – is that 26 years ago in order to encourage personal responsibility for future long-term care needs, the Health Insurance Portability and Accountability Act of 1996 was signed into law. It provided, in general, that the income from a qualified long-term care insurance policy is non-taxable, and the premiums may be tax deductible.

The tax deduction depends on whether you are paying as an individual, employer, business owner, etc. So, please review your situation with your tax advisor.

What is not readily known is that qualified long-term care premiums may be paid from a Health Savings Account. And, since qualified long-term care premiums qualify as a medical expense, they do not reduce the annual gift tax exclusion if you are paying the premium for someone else. Note, in both of these situations, there are age-based limits that apply.

What is not readily known is that qualified long-term care premiums may be paid from a Health Savings Account. And, since qualified long-term care premiums qualify as a medical expense, they do not reduce the annual gift tax exclusion if you are paying the premium for someone else. Note, in both of these situations, there are age-based limits that apply.

The key message is that 26 years ago tax benefits were added to the tax code – testifying to the vital social importance of this planning.

Long-term care policies have come a long way, and many are no longer “use it or lose it,” instead offering flexible benefits that can be accessed in various ways.

Personally, Todd and I have both experienced the responsibility for caring for a loved one. Thanks to the variety of services that can be funded by a LTC policy, we both saw the additional support and assistance that a long-term care policy provides during what easily becomes an overwhelming time for the insured and their family.

Celeste C. Moya

Long-term care planning should not be dictated by a person’s net-worth, but instead be considered as a risk management and asset protection tool that can be strategically utilized for clients at varying levels of wealth.

Most high net-worth clients have a legacy plan in place, which dictates how they want their assets to be distributed at their death. An unplanned and/or extended long-term care event could impact these plans. Monies they planned for family members and/or their community may now go to the health care system. Instead, lets help your clients develop a plan that keeps them in control of their assets, protects their legacy plan, and allows them to transfer this risk in an efficient manner.

At C3 Financial Partners, we look forward to helping you gain clarity in your goals and objectives, confidence that you are making the right decisions, and coordinating with you and your other advisors.

™

™