With the colder weather upon us, it seems like coffee is powering us all through the day, and “Coffee with C3” is still going strong. We hosted our fourth 15-minute webinar in October, “Going in the Right Direction (Farther and Faster) Using the Compass.” Todd S. Healy, Carolyn J. Smith, and Celeste C. Moya sat down to discuss ways to determine whether or not you are going in the right direction — in life, at work, or with your clients.

Lacking a clear set of next steps could result in a very expensive setback for you and your firm. In fact, Charles “Chuck” Hollander of Red Flag, LLC shared with us in our last Consume & Converse webinar that 40% of the projects we work on, whether that be client acquisitions or encouraging clients to take action, get delayed or put off. Of those, nearly half never get implemented/completed.

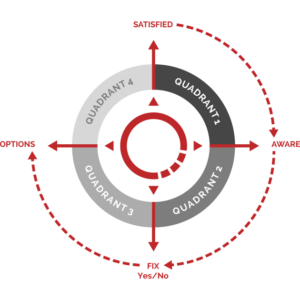

Our C3 team talked about how to improve problem-solving processes and client satisfaction using Chuck’s tool: The Red Flag Compass™ (The Compass).

What is The Compass?

The Compass is a tool used to inform the conflict resolution journey of a client or team. At the Northern point of The Compass, a client or individual is “Satisfied” with their current situation.

The Compass is a tool used to inform the conflict resolution journey of a client or team. At the Northern point of The Compass, a client or individual is “Satisfied” with their current situation.

“Satisfied,” in this case, typically means that the client is not actively moving forward towards their goals. It does not imply that the current situation is without potential problems.

Our job is to be cognizant of all the potential gaps between the current situation and objectives and make them “Aware,” bringing them into the Eastern point of The Compass. Next, we have to understand if those gaps are problems that the client or team wants to “Fix.”

Oftentimes, people only want to address their big problems, not their little ones. It is important here to move forward based on their objectives and not your personal opinion.

If a decision is made to fix the problem, you will move to the Western point of The Compass and model “Options” to help solve the problem. Based on the nature of the situation, a team or individual will explore and select an option, ultimately moving back to “Satisfied” through the implementation of a solution.

The Compass In Action: External Client Experiences

Our team at C3 has learned a great deal about The Compass over the last decade working with Chuck. Implementing this tool in our workflow has greatly improved our clarity in progress with clients and our internal team and advisors.

Todd recounted a recent situation with a young couple who had been referred to C3. The pair was going to inherit a tremendous amount of money. In an initial Zoom call with them, Todd asked if they foresaw any potential issues with this inheritance; if they were “Aware” of any gaps. The couple was uncertain and said they would get back with all the relevant legal documents to help.

After a couple of weeks of not hearing from them, Todd followed up and used The Compass in the meeting. After going through the points of The Compass, the couple was able to identify obstacles in their path keeping them from their goal of receiving their inheritance in a safe and responsible manner.

Understanding their specific obstacles moved them from “Satisfied” to “Aware,” allowing the clients, as well as the C3 team, to shift their approach and prioritize finding solutions to problems they wanted to fix instead of remaining stuck in “Satisfied.”

In another example, Celeste had a client that had received a significant amount of property in the U.S. as a gift from her aging parents. At that time, the property was valued around $15 million. Both parents and the daughter were Mexican nationals, with no permanent residency in the U.S. They spent most of their time in Mexico.

Celeste said, “When I met with the client, she was “Satisfied” without the coverage because she was not “Aware” of her estate tax exposure.” In Mexico, there is no specific inheritance or gift tax, so the concept of tax on U.S. property was completely new to the client. “We also discussed the exemption, but as a foreign national, her exemption is only $60,000. That meant that at her death, her estate was going to be subject to about a $6 million estate tax.”

Celeste identified the gap between the client’s situation and her goals, making the client “Aware” of the issue. The woman quickly decided that she wanted to “Fix” the problem and the two explored potential options to address the issue. In the end, a policy was placed on the daughter, moving the client back to the Northern “Satisfied” point on The Compass, knowing that her family’s property and estate would be protected.

Another C3 client, a business owner, owned 10-year term policy on one of his “key” employees. The end of the 10-year period was coming up. The client did not want to keep the policy nor did they want to convert it. They were “Satisfied” with letting it terminate with no value.

Our team made the client “Aware” of the life settlement market, and the owner agreed they wanted to explore the options. They ended up selling the policy and received back all the premiums that they paid during that 10-year period and an additional 40% on top of that.

Overall, The Compass helps our team identify if a client has potential exposure and provides information to help them gain clarity and, ultimately, the confidence to move forward with fixing the problem. Our experience, used with this tool, allows us to better serve our clients and their planning needs.

With all that being said, The Compass is a living, breathing tool that is guided by its user’s goals. For instance, it is entirely possible –common, even– to go around The Compass with a client and find that they are truly “Satisfied” and not interested in addressing any of the gaps we have identified.

Carolyn mentioned a client in this exact situation where she identified a potential opportunity for the client to look into family planning for future grandchildren. At the time, the client was truly “Satisfied” with her portfolio and related planning items did not interest them.

Then, when the client’s grandchildren were born, it rocked their world. Those planning items that were possibilities for them before became important items that the client wanted to prioritize and actively pursue.

At the end of the day, things will change. We know that. Understanding where someone is on The Compass and what their interests are in that situation is important, but that point could also change as their world changes.

What if there is more than one problem?

When it comes to financial planning, it is not uncommon for more than one problem to come up at the same time. We recently had such an experience with a business owner and her advisory team.

“Sally” and her two sons were very active members of the management team, and her current plan was for her sons to inherit the business upon her death. Recently, the business had been valued at over $50 million, leading Sally to become “Aware” of a looming estate tax problem.

She organized a meeting of her advisors to talk about this situation. Early on in the meeting, there were various ideas shared by the advisors for Sally to freeze the estate, and different ways that she could begin to transfer some of the business interest to her sons.

Quite surprisingly, Sally stood up and very firmly said “Hey, guys, I want you to realize, I’m still in the process of actually accumulating and building my wealth. I’m in my early 60s, [and] my mom is 95 and very active and healthy. I’m not in the mode of starting the transferring that you are discussing.”

This was a big ‘Aha!’ moment for all of Sally’s advisory team because it revealed that Sally was focusing on not one, but two goals: to plan for the estate taxes and to continue to grow her business. Before this communication of goals by the client, it was easy for the advisors to make an assumption. As the old saying goes, “You don’t know what you don’t know.”

Looking back, it would have been helpful to have spent more time getting clarity around what Sally’s goals or problems might have been. And then actually going through The Compass with her. As we think about it, many of our clients do, in fact, have more than one item on the table. Discovering a client’s goals and objectives, and then working with them to define priorities, allows our team, along with their advisors, to assist in building a plan that is best for the client.

Bringing Awareness to External Problems

Our role is to see all the angles, all the gaps. We can make clients “Aware” of potential problems and offer solutions. When they implement a plan, it’s a win-win.

But, sometimes, they still do not want to implement a plan. In fact, statistics show that half of clients and advisors do not go forward with solutions. In moments like this, realize that we cannot care more than our clients do.

With that, we encourage you to try The Compass with your own team or clients and let us know how it works for you.

Examples highlight the benefit of using the Compass process and is not intended to be representative of the experience of other clients. There is no guarantee strategy or process will be successful.

™

™