The Federal debt has more than doubled in the last 10 years. And economists expect it will continue on this fast, upward trajectory over the next few decades.

The “wealth gap” is getting larger each year.

The House, Senate, and the Presidency are all virtually controlled by Democrats.

We’ve never seen such a deluge of tax laws being introduced in Congress impacting everything from income taxes to inheritance taxes.

When I entered the life insurance business, the amount you could pass tax free was $120,000, and the top bracket was 60%. Today, roughly $12 million is exempt from gift and estate tax with a top bracket of 40%.

This amount will be cut approximately in half at the end of 2025, unless Congress takes action to extend it — which they are unlikely to do. In fact, as we have seen, they are more likely to lower it before then and increase the top brackets.

In addition, tools and techniques that we have used for decades to help our clients optimize their legacy to family and community are being challenged. This can lead to planning paralysis.

So, what makes our clients reluctant to take action?

Based on our experience, it’s often due to lack of clarity, confidence, and coordination.

Clarity of what their options are, that they don’t have to give up “control,” and what is likely to happen if they don’t utilize the current exemptions; confidence in planning and implementing around these proposed tax law changes; and coordination with their advisors.

What if they could create a trust for the benefit of their spouse and heirs that would:

- incur no gift tax on amounts just over $12 million in 2022;

- give that spouse a lifetime interest in the income and principle-limited to his or her health, education, maintenance or support under a Health, Education, Maintenance, and Support (HEMS) provision.

- allow the beneficiary spouse to be trustee of the trust;

- tax income to the trust back to the grantor spouse;

- taxes paid by the grantor would not be taxable gifts to the trust;

- exclude the total value of assets in the trust of either spouse upon their deaths;

- allow the beneficiary of the trust to do something similar for the benefit of the grantor of the first trust?

A Spousal Lifetime Access Trust, also known as a SLAT, may do all that.

SLATs are a powerful estate planning tool for couples who may be resistant to transfer a significant amount of assets to their heirs today, thereby losing access to those assets.

Let’s take a look at how SLATs work.

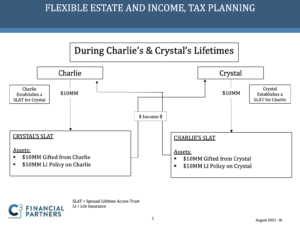

Charlie Confidential, as grantor, creates a trust for the benefit of his wife, Crystal. He contributes up to $12 million without any tax consequences. The income is distributed, as needed under a HEMS provision, to Crystal for her to use in any way she chooses, including paying for their normal living expenses.

Crystal does the same for Charlie. It’s critical to remember that the trusts cannot be identical due to something known as the “reciprocal trust doctrine.” If the trusts are identical, there could be tax implications. The trustee, the ultimate beneficiaries, and the creation of the trust should all be different. Obviously, legal advisors should be consulted on these, and other, issues.

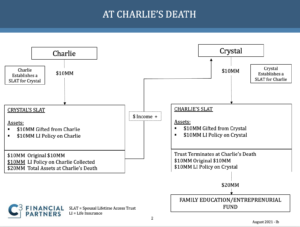

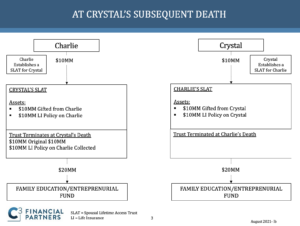

At the death of the trust income beneficiary, the remaining beneficiaries now begin to receive the trust benefits. Typically, the children of Charlie and Crystal.

So, at that time, the income that was being contributed from the trust to help maintain their lifestyle ceases. To some, that would have a negative impact.

One way to overcome that potential problem is to buy life insurance on the grantor of the trust. For example, the trust that Charlie creates for Crystal purchases a life insurance policy on his life. When his SLAT is distributed to his beneficiaries, the life insurance is payable to Crystal’s SLAT. The objective would be for the life insurance to make up for the income lost from Charlie’s SLAT.

When both have died, the life insurance on Crystal’s life will be received by the SLAT. Assuming no growth in the SLATs, and that they only took out the income, the heirs would receive more than twice what they would have received without the planning and implementation by Charlie and Crystal.

There’s no question that taxes are coming. The question is what will you do to protect your children and grandchildren by getting clarity, confidence, and coordination in preparing for the arrival of those taxes?

At C3 Financial Partners, we look forward to helping you gain clarity in your goals and objectives, confidence that you are making the right decisions, and coordinating with you and your other advisors.

™

™