Back to the Future: The Central Role of Family Legacy and Family Governance in Today’s Estate Planning

Before there were estate taxes, there was estate planning, but it was about the people, process, possessions, places, Legacy, Governance and THE FAMILY PURPOSE. Without shared purpose there is often separation and conflict. Many estate planning strategies actually make family governance, legacy and harmony more difficult. Most estate plans today treat future heirs as children for the rest of their lives.

Before there were estate taxes, there was estate planning, but it was about the people, process, possessions, places, Legacy, Governance and THE FAMILY PURPOSE. Without shared purpose there is often separation and conflict. Many estate planning strategies actually make family governance, legacy and harmony more difficult. Most estate plans today treat future heirs as children for the rest of their lives.

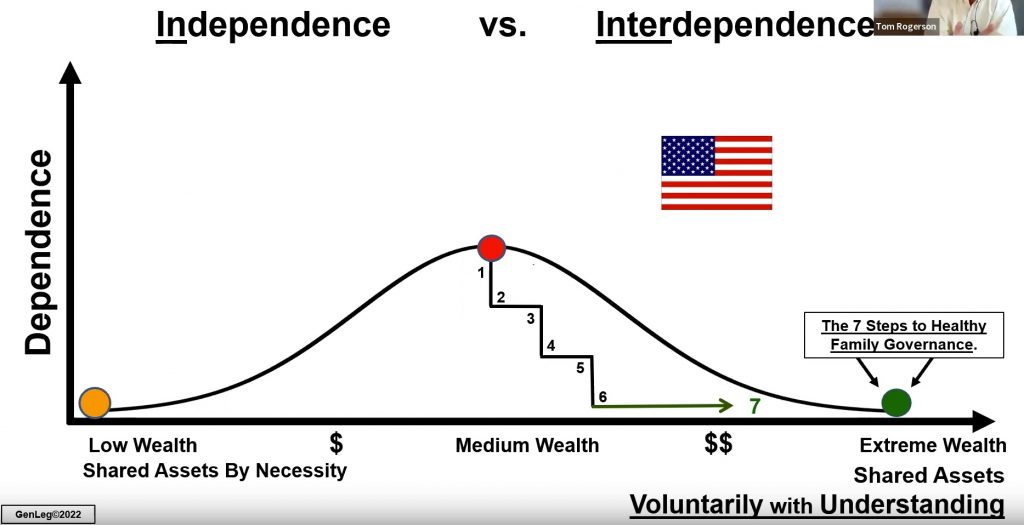

In this talk, Tom breaks down how planning can help a family go from unhealthy independence to healthy interdependence, and then can the plan endow the process? See how a “seven-step process to healthy family governance” can become a critical part of your practice and your client’s success.

Todd: Good morning and afternoon! This is Todd Healy with C3, and we’d like to welcome you to the 2.22.22 webinar event for our group. An event that only occurs once every 100 years. Not the C&C, the date. In fact, this is our 20th C&C event, so we’re really pleased to have you all here from all over Texas: Dallas, San Antonio, New Braunfels, the Valley. Also, in Mexico City! Welcome Jose, glad to have you on the call.

We’re really pleased today to present our topic: “Back to the Future: the Central Role of Family Legacy/Family Governance in Today’s Estate Planning.”

For any of us that have a family, or work with families that are interested in preserving their legacy and their wealth, we are pleased to have Tom speak with us today. We will ask that you please hold your questions and put them in the Q&A. We’ll have a couple of breaks when Tom will take those questions, and we’ll also leave some time in the end. This is being recorded, so we will send it to those on the call.

We’ve heard for many years the saying “shirtsleeves to shirtsleeves in three generations.” That’s something you’re going to hear from Tom this morning. The thing that’s different about Tom is that he has lived it. For those of us who are on the call – because we’ve heard Tom before and we’ve always learned something from him – we value his perspective, and that’s the reason he’s giving this presentation today.

Tom has a very interesting background. He’s been with banks and he’s currently president of GenLegCo. It’s a firm that provides guidance and education to families and their advisors. He helps them with transitioning significant capital: both financial, which is tangible, obviously, and human capital, which is intangible. The focus of his business is transferring from one generation to the next. He’s truly a recognized leader in the family governance and legacy planning arena. He’s worked with over 260 families, facilitating family meetings where they focus on transparent communication, entrepreneurial motivation, philanthropic vision, and legacy planning. He has a very interesting definition of legacy planning that you’ll hear about today, as well as succession development, and then endowing the process for the future so that all can create a generational family bond.

He has a Bachelor’s degree in Economics from Ithaca College and has spoken to way too many organizations to name, but I do want to highlight a couple. First, the World’s Presidents Organization, which is an outgrowth of the Young Presidents Organization. He’s spoken to Harvard Business school, Yale University, Tiger 21, the Museum of Art, and Heckerling Foundation, to name just a few.

So Tom without further adieu, I’ll turn it over to you. Thank you for being here.

Tom: Thank you for having me. Welcome everybody and thank you for attending. We do have quite a bit to cover, so I’m gonna jump right in. I’m glad that in the introduction Todd talked about the fact that all families can benefit from this presentation. It is not just the high-net-worth families. My wife, Cathy, and I coach high-net-worth families primarily, but anybody can benefit from what we do.

In fact, I’m going to talk a little bit about my own family. My father’s family came from a wealthy American family. My mother came from a very low net worth Cuban family. I might have learned more about wealth preservation – true wealth of a family – from my mother’s family. But wealth isn’t money – part of it is – but there’s a lot of other things, such as human capital. My father’s family had financial capital but didn’t have the human capital. So it really is interesting how families that have financial capital and human capital are actually making the longer term difference. That’s what we’re going to be focusing on.

Some statistics to focus on why this is relevant and timely nowadays – in a Mindscape Study not long ago, of the respondents, 61% rated legacy development as a top financial need. And yet, they said their estate planning advisors were not focusing on it when putting together their estate plan.

Eighty-six percent of families, according to a Morningstar survey, said that leaving values and life lessons was an important part of inheritance. And again, that was not something that they said was prioritized, at all, in their estate plan or with their advisors.

David York is a top estate planning attorney from Utah. He’s one of the few advisors in the country that I’ve ever met who understands how to incorporate the family purpose into the estate planning process itself. I know a lot of estate planners – there are very few estate planners in the entire country that incorporate the family purpose. There are a lot of people that can help you with the taxes and tax minimization, as well as control of assets after the parents are gone, but very few are really making this transition into what I call “legacy planning” and have it embedded in the document. Not in a side letter, but embedded in the document. David York’s a good example of it, and he’s done some wonderful work.

Marvin Blum in the Dallas/Fort Worth area is another great example of this. David York found that of the families coming into his office (very high-net-worth families, often business owner families), said 90 percent of them had plans that were not currently dealing with their goals, wants, and objectives. Because believe it or not, their goals, wants, and objectives were usually not to get 10% more money to their kids. Their goals, wants, and objectives were mostly for whatever they leave to the kids to have them receive it well. Have it be the intended blessing. How do we prepare them for that? And that was a missing piece.

I spoke at Heckerling last time they had a physical Heckerling on this topic and it was interesting. TD North had done a study of the Heckerling attendees the year before and it was one of the reasons they invited me to speak. What they found in their survey when the Heckerling attendees were asked, “What’s the biggest threat to your estate planning for your clients?” The answer was family conflict. That was the biggest response by far; the biggest issue and concern. It wasn’t that we wanted to figure out how to draft documents that they were looking for. How do we draft documents to protect the assets from family conflict? They were saying, “Our families, our clients, are dealing with family conflict right now. How do we help them with that issue? How do we help them incorporate a conversation process where we can incorporate the family unified shared values into the overall plan down the road?

Our own studies, along with the studies done by Roy Williams and Vic Preisser, have found that most families are failing at preserving family long term – multi-generationally. If you’re not preserving the sense of family multi-generationally, it’s very hard for a fractured, disjointed family to preserve the financial assets, as well. People often focus on “it’s about the money, the money’s disappearing.” Well, it’s because the family is disappearing. In most cases, that is causing the money to disappear along the way.

So far, most of the studies haven’t been able to document the enormity of the loss of family connection and history. Because most of the studies have been focused on a family losing the business.

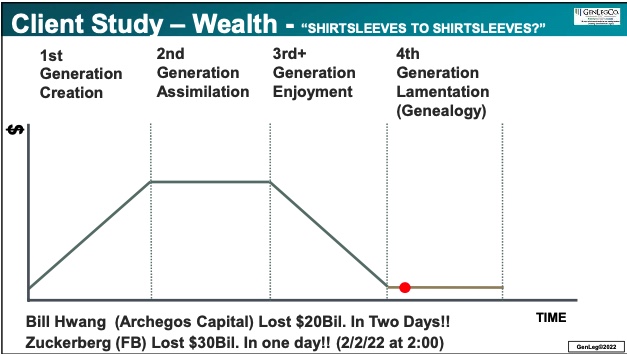

John Ward of the Kellogg school also focused on that in his original study. They might have lost the business, or sold it, and they might still have wealth and other businesses. We found it was a little bit lower than what was originally projected, but it’s still a very high number. In fact, 60% by the end of the second generation lose connection and history. Eighty percent by the end of the third. That’s where Todd mentioned the “shirt sleeve to shirt sleeve” phenomenon that we all are concerned about. The first generations create the wealth, second generations get used to the wealth, third generations enjoy the heck out of the wealth, and then the fourth generation lament the fact that it is gone.

My own family, as Todd mentioned, is right where that red dot is [above graph]. My great grandfather was the president of Boston Safe Deposit and Trust company. It grew to be the largest financial institution in the Northeast by virtually any measure. It was dominant. He started a foundation in Boston that right now has a little bit more than a billion dollars in it. So he was doing pretty well, even by Texas standards. But his estate plan was designed to leave the bulk of the money to the future generations. I’m his great grandson and that money was gone a long time ago, not because of bad investment management. He owned an investment management company, so if you think you can invest your money out of this problem, you’re deluding yourself. Not gone because of planning – one of his son’s, my grandfather’s brothers – was one of the top estate planning attorneys in the country in his day. He was one of the founding members of Act Tech, different name back then, but same organization. His son became the president of Act Tech later on. So it wasn’t gone because of bad planning – there was phenomenal estate planning in the family. It is gone because of how the family operated. And when I say that, I am not saying anything bad about my family–they are a wonderful and loving family – but they were just doing what they thought was normal from generation to generation. But no one in the family, and none of the advisors were teaching them what it otherwise could have looked like. Money can disappear a lot faster than I’m indicating here. As you know, Bill Hwang from Archegos Capital lost $20 billion in two days. Well, because Zuckerberg from Facebook likes to beat people, he lost $30 billion dollars in one day. Today is 2-22-22. On 2-2-22 at 2 o’clock in the afternoon (just about), he lost $30 billion.

“Happiness is having a large, loving, caring, close-knit family in another city,” said George Burns. How do we preserve the sense of family? Because if the family can hold together, it is much more likely to be able to preserve things like the family business, the family wealth, the family foundation. So what does that look like?

The definition of failure is, first and foremost, losing their sense of who they are as a family. It’s amazing how often family members don’t know their family history. Multi-generationally, they don’t know their great-grandparents on both sides of the family. It’s amazing how rarely that’s the case.

Second thing that they lose is a sense of knowing each other within the family. Again, when families gather together for their five-year reunions when they get older. It’s amazing how often they need name tags because they forgot who those cousins are. Especially second cousins. They are losing a sense of who they are. I often hold up a cell phone when I’m doing public presentations and say, “If one of your second cousins called you right now and you picked up the phone, but didn’t see the name, could you recognize them by voice as your second cousin?” Most people say, “Are you kidding me? I mean I don’t even know their names.”

We all say family is the most important thing, and yet families are falling apart incredibly quickly and typically advisors are not helping. The title indicated that before there were estate taxes, around 1916, there was estate planning. Well why would there be estate planning before there were estate taxes? Because nowadays estate planning is almost entirely about the taxes. Well back then it was about the people, the purpose, the intention, the values. If you read an 1800 will, it is embedded in the document. Why isn’t that still the case? Certain attorneys are starting to re-embed some legacy planning back into the mix. It’s very few and far between, but there are some out there.

The third thing families were losing, and the least important, was losing their money in their businesses. I know those are important! But they’re not as important (according to the parents we are working with) as the family knowing each other and being able to work together. It is not as important as the family knowing their history long term and knowing “who we are.” Leonard Sweet said what you set in motion is your family legacy. Some statistics though that are pretty daunting is Williams and Preisser’s original work that of the sixty percent of families that are failing attribute that failure due to lack of trust around group decision making.

This corresponds to my wife, Cathy, and my own work. We have now run over 270 family meetings and, in addition, have surveyed another 200+ families who have succeeded multi-generationally. We were looking for what are the themes of what they are doing that’s different. What are the themes that we hopefully can educate people on and move them forward? Again, what we are finding is that sixty percent of the families that are failing attribute that failure due to lack of trust around group decision making. You are going to see this theme returns time and time again. What we’re going to talk about today is, “how do we build trust around group decision making.”

The second biggest reason for losing was unprepared heirs. People received money they didn’t have the vocabulary of what to do with it. This is important. 77% of the wealthy people you might be dealing with in this country are first-generation wealth. That’s what the studies are showing. The wealthiest people in this country that we look at are 77% of the time first generation. It’s not all old money, it is often new money. They come from what they define as blue collar or a working class background.

The reason that’s important is, preparing themselves for wealth that they earned themselves over time, is different than preparing their children for wealth that they might receive in a moment by a distribution, a gift or a bequest. The first generation probably knew things about wealth before they had any. They knew things like budgeting and lifestyle, what can they afford and not afford, savings and taxes. They knew a lot of things about wealth before they had it. Second generations don’t have the urgency, don’t have the necessity, and they don’t have the wealth to deal with right away. So how do we encourage them and how do we get them involved? It requires motivation. You’re going to see what I think is one of the primary roles, we, as their advisors, can add to our offerings to our highness worth families. How do we help the family educate the next generations in a motivational way? Why do they need to know it along the way?

The third thing that was causing failure is 10% of the failures are due to no clarity of feelings such as, “I have a purpose in my family.” Or, “I don’t have a role in my family.” Most families that we deal with in the estate planning area, give their children the sense that “a few of you are really important to our family and most of you are not at all.” Now nobody would use those terms, nobody would say it that way. But they gave this sense because these are the people in the family who are now going to be running the family business/foundation/investment management or trustees. Then there’s everybody else, “we just love you, but you know you’re not important.”

How do we change that? It turns out if a family succeeds multi-generationally it’s highly likely that the people that we think of as ‘down here’ were more likely the cause of the family succeeding. They had important roles, the family and advisors just didn’t identify it, didn’t celebrate it, didn’t talk about it. That is one of the biggest reasons that families are feeling “we’re not giving everybody a sense that you’re involved, that you are important.” Less than five percent of the failures were due to mistakes made in the planning and investing areas. Maybe the advisor is doing a great job on the money side. But 95% of the reason that families are failing is not about the money, it is because of the family.

These are culture related issues. Business owners talk about business culture a lot. There’s a great deal of focus on that. Peter Drucker talked about a lot, as well. He’s a business consultant and he had a famous quote, “culture eats strategy for breakfast.” His whole point was you, as a CEO, can focus on the numbers/metrics/sales/initiatives and the business building. But the culture of your business itself is perhaps more important than anything else you do. The same is true in families. Yet, as advisors we almost always focus on the strategy around the money, the tactics around the money, as opposed to what is the culture of the family.

My wife, Cathy, and I often say this to business owners, “A strong business cannot hold a family together, but a strong family can hold a business together. What are you doing about the family? We don’t care about your business. We are more concerned about your business preservation, by what you’re doing with your family. Please don’t tell me you’re training up one of your kids to be the CEO of the business. That is not building the family, that’s building an individual.”

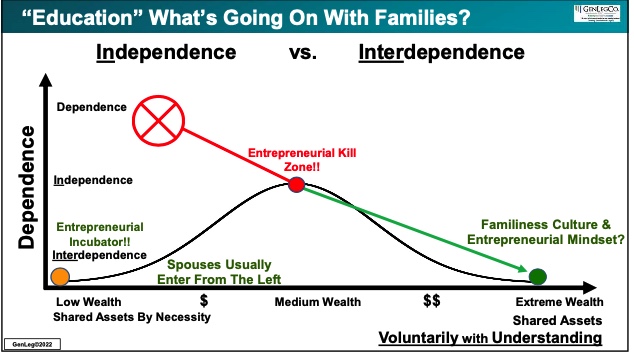

What is interesting is a graphic that we created. Jim Grubman gave me an idea on this. Everything we were looking at, all the research fits into this.

Notice wealth going up to the right in this graph. The level of human independence to dependence on the left. Babies at the top, then independent like teenagers, then becoming young adults. Then interdependent people have a higher intellectual state but in reverse order. There is a wide-tail bell-shaped curve going on that low net worth families had tremendous interdependence. What I mean by that is dinner table conversations in a low net worth family are pretty consequential. Johnny asks “May I borrow the car on Friday night?” Everyone might get involved because it might be the only car. When Jill says she is going to college then everyone might get involved because if she goes to college, everyone’s life is going to change. They are making consequential decisions even at dinner. Even during the day they’re having to make decisions such as who gets the bathroom first in the morning, who shares bedrooms with each other and who does the chores.

To paint the picture broader: many times, children in a low net worth family often go to public school, come home at the end of the day and have to work together. They often have summer jobs. They usually live at home. They don’t go to summer camp. Lots and lots and lots of opportunities to learn how to make decisions together. Do you remember the number one reason that families fall apart? It is due to lack of trust around group decision making. Low net worth families were making decisions together all the time. They might not like it, but they actually knew more about how to work with each other by experience, than a high net worth family.

High network families had the privilege of getting away from all that. They had the privilege of being able to raise their children in that middle dot on the graph. Because if somebody in that lower left-hand corner has chutzpah, and ability, and is able to build up some financial wealth they want to get away from all that. They want to raise their children to be independent. What does that look like? Well dinner table conversations in a more independent family tend to be more social. How’s your golf game dad? How’s your tennis game? You know it’s wonderful and seems really nice, but it’s almost more like a cocktail party. There are not as many consequential times. These children have their own bedrooms and sometimes their own bathroom ensuite. Oftentimes, but not always, they often go to private school and they often go to summer camp. The families have more and more opportunities to be separate. The simple imagery we often give as we say, “Families who are lower income do this automatically and have their wealth increase.”

The speed at which they do this all we’re trying to add. And if we want to add a little bit of this into the plan itself, we can differentiate ourselves as advisors by talking about it. We can differentiate ourselves and we can build more business. We can raise the level of net worth of the families we’re working with by talking about these things. These items are very interesting to the families that we are working with. But you can also bring in more new clients. It’s hard to differentiate when you’re going to talk about estate tax planning from a numbers standpoint, investment management product, you name it. It is very hard to differentiate yourself because people think they know what you’re talking about and they’ve got it covered, but they are wrong. But they do think that, and it’s very hard to get them to listen. In this lower left hand corner that I was painting before, these people are sharing assets by necessity, and this is an entrepreneurial incubator over here.

Seventy-seven percent of entrepreneurs in this country, as I said before, would self define that they came from this lower net worth working class blue collar background. So when I paint the picture of what I just described to you, you wouldn’t believe how many of them are not in here. Such as, “Oh my goodness, you’re describing my upbringing and you’re describing how I’m trying to raise my kids.” Because that middle dot, where they raise their kids, is an entrepreneurial kill zone. When you then start talking about what that could look like, they say again, “I can’t believe it, how do I change this?” Now most parents want to encourage their children to move in that right hand direction – to continue to be independent, thrive and make more money. By encouraging that, some actually do move in that direction. But unfortunately, what they’re finding is that by motivating children for it, there’s a higher percentage that can end up growing up in the middle area where they can feel a sense of guilt or embarrassment from the lifestyle. “Gee, my friends don’t have to go to summer school or my friends are on scholarship at college.” It can be really difficult, typically not when they’re young, but when they go to college and they ask their friend at college, “So where do you go in the summer”? And the college roommate replied, “At home.” We were at a family meeting last week and one of the family members said, “Yeah, it really was a problem when I talked about our second home, or our boats, or our yachts. It was just embarrassing and awkward. I had to not only stop talking about it, I had to get my family to not talk about it around my friends.”

What they’re finding in the studies is that children raised in the independent phase are, unfortunately, quite likely to either never leave the dependent phase of life, or are likely to return to that again. Madeleine Levine in her book, The Price of Privilege, found that children growing up in an affluent environment, or in a high net worth family, are two to five times more likely to have some of these presenting problems listed in the upper left hand corner. Loneliness, anxiety and depression. These are things we had as an epidemic in America before COVID. But the pandemic made it worse. High net worth families are two to five times more likely to have those presenting problems. We can really help clients if we can help them get into this space. Even if they don’t have a kid that is presenting a problem, in general Americans are indicating they’re at a higher level of anxiety and stress.

Wealth doesn’t cause any of these problems, it’s not wealth’s fault. Wealth allows it. Parents often lovingly and intentionally use wealth in ways that often create a higher likelihood of these unintended negative consequences. Nobody seems to be pointing it out, or not enough people are pointing it out along the way.

A few more statistics (this is where COVID really came in), anxiety systems are three times as high. Depression four times. Sixty-three percent of young adults have symptoms of anxiety and depression. Loneliness – off the charts. Anxiety rates – through the roof. Online alcohol sales are up 400 percent. Thirteen percent have increased substance use over time, and again loneliness and stress. Adults report negative impacts on mental health. Again these all existed before COVID it’s just we are in a hyper situation where we could really help families by being able to address some of this.

The whole business model that my wife Cathy and I created is trying to help families from having children moving back in this area, or at least staying in that area and moving down if possible. At the very least, moving to an interdependent phase. How do we reintroduce interdependence? Because if you’re going to become interdependent, as a high net worth family member, you don’t have to do it. If anything, you have the privilege of getting away from it. This has got to be voluntary. And you’re only going to do that voluntarily if you’ve got an understanding. Who’s best to create the understanding? I actually think it’s you on the call, advisors, who may be able to speak better to the family. Because if the parents try to take on this message it’s viewed as another lecture.

So how do we add this to our practice? One of the things that Cathy and I do is consulting with wealth advisors on how to add this language to the conversation. How do we differentiate ourselves? And maybe, how do we add some of these services to what we’re actually offering? It is really necessary. Even if you do a brilliant job on all this and you’ve just got the most well-adjusted kids and they’re all working incredibly well together, then they get married. The odds are, they are going to be marry people coming from that lower left hand area. Just by numbers, there simply aren’t that many people at a high enough level of net worth that they have estate tax planning problems. There just aren’t. The exemptions are too high. So that means that their candidate pool is probably on the lower end. How do we onboard spouses into a family? What I find really interesting is that wealthy families often do this faster. They marry into families from a bit lower income and have a little bit more togetherness. If you are from a wealthy family, where do your kids want to hang out on Thanksgiving or Christmas? Or go on vacation? Believe it or not, it’s amazing how often they want to go on these vacations with the lower net worth family, rather than the higher net worth family. Because of the camaraderie. So again, these culture issues are really powerful to add to what we’re doing. That’s what my wife and I call this “familyness culture” and “an entrepreneurial mindset.” There’s a lot to that, but I am going to skip it for now. We call the middle dot the red zone, we call the lower left hand corner the orange zone, and then the lower right is the green zone. The healthy zone is actually in between the two. Independence is great, but not to the point of estrangement. Interdependence is great, but not to the point of collectivism. So there is a benefit to both.

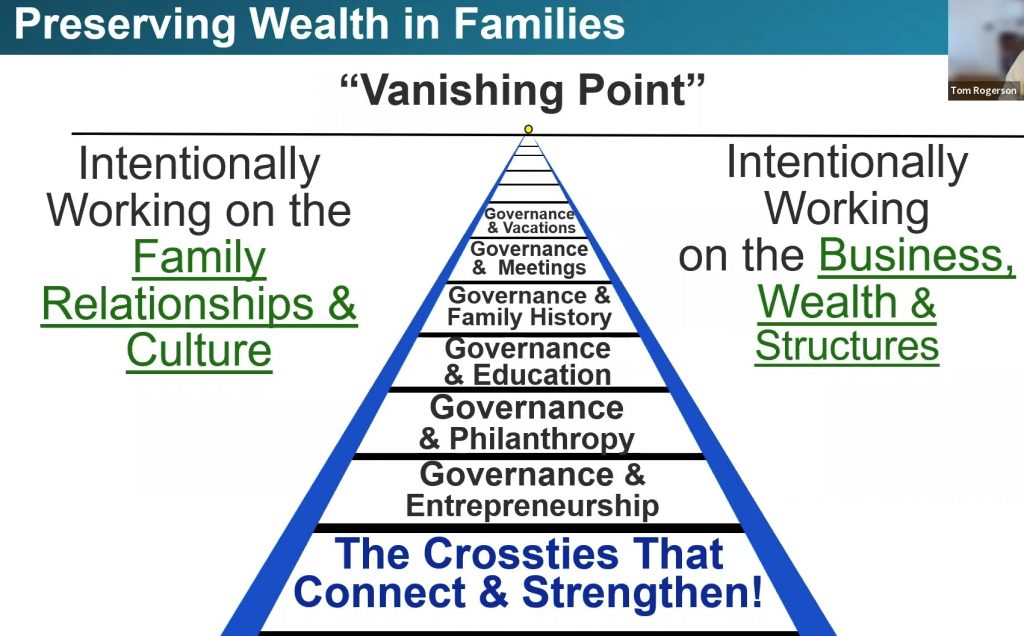

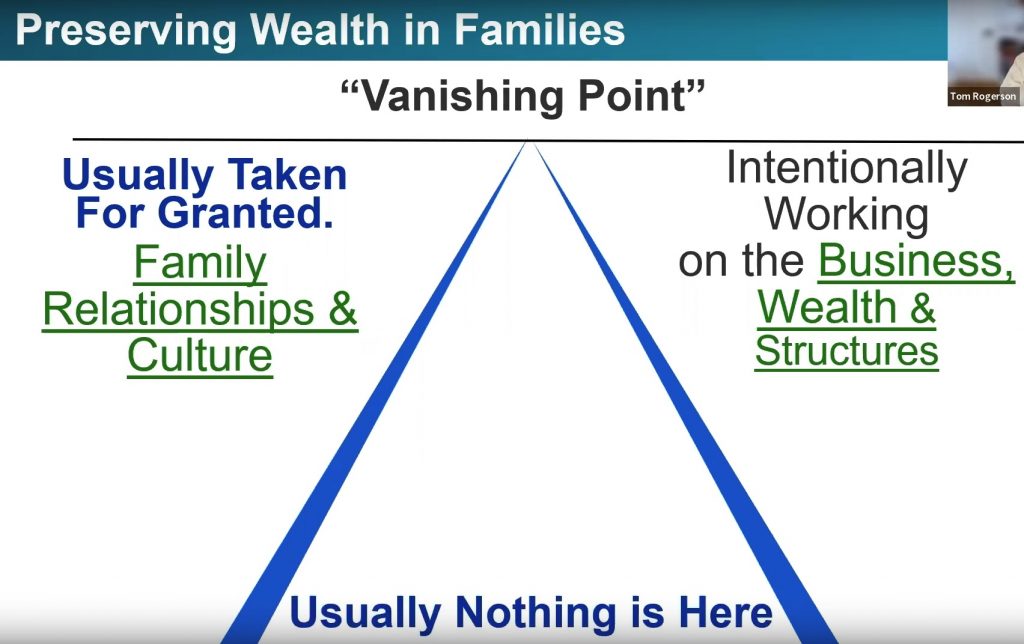

The vision that we use on this: imagine you’re looking at railroad tracks going off to the distance. The lines go out to a vanishing point on the horizon. They look like they come together, but they don’t. There are three things going on in this vision that help parents start to get a sense of how these are different things to focus on. There’s the right hand rail which is the money and the business. That’s really important, don’t get me wrong, and we’re going to focus on that. But there’s the left-hand rail. Are we intentional about relationships?

To know and to be known. To trust and to be trusted. To love and to be loved. Are we intentional about that? Interestingly these cross ties in the middle, that hold this all together, are not quite only focusing on the relationship, it’s not focusing on the business yet, or the money in the real estate investments. It is these activities we can do as a family that would hopefully encourage us to learn how to make decisions together. Again remember, the number one reason families are falling apart is due to lack of trust around group decision making. These activities in the middle are the opportunity for them to learn and practice and how to work together. It is things like family philanthropy, family entrepreneurship that are really cool ideas. I’d love to talk to you offline, we don’t have time to get into all this today. The family education process – this is not sending your kids to college – this is teaching them at home. What does it look like? I’m going to show you an example of that in a minute. Because if they’re going to build trust, trust it requires three things:

1. reliability

2. sincerity and

3. competence

You can’t evidence reliability, sincerity and competence if you’re not doing things with other people. Not trying to do something together. Without all three, trust is never built. That is why we encourage these activities in the middle. What we normally see with the family is there is a lot of focus on the business and there’s an assumption that family just means “oh yeah, we just have a great time together; our family’s really tight.” I just don’t believe it anymore. I used to believe it. I’m finding that families that think they’re really tight, are slowly drifting apart because they’re usually avoiding conflict instead of practicing how to have conflict in a healthy way. Usually there’s nothing that they’re doing in the middle. They’re encouraging interdependence to the point of estrangement.

There’s a wonderful African proverb: “If you want to go fast go alone. If you want to go far, go together.” That is what we are primarily encouraging. You’re going to do this as a family anyway, what would it look like if we add a little bit of this?

Cathy and I created the seven step process to help the family move from that red dot in the middle down towards the interdependent phase. Now I know this sounds un-American, because come on, it’s the declaration of independence. But if you read it, it’s really the declaration of interdependence. The most famous line in that document is not “I hold these truths to be self-evident” it is “we hold these truths to be self-evident.” It’s a we document saying that we are separating ourselves from you guys over there in England, because our values are different. And so it was an us document, before it was a separation from you. If you really want to get goosebumps, read the last line of the declaration of independence, “We mutually pledge each other our Lives, our Fortunes and our sacred Honor.” That’s what parents say, “I die for my children.” Okay great, then why aren’t we more intentional about building the sense of who we are as a family? Interdependence (being part of something bigger) ultimately brings Resilience, Grit and Freedom.

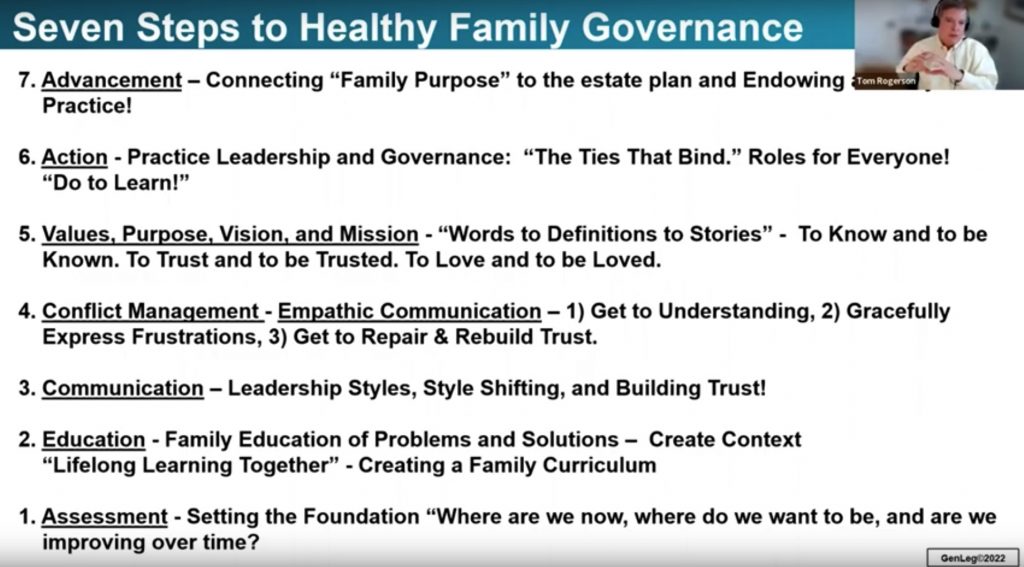

The seven step process that we created comes from all the families that we worked with, as well as the ones we researched. And there’s been a lot of research in the area. I wish I could say it’s just black and white. Do this, and you succeed. Do this, and you fail. But it isn’t. However, there are themes you’re seeing in families that tend to be present in most families that are succeeding multi-generationally. What we try to do is build on each other. What are the ones that we’re most likely seeing, and then going up from there. What we think are foundational before you go up to the next level. We start at the bottom because you must build a foundation before you go up. So the first thing we do is an assessment of where they are today. I can share information if you’d like. You know, I can’t teach you enough in this presentation, but I can share with you some concepts. If you want to call, we can get into more of this. We think that there’s an education process. Normally, the first part of the education is we share the assessment we did of their family. They find it really eye-opening because they see themselves and they set their own agenda. They tell you what’s really important and what they are not doing really well at. In the end of the assessment process, they create the agenda for the education of what they need to learn. There’s more education. This is another place that I think advisors can really step in. You can help your families with the literacy around wealth. But there’s much more you can get into regarding the culture around wealth if you want to add that to your mix.

The next level we think of in the above graph, is that now the family has an assessment and they are starting to understand the issues. They are now more motivated. Do they have to talk to each other? Most families actually have a hard time talking. “The last 10 times I tried, and the 11th time I tried, but spoke louder” is typically not a good strategy! They need to learn how to communicate with each other differently. This is where we teach families their communication and their leadership style. I’ll show you what that looks like. Again, now we’ve learned how to communicate with each other. Then we need to teach the family how to practice and manage conflict. Cathy was a relationship coach before we merged our business. She had built what we call “empathic communication.” But how do we practice and manage conflict? Avoiding what is not healthy? How do we do it in a safe way, where it’s actually a conversation about things you disagree with? In a safe way. It sounds impossible in America. It’s actually quite common and quite possible, but we have to be taught. After they can communicate and express their differences, how do they then start talking about their individual and their shared values? Values then lead to, what is the purpose of their family? What’s the purpose of their family wealth? This leads to what’s their vision for the future, and perhaps what would their mission statement be? If they shared all that work with the advisors on this call, you could put together a better estate plan.

But if they don’t do it, it’s much harder for you to create a plan that’s going to include all this. We believe this leads to the actions they can start taking to get on that journey to where they want to go.

The final step of the whole process is: how do we take all this work we did with our family legacy advisors defining our purpose and mesh it into the estate plan that we are putting together with our advisors?

Carolyn, I see you coming on.

Carolyn: Tom, wow, I was thinking about all these different steps and the family. It makes me wonder, I bet the family is at different ages. And I wonder, you probably have families that have all different age groups trying to work on this together. What have you seen work best?

Tom: That’s a great question. And thank you for slowing me down on that because that is what a lot of people wonder about. We’re finding a lot of the content is very similar, but you share it differently. When families have children that are from three to around 14 years old it’s not so much that you can engage them in learning this stuff, or that they can tell you their values at the younger age. If they do, they are parroting what their parents say. But you can work with their parents. Such as, what is the lifestyle they are raising their children in? What is the culture they are raising them in, the vocabulary, the patterns that they use in teaching them? They are really pliable about philanthropy and engagement, so you can do a lot of work there. But normally we are working with the parents on what they could be doing with their children. Once the children get to about 14 or 15 they can engage. Then they can be a part of the family meeting. They can make decisions that have consequences. They can make investment choices and things like that, and they’re learning. Ideally it’s pretty small. But from 14, or so up, to about 25 we’re really bringing them in. What it would look like to learn to work with your siblings together. From about 26 up to about 36, they are bringing spouses into the family. How do we bring spouses in? From 40 and up, we are finding many times parents say “my kids are in their 40s they’re already baked. I’m not going to restart the baking process.” I say, “I agree.” But if we focus the parents on what they could do to raise their children differently, they pretty quickly recognize the best thing they could do to evidence a different pattern for their children is to change the pattern of how they’re working with their siblings. It often brings them back to wanting to do something with their sibling(s), because that’s modeling different behavior to their children.

Carolyn: Tom, you just brought up another point about bringing in the in-laws. However that looks. There’s also age and times and just building in, “how is our family going to do that?” I’m sure that too often you’ve seen it just left to an accident. Almost how it does, or doesn’t, happen.

Tom: Again, a really good point. It is one of the first things we address when we talk to the parents, or a prospect. They’ll often wonder, “Well wait a minute, we’re going to talk about the estate plan because that’s what you guys do. So I’m not bringing my in-laws. I mean I don’t want my kid’s spouses there.” And I say, “Why do you think I’m going to talk about the estate plan? If you looked at the seven step process before the meeting, we are going to do an assessment of where you think the family is. We are going to talk about education. Just some of the language that you need to know. We are going to actually learn communication. We are going to learn about conflict management and we’re going to learn about values. We’re not talking about the estate plan until way up in the process, and that’s not till the second or third meeting. If you think that you’re going to avoid issues by not inviting the spouses, that has not proven to be the case. Pillow talk is where they will hear it. And pillow talk is very different from reality. So wouldn’t you rather them hear from the family directly in the room?

You know it’s Hamilton, it’s who’s in the room. You can have an executive session where you talk about money related issues, but ideally that’s really short. For family related issues everyone should be involved. Many of those cross-tie activities I was talking about, are opportunities for the spouses to be actively involved in the family in philanthropy, or the next vacation planning, or coming up with the family mission statement. They can be actively involved in who they are.

Carolyn: I envision seeing all the cousins and second cousins getting to build it. Thanks Tom for spending a little more time on that.

Tom: Sure! The second step in that process is the education. As I said earlier, this is where I think a lot of you advisors can help. Again, call if you’d want to add a little education for the family into your program. I’d love to talk to you about what that could look like.

George Bernard Shaw had a great quote. He said, “The single biggest problem with communication is the illusion that has taken place.” There is so many ways we can mess up communication.

There is:

what I want to say,

what I actually say,

what you heard me say,

and then there’s what you think I meant by it.

And then there’s my body language. I think I got my point across. But if I think I got my point across I am delusional.

How do we help a family actually get through all of this to a place of really communicating effectively? We use a tool that helps a family learn where everybody in the family is from a communication standpoint, and then learn how to ‘style shift.’ Unfortunately, I don’t have time to show it today. But this is a great opportunity to give us a call and we can talk you through some of these.

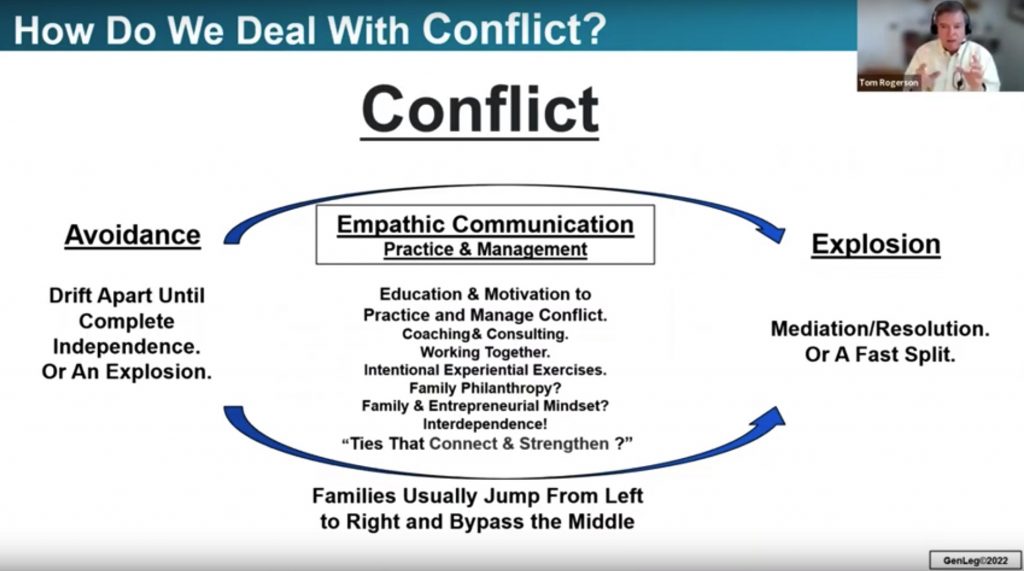

The next step up, I think is a critically important area – how do you practice and manage conflict? This is what Cathy calls ‘empathic communication.’ Normally, when it comes to conflict, families are over here in the conflict avoidance modality. You know, everything’s just going along fine. Why? Because you’re avoiding conflict [left side of chart below.] When you’re avoiding conflict, you are actually slowly drifting apart. The reason is because you are not learning about the other person. What is inside their head that motivates and drives them. So they slowly drift apart until they have a fast split.

Now they need expensive mediation and/or expensive therapy. We all see frequent lawsuits. There is a billion dollar beer distributorship lawsuit’s going in my hometown on this very issue. They’re having a family explosion. What they bypassed in going from here to here [in the chart above], was the whole middle ground of practicing and managing conflict. Families that don’t have conflict are avoiding it.

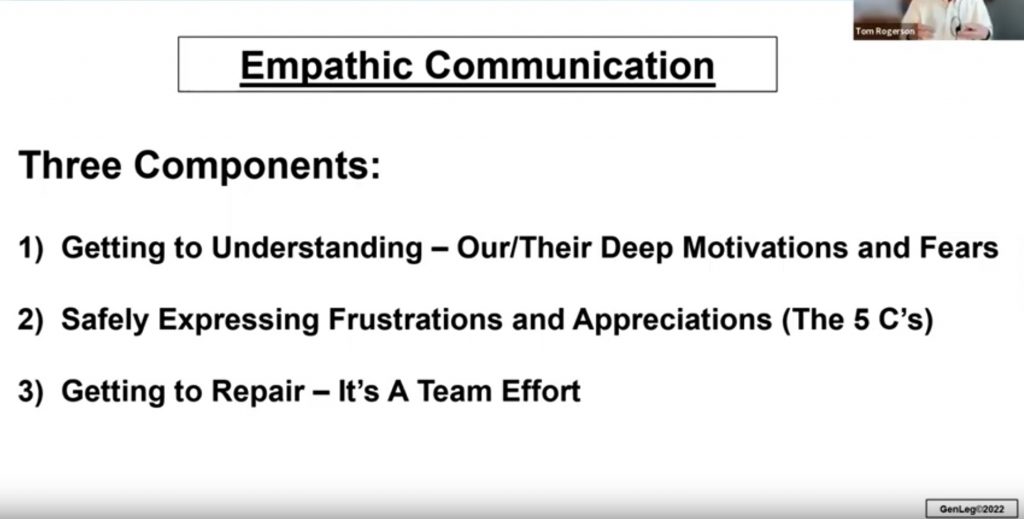

By the way, this is what Cathy calls empathic communication. There are three components to empathic communication.

The first step is getting to understanding, “do I really know what drives this other person?” That squirrel on the treadmill inside them. Do I know what is motivating them? Is it fear, jealousy, anger? If I don’t know where they’re coming from, I’m very likely to misunderstand what they want to accomplish. If I don’t understand what their goals are, I’m going to misunderstand why we’re not getting to my goals.

The second step in empathic communication is being able to safely express it. Because I will have frustrations. I will have differences. That’s fine, but how do I safely express it? It’s usually not in the moment. Usually we make an appointment.

The third step is: I’ve got to a place of understanding you. I’ve expressed where I still find differences and difficulty. How do I get to repair with you? And that actually is a governing structure. How do we come up with a method that you and I are going to work together with this governance? It is group decision making and governance. How are we going to work together and what would that look like?

One of the Green family members of Hobby Lobby had a wonderful quote for this:

He said, “The family brings me into the family meetings. Even before we got married!” Talk about bringing spouses in, they are bringing in significant others. They are learning about each other’s values and what they care about. They were engaging in some of the railroad tie activities. He said “…this family recognizes – and it’s so powerful – that we need to build a bridge of grace and trust with each other so we can drive the truck of truth over it.” That’s Cathy and my motto now as well. Because we are helping a family build a bridge of grace and trust so they can drive that truck. They have to speak the truth if they’re going to get to conflict resolution. The eventual goal is to handle the family businesses and the estate plan. Then where they are going to go, and what they are going to do with the family vacation house, etc. They have to speak the truth. But how do we help them build the bridge of grace and trust first?

The number one reason that families are falling apart is due to a lack of trust around group decision-making. They are trying to speak truth first, without trust.

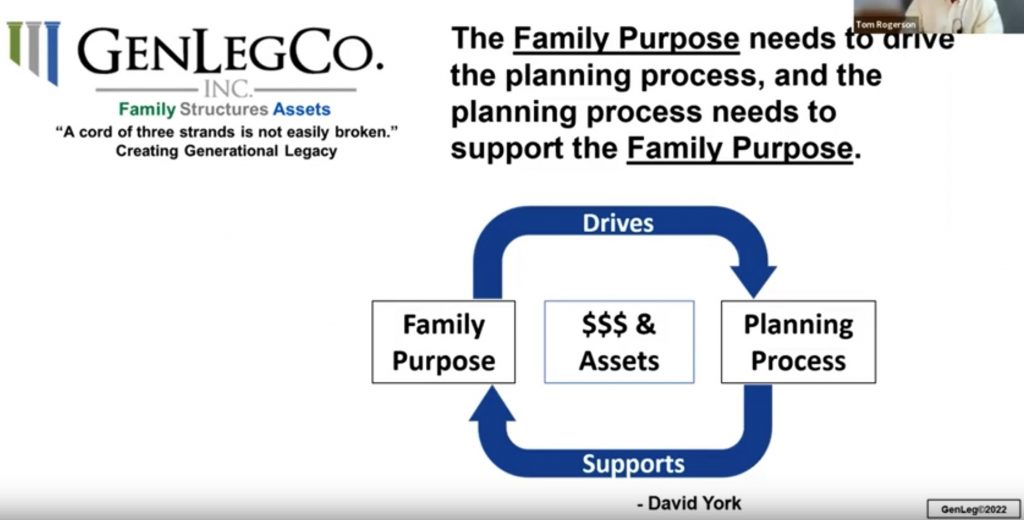

All of this leads up to the seventh step. How do we blend this all together with the estate plan? I think I mentioned David York before. He has wonderful imagery for this and it’s really this simple notion.

The agreed upon shared family purpose (this is not mom and dad’s purpose) should drive the planning process. And the planning process should support the family purpose. Now the parents don’t have to agree. When the parents hear what the agreed upon shared family purpose is, the parents don’t have to design a plan that does all that.

However, I am amazed how often the parents say, “wow it is almost identical to what we were hoping for as well. Why wouldn’t I design a plan to fund that?”

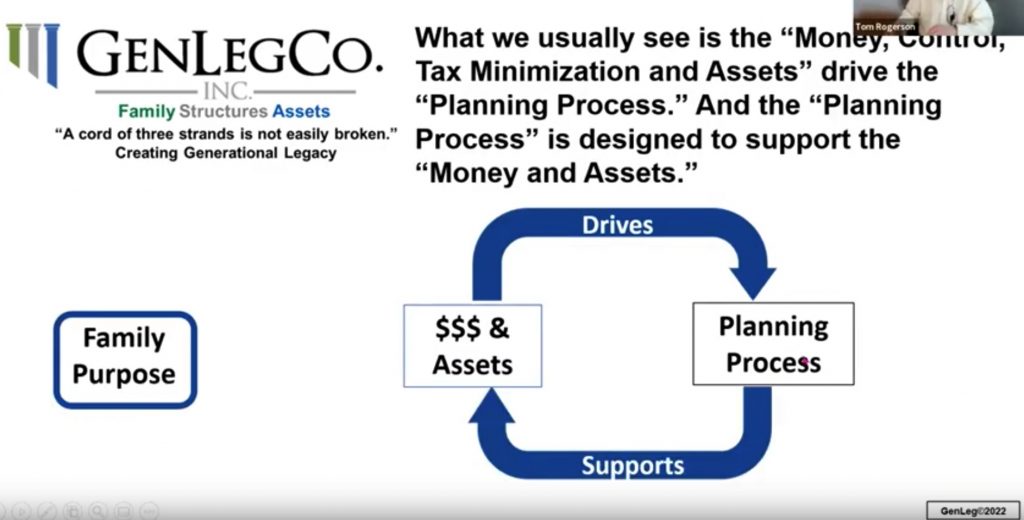

But it ends up looking very different from a traditional estate plan. If you build this very simple imagery, then the money in the business is in the middle going along for the ride. It’s a wonderful image. I love it. I think David did a great job of portraying it. The only problem is I’ve almost never seen it exist in reality! In reality, what we almost always see is the tax minimization concerns of the parents and the advisors. As well as the control issues of the parents. The trustees drive the planning process and the planning process supports the tax minimization and the control issues. The family purpose is over in left field that nobody ever focused on. So here is family purpose over in left field [reference the chart above] and it was never focused on.

How do we bring that into the picture? The Family Office Exchange does a lot of work with family offices and gives examples of how very wealthy families are now coming to reality around this.

This quote really blew me away:

“Structures that are created contain present and future, cultural issues (e.g. trusts, foundations, business entities, family offices, private family trust companies, etc.) tend to either institutionalize the family dysfunction or they’re torn apart by the family.”

Wait a minute, as advisors, aren’t these the exact strategies we would bring to the table for a wealthy family? Trying to tear it apart in court separates the family forever. Designing plans to just protect the money does not protect the family. Money doesn’t make a family, people do!

Marvin Blum, a founding partner of The Blum Firm which is in your own Dallas/Fort Worth backyard. The Blum Firm is the largest estate planning practice in the country that I know of, which is just an estate tax planning practice. They have approximately 30 attorneys doing nothing but estate tax planning. He and I were talking about this at a Tiger 21 meeting. He has recognized that this is so important to what he wants to do for their clients. He builds teams of advisors that have an older member and a younger member for continuity in the relationship. Most advisors lose their client when the parent dies. The Blum Firm is intentionally building teams of advisors within the firm that are working with families that have older and younger members. They meet with the whole family with the very purpose in mind that they want to maintain these relationships. It will help the family, not just the firm. The same is true for all other advisors.

How do we build these teams? How do we meet the next generation so that we have continuity? Well Marvin and I thought: there’s a piece missing. The families who are succeeding multi-generationally are doing things differently. Whatever they’re doing differently they’re endowing it – either intentionally or accidentally. Could we take a look at what all these different families are doing and create a structure that other families could incorporate into their own plans? It would encourage the meeting process and endow it. As we built it out we called it F. A.S.T.

It stands for:

Family

Advancement

Sustainability

Trust

It is a mouthful, but it’s fast and simple. We wrote an article in Trust and Estates Magazine a few years ago. It provides funds for the family. Most trusts the family puts together are designed to distribute money to beneficiaries. This trust is not designed to do that. This trust is designed to invest money in the beneficiaries. Marvin put it this way, he said the big problem that he sees is that G1 buys into family meetings and legacy planning and will pay for it. But G2 typically drops the ball. Over the years, the G2 doesn’t want to plan for it. They often don’t want to pay for it, or they’re just busy. The idea goes into atrophy. If it is delayed and delayed then it is dead. However if it is endowed, it is highly likely to keep going. He finds that usually one of the most practical solutions is to fund a F.A.S.T. with insurance; it’s a lower expense to get the endowment down the road and to really kick.

The simple analogy he often uses is of a football game. G1 is the quarterback. They throw the perfect pass. Their advisors are so excited! Boy can we tax minimize and set up the right structures, we have a funded SLAT, and oh my goodness, it’s incredible! But the receivers, G2 and G3, often don’t know how to catch the ball. Remember, preparing yourself for wealth you earned over your lifetimes is different from preparing a receiver who may receive it in a moment. Often they don’t know how to receive it. They don’t have the vocabulary, the lessons, the teaching, or the advisory team. And they don’t have a team within the family to do it. The F.A.S.T. provides funds for running the family meeting, paying for the advisors, encouraging family philanthropy and gratitude. It’s designed to endow a family meeting process. You don’t walk away with things in your hands from this meeting, you walk away with things in your head. Knowledge of who the family is and who the family members are.

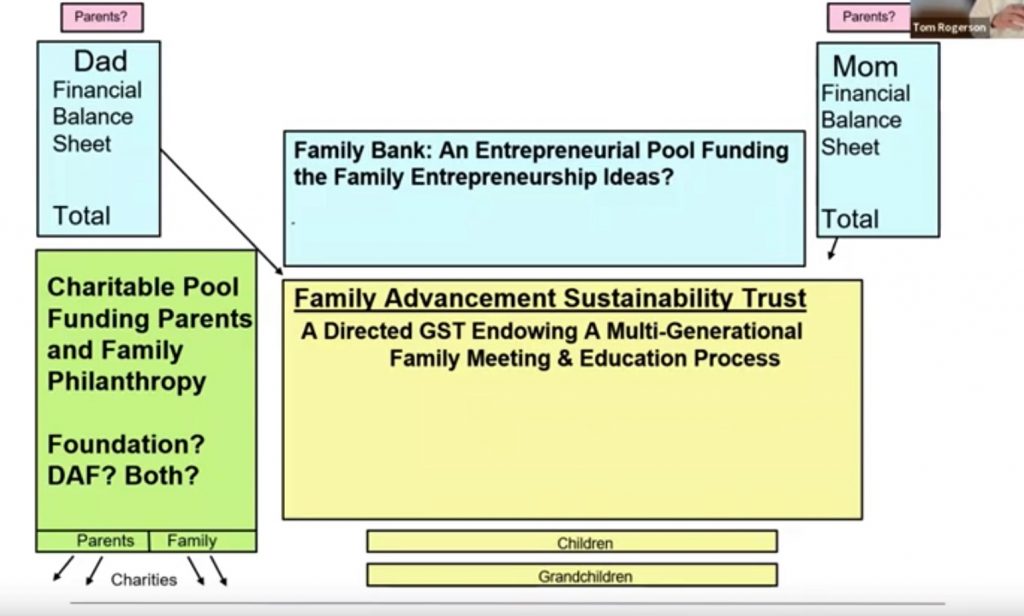

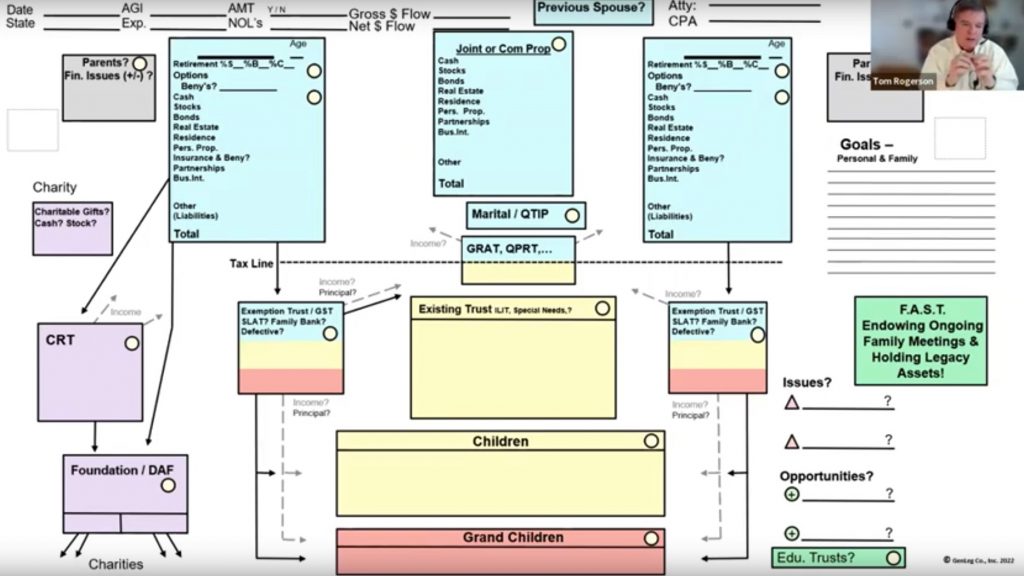

The F.A.S.T., between the parents, would be another trust structure that would be along with all the generation skipping and charitable vehicles the family puts together. We often find that the F.A.S.T., [yellow box in this picture] creates the education of the family. Such as how they can use a family bank, which is often a separate structure. But it’s better that the F.A.S.T. educate the family on how to use the family bank and encourage entrepreneurship. Also the family foundation. The F.A.S.T. shouldn’t give money to charity – it’s not tax as efficient – the foundation should. But it can educate the family members on how and why to work together to be able to use the foundation more effectively.

Todd: Excuse me, we’ve got about eight minutes. I just want to give you a heads up on the time.

Tom: Great. I’m going to show you one of the things we often say to the parents that we work with. They are more likely to endow a charity university to help educate strangers than to endow a chair at their family table table to help educate the family. So many families I’ve worked with said, “I endow a chair at Harvard and I have a 529 plan that I’m paying for my kids’ education.” That is proving my point – they’re paying for their children to get educated somewhere else, not within the family.

We often use a family diagram to indicate what this can look like.

I created this many years ago when I was at Coopers and Lybrand. It might look convoluted. Yet, you wouldn’t believe how many times clients can see themselves in it when we fill it out! And when we put their assets into this then we can create a very complex picture in a simple form. Two weeks ago, we put a billion dollar family’s net worth into one of these simple diagrams. The parents said, “This is the first time we’ve seen our whole situation in one picture!” The benefit of this is the KYC (Know Your Client) process that you are all involved in, and that the SEC is talking about getting more involved in. It allows the client to participate, because they can see themselves in this fact-finding form. They can’t see themselves in a form that you might have for fact-finding. One of the pieces of this puzzle is the notion of reviewing their insurance. It is a really important area now. Because life expectancies have changed quite dramatically during COVID. And interest rates are changing quite dramatically. This is affecting a lot of insurance policies. If you haven’t had an insurance review done – it is a great time to do it. I know this is something that’s near and dear to Todd’s heart, because he does an insurance review process all the time with clients. If you don’t have a process of doing that, I highly recommend it.

This diagram is a wonderful picture to use where a family can see themselves in it. Here’s an example from one of the top estate planning attorneys in the country. This is what he put together for a family to show them their estate plan. I’m an estate planner by background, and I can’t figure this chart out [not shown in this transcript.] I really encourage you to use simple imagery so people can get involved in it.

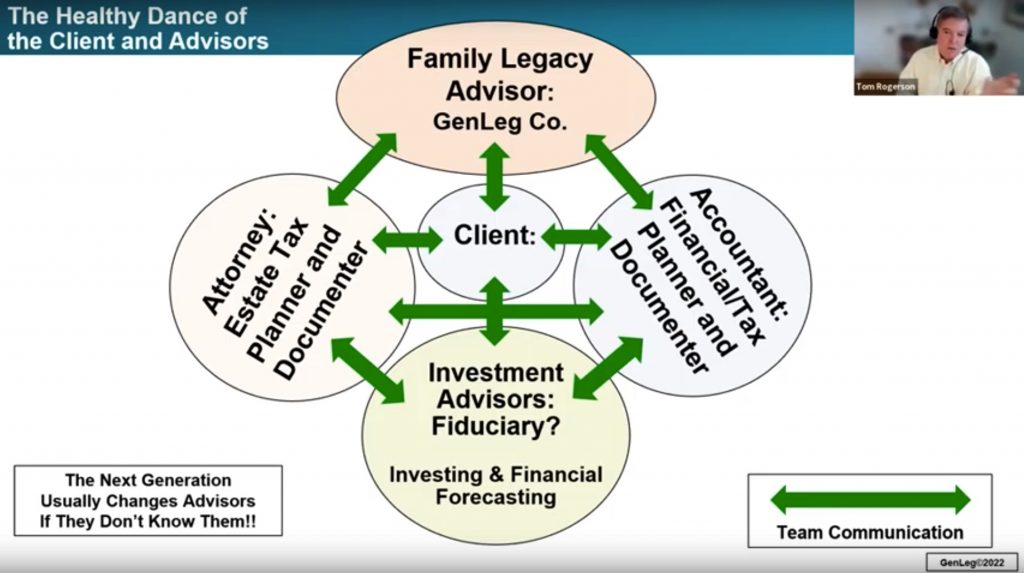

Advisors typically build a shield around the client. This was an older study looking at who are the main advisors the client described. And they said, “My attorney, my account and my investment advisor. But the communication was from me to my attorney – only when I needed him/her. When I need the accountant, it is more of a give and take, because we have quarterly meetings. With the investment people, it depends on who they were. If they are from Wall Street they are going to call me with a product or an idea. If they’re a fiduciary or registered investment advisor it is intermittent.”

My point is, the communication is not between the advisor and the client, it is between the advisors. And there is usually very little. To make it worse, most of these advisors would often protect their clients from getting ideas from other advisors. Because they felt threatened. When I was at Coopers and Lybrand, if a client came in and said they were thinking of working with Arthur Anderson, or they heard a great idea from Arthur Anderson, I felt threatened. That’s normal.

I think a new look at the advisory teams should include a family legacy advisor. It could be GenLeg Co., or other firms, but the role we often play is working with the other advisors. The advisors need to be able to work together with the family. It’s less expensive for the client, it’s better for the result, and it’s better for the advisors. In the process, you usually meet the family members, which means you have continuity from one generation to the next.

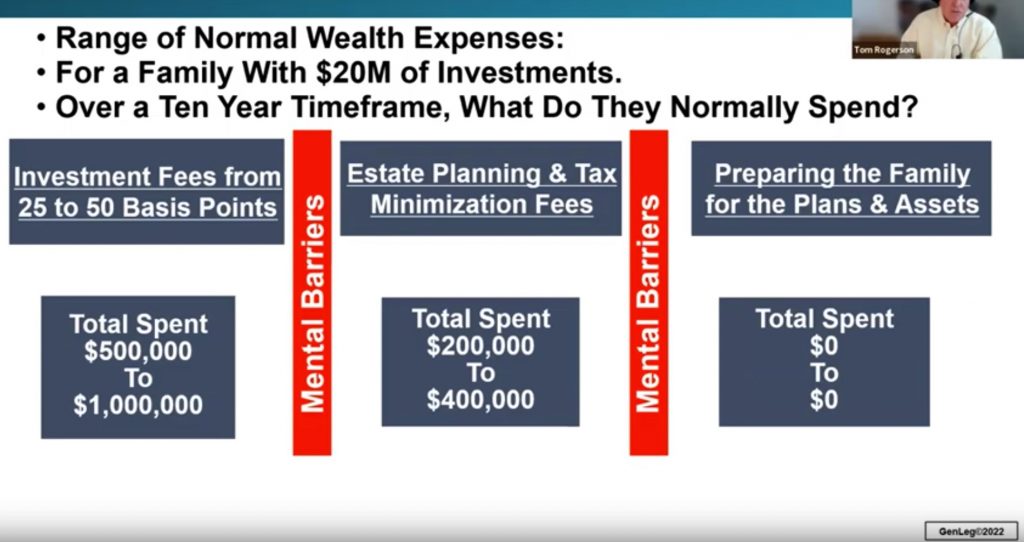

The last thing I’ll say and before we open it for Q&A, is how much does all this cost? Just take an example of a client with 20 million dollar investments, over a 10-year period of time, what are they paying for their investments, their planning and their family legacy work? They usually keep those things separate by the way – with mental barriers. In the investments they’d be lucky if they’re paying 25 to 50 basis points. So over 10 years, they’re paying between $500,000 and a million dollars. In the estate planning, financial planning and investment management work every year, for 10 years they’re probably paying $200,00 – $400,000. What are they usually paying on family governance? Zero, usually nothing. They assume that, “We all get along on Thanksgiving.” But we are finding that if a problem comes along, they’ll spend almost anything on this.

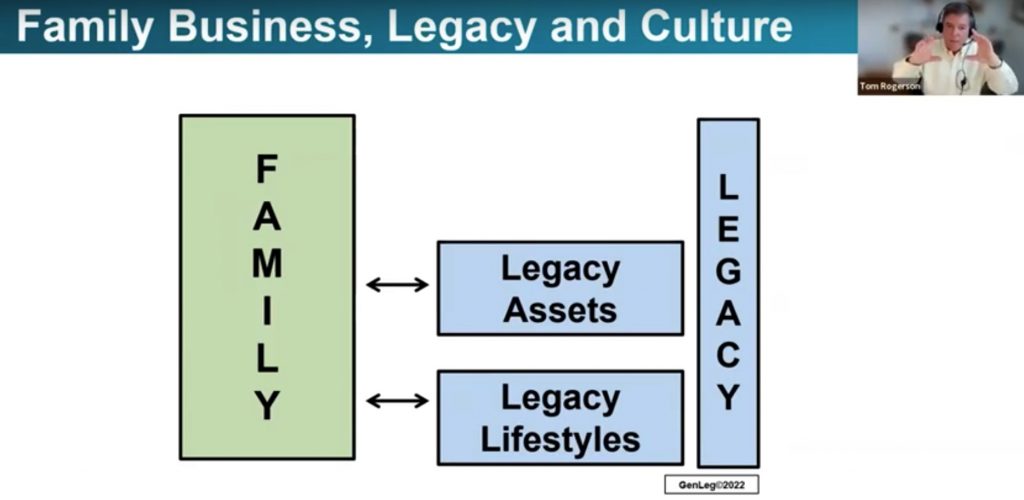

Well that’s a lot to cover, but I just want to cover this one last thing. We think it’s this way.

There’s the family and there’s the family legacy. There needs to be a legacy lifestyle education. What is a legacy lifestyle? This is bigger and broader than we have time to get into, but Jay Hughes referred to it as: “there are inheritors and there are stewards.” How do we help educate families on being stewards? There are legacy assets (the lake house is not a legacy asset.) Foundations are often not a legacy asset, they can be. It is how we introduce them and structure them in the governance that makes them a legacy asset. And then that leads to legacy structures themselves. Could a F.A.S.T., a trust, as I was describing before, that Marvin Blum and I created, be the solution? Could we have a legacy structure to hold all this together? That’s really what we are doing within families, and that is what we think a legacy advisory is all about. Todd, I apologize I went over. But, I hope that was helpful stuff.

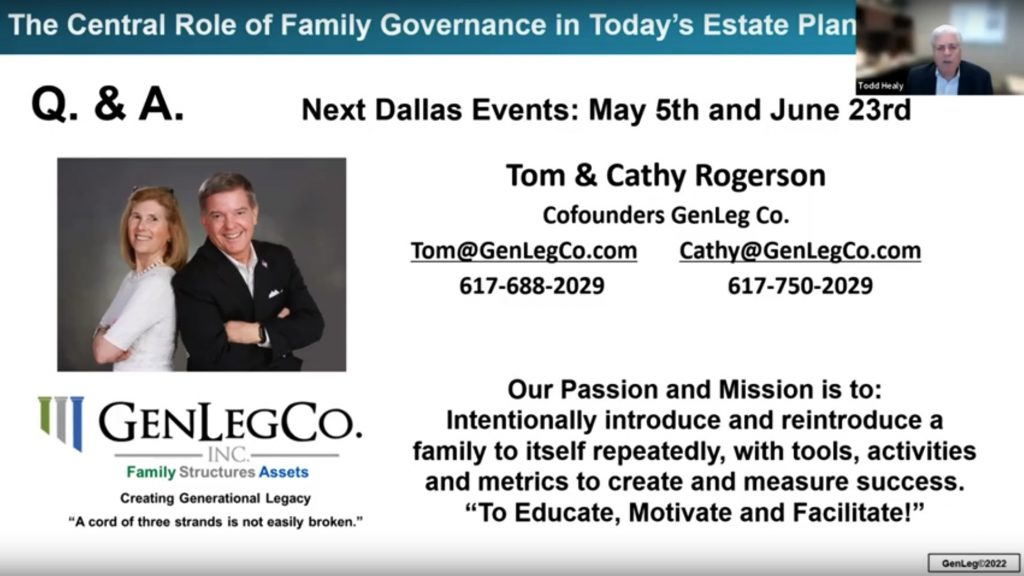

Todd: Tom, it is great information! I do want to highlight a couple things. First, I want to thank you very much for the challenges you’ve placed before us. More importantly, for the tools you’ve given us. Oftentimes we hear these challenges without tools. You gave some very very specific tools. I want to thank those who are attending. If you have additional questions, please reach out to us or to Tom. There are additional resources we will send to you, but the main ones I think are Tom and his wife’s contact information.

I want to highlight a couple of things. Tom will be back in Dallas on May 5th at noon speaking of the Dallas Estate Planning Council.

On the afternoon of May 5th, he’ll be speaking to the donors of the Dallas Foundation. That is specifically for donors. If donors want to invite their advisors, they’re certainly welcome to do so. But in general, the advisors are not being sent a separate invitation.

Tom will also be back on June 23rd for another session with the Legacy Partners Group. Again, we will give you additional information on it in the email that we will send soon.

There will be a book list from Tom. A short list and then a more detailed list broken down by topic.

Finally, I want to say that our next C&C Event will be May 18, 2022 at noon with Pyxis. One of the things that we’ve learned as we all get older, is that no one teaches us how to deal with our elderly parents and in-laws. Mindy and her team have done a great job of helping families work through that process. Therefore, there aren’t any surprises.

With that, we’ll say thanks for attending! We really appreciate the attendance. Please feel free to reach back out if you have questions. We can help provide additional clarity, confidence and coordination with your planning. Thanks again, and have a great afternoon.

™

™

In 2017 Tom teamed up with his wife, a certified relationship coach, and started GenLeg Co., Inc. Together they provide guidance and education to families and their advisors, helping them transition significant capital, both financial (tangible) and human (intangible), from one generation to the next.

In 2017 Tom teamed up with his wife, a certified relationship coach, and started GenLeg Co., Inc. Together they provide guidance and education to families and their advisors, helping them transition significant capital, both financial (tangible) and human (intangible), from one generation to the next.