The federal debt has more than doubled in the last ten years. As of December 2021, Congress had approved $4.5 trillion in COVID-19 relief spending and more could be coming.[1] The country has never seen anything like the tax laws currently being introduced in Congress, impacting everything from income taxes to inheritance taxes. Higher taxes are likely inevitable. It has never been as important as it is today for Americans to preserve their legacies through proactive planning.

Currently, the top estate tax rate is 40% with a $12.06 million per person gift and estate tax exemption. The exemption amount is set to be cut approximately in half at the end of 2025, and Congress is unlikely to prevent this reduction. Fortunately, there are tools and techniques available today to mitigate the impact of both current estate tax policies and planned, future changes to these policies. A spousal lifetime access trust (SLAT) is a relatively simple way for a married couple to meet wealth transfer objectives while mitigating potential negative tax consequences.

What is SLAT?

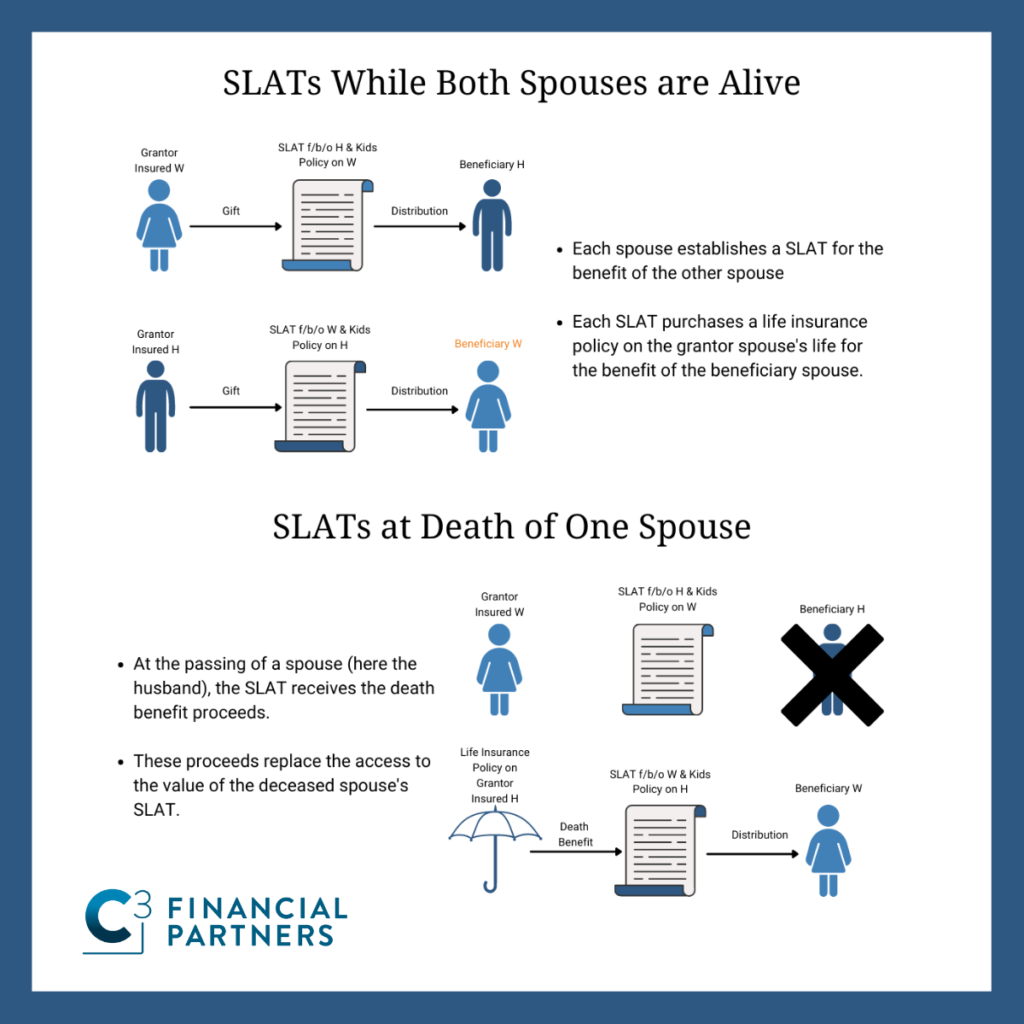

A SLAT is an irrevocable trust established by a grantor spouse for the benefit of the other spouse – called the beneficiary spouse – plus other family members, such as children and grandchildren. Each spouse gifts up to their maximum exemption amount to a SLAT set up for the benefit of the other spouse and their children and/or grandchildren. The beneficiary spouse of each SLAT is granted limited access to the trust’s funds to meet his or her needs.

In an example, Charlie, as a grantor, creates a trust for the benefit of his wife, Crystal. He contributes $12.06 million (his 2022 maximum estate and gift tax exemption) to the trust without any tax consequences. Income from the trust is distributed to Crystal under a HEMs provision and Crystal can do whatever she chooses to do with this money.

Crystal does the same for Charlie but is careful that the trust she establishes for her husband is not identical. If the trusts are identical, they could run afoul of the ‘reciprocal trust doctrine,’ resulting in negative tax implications.

At the death of the trust’s income beneficiary, the remaining beneficiaries – the children and/or grandchildren – begin to receive the trust benefits.

A problem arises when either Charlie or Crystal dies and the surviving spouse only has access to the assets in the trust for which they are an income beneficiary. In other words, the surviving spouse used to be able to access assets in the other trust via their spouse who was the income beneficiary. Now, the surviving spouse could be cut off from up to half of the assets transferred to their SLATs.

A solution involving life insurance can replace this loss of access. Each SLAT should purchase a life insurance policy on the life of the other spouse. If Crystal dies before Charlie, Charlie will continue to benefit from his SLAT and his SLAT will collect the life insurance death benefit proceeds to replace the access to the values of Crystal’s SLAT, which have gone to the children and/or grandchildren as the remaining income beneficiaries.

Similarly, if Charlie dies first, Crystal will continue to have access to her SLAT and her SLAT will collect the life insurance death benefit proceeds on Charlie’s life, replacing the access to the values of Charlie’s SLAT.

Benefits of a SLAT

A SLAT is a key estate planning strategy which may have a number of benefits:

- No gift taxes are incurred on amounts up to $12.06 million transferred to a SLAT in 2022.

- Provides a spouse a lifetime interest in the income and principal – limited to his or her health, education, maintenance or support under a SLAT’s HEMs provision.

- Allows the beneficiary spouse of the SLAT to be the trustee of the trust.

- Taxes income to the SLAT back to the grantor.

- Excludes taxes paid by the grantor from being characterized as taxable gifts to the SLAT.

- Excludes the total value of assets in the SLAT of either spouse upon their death.

- Allows the beneficiary of the SLAT to do something similar for the benefit of the grantor of the SLAT.

There is little question that new taxes are coming. At C3 Financial Partners, we work with a client’s legal, accounting, and advisory professionals in developing and implementing strategies to optimize their legacy to their family and to their community. A SLAT may be a solution to help prepare for higher taxes and to preserve the federal estate and gift tax exemption before it is reduced.

[1]Rattner, N., & Pramuk, J. (2021, December 9). The U.S. has spent most of its Covid relief funding, but there are still billions left to Dole OutNate. CNBC. Retrieved January 15, 2022, from CNBC.

™

™