No one plans for their health assets and lets the “system” dictate care choices for themselves and their loved ones. By legally empowering health assets as a part of the planning process, through a holistic care management approach, clients and their loved ones can take back control, dignity, and peace of mind with their health choices.

Key Takeaways:

- Relevant trends and patterns in life care

- Definition and criteria of care management

- How to use palliative care

- Building a care plan

About Mindy Legler Jones

Ms. Jones founded Pyxis Care Management, a healthcare advocacy firm. Daily, she pairs her passion for improving lives with health industry expertise and 20 years of management and corporate experience with extensive senior management background in business analysis, sales, and marketing. Mindy is a Texas Certified Guardian, a Certified Senior Advisor, and was named a “Healthcare Hero” by the Fort Worth Business Press. Community service plays an important role in her life. Not only is she a mother, she is also a lifetime member of Girl Scouts of America and a member of National Alliance on Mental Illness. She and her husband are active in their church and in scouting as well as in their children’s schools. Mindy has been an active member of Texas Wall Street Women since 2015 and is an active member on the board.

Ms. Jones founded Pyxis Care Management, a healthcare advocacy firm. Daily, she pairs her passion for improving lives with health industry expertise and 20 years of management and corporate experience with extensive senior management background in business analysis, sales, and marketing. Mindy is a Texas Certified Guardian, a Certified Senior Advisor, and was named a “Healthcare Hero” by the Fort Worth Business Press. Community service plays an important role in her life. Not only is she a mother, she is also a lifetime member of Girl Scouts of America and a member of National Alliance on Mental Illness. She and her husband are active in their church and in scouting as well as in their children’s schools. Mindy has been an active member of Texas Wall Street Women since 2015 and is an active member on the board.

Todd: Good afternoon, I’m Todd Healy with C3 Financial Partners. On behalf of my partners, Carolyn Smith and Celeste Moya, I want to welcome you to another C&C Event. We are very pleased today to have a topic that’s of interest to all of us. We’re going to be talking with Mindy Jones and Michelle Fenimore about what they do to help advisors add additional service to their clients.

The official topic is, “What Smart Advisors can do to help their Clients Prepare for the Inevitable.” That’s something that we all find very very near and dear to us as we’re all dealing with aging parents, or parents who are dying. The president of the American College was in our office about two years ago. He made the point that as advisors, we don’t prepare each other or our clients for the inevitable. I’ve lost both my parents and both my in-laws. Even though I’ve been through it four times, with my mother-in-law (died at age 99 last December) it was still a totally different experience that no one had any idea how to prepare me for. And I didn’t know what to expect.

We have real experts this morning to help us. Mindy Ledger Jones, who many of you know, is the Managing Principal at PyxisCare Management. She founded it as a health care advocacy firm. Daily she combines her passion for improving lives with health industry expertise. Mindy has over 20 years of management and corporate experience, with extensive senior management background in business analysis, sales, and marketing. In addition, she’s a Texas Certified Guardian, a Certified Senior Advisor, and was named Healthcare Pro by the Fort Worth Business Press.

You may go to the Q&A, or chat, to add your questions. Mindy has allowed some time at the end to address those. I am going to start by asking her to define a Texas Certified Guardian and a Certified Senior Advisor. Mindy, welcome! We are glad to have you here.

Mindy: Thank you Todd, and your team, Celeste and Carolyn. I really appreciate the opportunity to be able to speak to everybody about something that’s very near and dear to our hearts and our business in dealing with care. Specifically, the two certifications that Todd mentioned involve both the legal aspect of care with respect to Texas guardianship laws and also around the financial aspect. Those would be the government benefits of medicare, medicaid, and social security. What we find as care managers is that if you’re not certain on who’s making medical decisions, or who’s legally empowered to do so, and/or how things get paid for, care plans don’t really have the ability to go anywhere. Those are two areas that we focus on and are experienced in.

Jumping into the topic. We hear a lot, and we’ve heard a lot more since the 2020 pandemic, about changes in the healthcare landscape. We have also heard from folks as they are planning for the future – including expenses.

I’d like to share with everybody a little bit about the trends in the life care space. I will touch on these issues:

- What is this fundamental market challenge that we are seeing in the advisory space?

- How is health, and the asset of health, being managed?

- What are advisors doing about it?

- Why is this a challenge?

- What are some typical approaches we’re seeing from advisors in the marketplace?

We will be sharing a little bit more about the attributes of care management and some solutions. Then we’re going to close with what we believe everyone needs to do for themselves and for their clients.

Why aren’t advisors preparing families for transition? Todd, as you mentioned at the beginning, there is a gap. We are not talking about the fact that everyone is living longer and longer. Those periods of life where people look at retirement, it used to be a “go-go time,” to a “slow-go time,” to a “no-go time.” As far as the activity and intensity, those time periods are lengthening significantly and may, or may not, be accounted for. I would postulate that we’ve become very specialized in different areas of advising. We have great advisors out there who don’t know what they don’t know when it comes to health care scenarios. Not everybody has experienced the breadth of what can happen, or all of the different facilities available, or the therapies offered, or the approaches.

We’re not sure how to incorporate that into the overall planning process. Working with clients – how one wants to live and how one wants to die – is the most intimate of decisions. Oftentimes it is something that clients themselves aren’t thinking about.

Advisors, you may not be thinking about this yourself as well. But what do I do if I am not fully in charge of living the way that I want to be living? What are my options? There is not a plan. Or when I am in transition between actively living and the past. That can happen over five days, five weeks, five years. That transition period causes a tremendous amount of uncertainty. Guilt has the potential to cause family conflict. When it happens, oftentimes I don’t have a voice. Such as, where would I want to live, how would I want to be treated, or do I want this additional medical care.

We just talked about people who are living longer as a trend that we’re seeing in the life care space. An 80-year average is what’s projected by most actuaries. However, we know that in the high-net-worth space, we’re looking to plan for couples that are going to be living well into their hundreds. That is something to be mindful of, and looking for, as we’re dealing with multiple chronic conditions in our population. Statistics are showing that anybody over age 65 has an 80 percent chance of being diagnosed with one chronic condition. Sixty-five percent have a chance of being diagnosed with two chronic conditions. By chronic condition, I’m talking about diseases such as diabetes, asthma, depression, heart disease. Things that are managed but not cured. Because we have the advent of modern medicine to manage some of these conditions, life expectancy is increasing. These are the illnesses that would have knocked us off the chess board earlier, but they are not any longer.

What we’re seeing now is this higher incidence of Alzheimer’s diagnosis, because the other conditions are not taking us down. You can expect, and I don’t mean this to be shocking or chicken little, but you can expect one out of three seniors will be diagnosed with Alzheimer’s. Therefore, a 30 percent incidence in that population – where truly we’re keeping our bodies engaged but our minds are going – is more and more of a reality for more folks. In the senior care space, we are seeing more approaches, and variants to the approaches, for housing options. It can be a care home that can come in a variety of forms. Some have a bed and breakfast feel and can be very luxury oriented. Some are very bare bones aesthetics. There are also traditional facilities which many folks are more familiar with. Where there’s an independent living area, then perhaps an assisted living area and then either a skilled nursing or rehab type area. Sometimes a memory care area. We see these campuses and we’ve seen facilities that are specializing in the big growth area related to an Alzheimer’s diagnosis. Memory care happens to be the most expensive type of long-term care. It is something to be mindful of. We are seeing a tremendous amount of technology that’s geared towards seniors, aging well, and supportive devices, as well as home design and equipment. This is an exciting time and an exciting space.

It is interesting because the demographic that folks are targeting are not always tech savvy, so they are actually advertising to the second and third generation.

We are seeing another level of complexity in medical approaches. What is the newest, hottest thing on the horizon, is what’s called personalized medicine. This is caused, and available, because now we have the human genome sequence. That whole project has been completed.

When we’re looking at Parkinson’s or other neurological conditions, cancer or multiple sclerosis, ALS, we are seeing that pharmaceutical companies are going to be able to provide therapeutics that are going to be more specific to the individual and customized to the individual. These are fantastic outcomes. Of course they come with a cost. But it is very exciting that there are extended disease management options. Michelle, I’m going to ask you to speak a little bit more about what that is referencing.

Michelle: Hi, I am a nurse practitioner. I’m certified in hospice and palliative care. I have been working with people with chronic and serious illness for over a decade. Extended disease management is the fact that many people are living a long time with a serious illness. One could be living years with cancer and Alzheimer’s or any of these serious diseases. So extended disease management options just means that there’s not one rulebook that you follow for these diseases. Take Alzheimer’s, there is a new drug out this year that costs upwards of $50,000 a year. It was really controversial when it passed, because it shows that it might slow down the disease process, but it’s really not curing it. In fact, there’s controversy on how much it is even showing to improve the disease process. Therefore, some people might elect to not take this treatment. These are the kinds of big and little decisions that arise with all of our chronic illnesses.

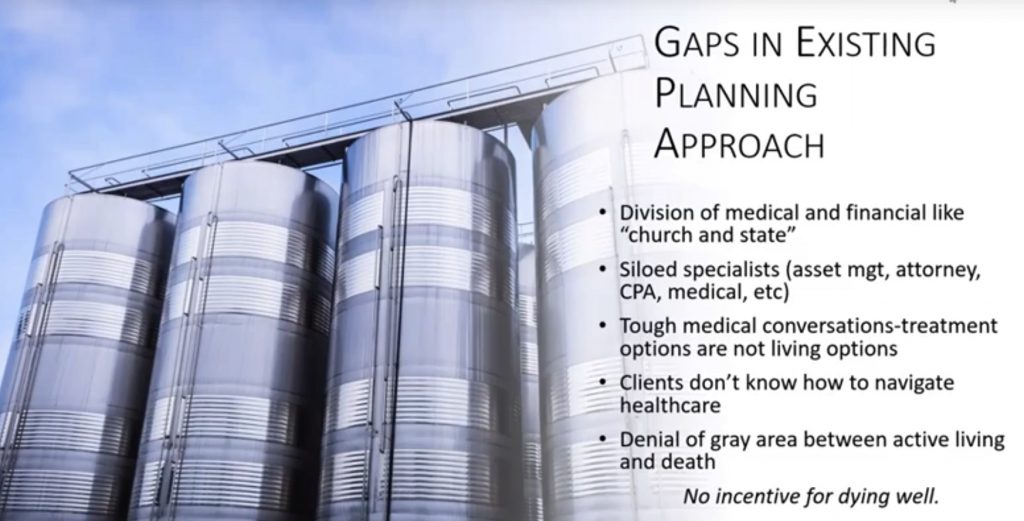

Mindy: Thank you. Again, what we’re seeing is this big gap. I believe folks (clients) often see a divide between their health, their medical care, and their financial planning or asset management. Like a division between church and state. They are separate, but equal, and they don’t frequently interact. What we’re definitely suggesting is that that bridge needs to be crossed. There’s also, especially in clients that have complex situations, specialists with planning that are in their own zone. These can be asset managers, your attorneys, CPAs, or physicians. They each may not know what the others are doing, or the scope they’re covering, or where there could be gaps, or where there could be overlap.

The other thing that we’re seeing that makes a gap, is that there are tough medical conversations. Michelle just gave a great example of, “Okay, we have a drug that’s on the market that’s a very expensive treatment option.” It may or may not be a conversation about living options. Oftentimes advisors that are in the financial space think, and family members do this as well, what living options are discussed in the medical field? Michelle, would you speak to what we’re talking about here? What the doctor will talk to you about options, versus what they leave out of that conversation?

Michelle: Look at this slide with the silos. I think this is a great illustration of what’s happening right now. We are all very specialized – financial advisors and attorneys – but even within the medical field we are also very divided. We have our specialists, and really almost exclusively the only medical professionals that talk about these complex decisions and choices are palliative care specialists. The way the current system is, we are not usually brought into the conversation until close to the end of life. Yet, all of us in palliative care strongly believe these conversations should be happening way before that time. The reason: there are so many decisions that should be discussed by the family, beginning when somebody’s healthy, so that they are not having to make these big decisions when someone is in a medical crisis. That is a very difficult time to make big decisions. Many times one is thrown into a quick decision. An example is when someone’s in the emergency room. “Oh do you want this? Yes or no.” It is a hard time to gather family and make big decisions.

Back to the slide, we believe advisors and attorneys should start these discussions to start when the client is healthy. It is a gap. Don’t assume that their medical doctors are bringing up ideas of these complex ethical treatments. When you are diagnosed they’re going to say, “Okay, this is a treatment. Do you want to try it?”

Mindy: Yes, this is something that we’ve seen in our practice for the last 13 years. Clients, regardless of how sophisticated they are, are not comfortable navigating the healthcare system. There are a lot of twists and turns, lots and lots of choices. I would say for our clientele, many of them are very used to having more control but feel un-empowered and disfranchised within the healthcare space. And that’s not unique to them. That causes a gap.

Part of the human condition is that there is a denial in this space. There is the gray area between active living and death. If we could draw a quality of life curve, I think everybody would want to have a high quality of life and then die. In fact, I know both Michelle and I have had clients say things to us like, “Well if I just get like that, kill me.” That is not something that can be done. It’s a difficult subject to broach. It’s not something that clients want to discuss, but most people will have a quality of life and then an episode that causes a little decline. Then they go along until they have another episode, and then another episode. It is at these points that there are many options and considerations that need to be taken.

Michelle: A big report came out on “Dying in America.” It showed that 92% of us are going to have a chronic illness. We call this “dying a long death.” When we talk about the gray area that is most of us, and most of our loved ones, will be. As Mindy said, people want to live and then die quickly. Unfortunately that just does not happen very often. I think eight percent or less die suddenly.

Mindy: So knowing that we have that high incidence, we must determine what is the conversation around dying, and how do our clients evaluate what ‘dying well’ means to them?

Michelle: A nicer way of phrasing that is to say “living with illness.” Because people aren’t even aware they are considered to be dying. Or, what is the point of “considered as dying”? That is a whole nother conversation. But it is just living with chronic illness.

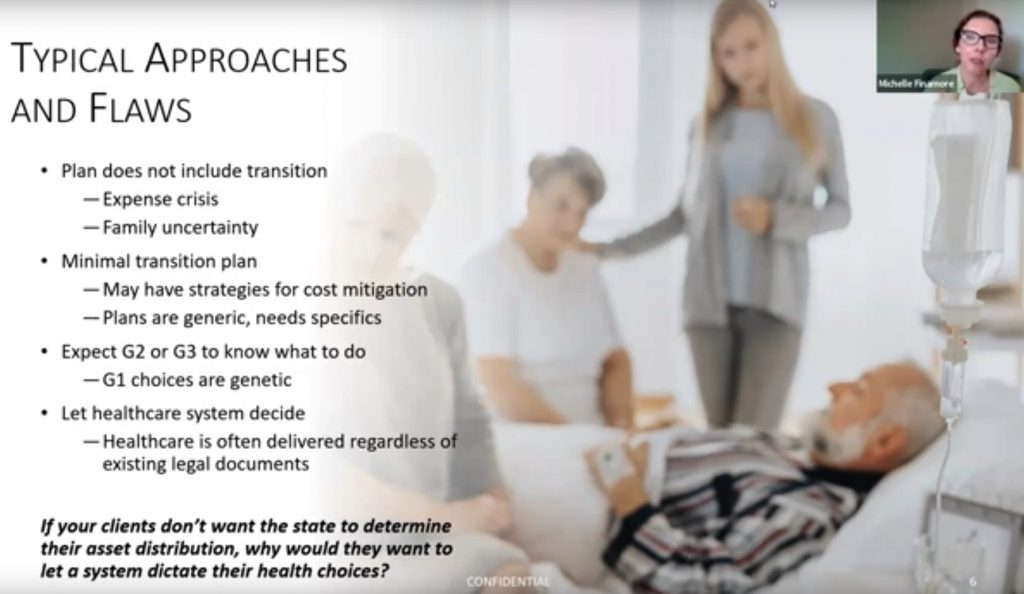

Mindy: Absolutely. What we are seeing now in the marketplace is incredibly complex estate plan documents without any consideration for transition in this gray zone. With extended serious illness like Michelle mentioned, that can cause a tremendous crisis from the expense side, as well as crisis in the family dynamics.

Carolyn: Mindy, I would like to comment here. As I think about families in transition, I guess it’s easy to personalize this conversation. I can’t help but remember my mom. One Saturday, she was around 75, and my sisters and I were visiting her place out in the country. She said, “Girls, I have something I want to give you.” We thought, “Okay.” So mom leaves the room and comes back. She put her car keys on the table! She said, “I’m no longer going to drive.” She had definitely been on that “go go go,” but her macular degeneration had developed to the level that during her conversation with her doctor she had decided she was no longer going to drive. We were definitely not prepared for that because she was so much in that “go stage.” She said, “I know I want to move into Austin. You know what resources I have.” She had a nice pension, she had long-term care insurance. She said, “Girls, you know me, just go find what I should do. Y’all figure it out and come tell me.” Mindy, as you know, I am a practicing CPA. One of my sisters was a nurse practitioner, one was in IT. We thought, “Okay, we can do this. We can figure this out.” Then, we thought, “Wait, where do we start? How does this work?” So we thought, “Okay well, we’ll get a map and find the places. Then we’ll go on tours. Well, we didn’t know what to look for. We didn’t know what to ask. Fortunately, my sister learned through her nurse practitioner group that there was a consultant that could help us. Help us ask the right questions. One of the questions was, “What would be most important to your mom?” One of my sisters reminded us that her two sisters, that she’s so close to, live in North Austin. We knew mom would really like to be close to them. As we dug into it further what that meant was her sisters could drive to her assisted living without having to get on I-35. That was that! That became the focus. Our mom lived in care for 10 years. She and her sisters are now both deceased, but during that time my aunts thanked us over and over again for making it so easy for them to go see my mom. My cousins still thank me for the joy their moms got by visiting my mom. It really came from that one person that helped us step back and think about what would be most important? Location, because there were so many good facilities to choose from. Like you’re talking about Mindy and Michelle, we knew that this condition was chronic. And you’re so right, two other chronic conditions developed. But they had prepared us for that possibility, so we were in a place of continuum of care. It was more natural as we transitioned her to different places on their campus. Thank you for letting me share this. We had the financial part, she was very well prepared, but we weren’t prepared for the day she gave us her keys. I know some people talk about the parents won’t give up the keys. In our case, she gave them up! Our response was, “Whoa, what do we do now?”

Mindy: I appreciate you sharing that story. It sounds like you had a very healthy dynamic family. While you were surprised your mom had the awareness and the fortitude to be able to make those decisions on her own behalf, you figured it out. You are just absolutely correct, many families don’t have active participants that want to acknowledge that their bodies are changing. Or that there can be other alternatives to continue with independence and quality of life. If you and your sisters were not all on the same page, you can see where that conflict could have escalated as to what would be best. Especially if your mom wasn’t able to share what was important to her.

Carolyn: Me and my sisters all were both working full-time and raising families. So it wasn’t like we had this free time to figure this out.

Mindy: I really do appreciate you sharing. It sounds like she had some transition plan, you said the financial component was taken care of. That’s what we’re seeing. We see folks that will have some cost mitigation, definitely long-term care insurance is a fantastic tool for that. But only having money doesn’t mean you know how you’re going to spend that money. Or how you’re going to be able to incorporate it to make sure that folks are having the choice that they want and having the plans executed the way they want. Especially during those times when their abilities are changing. You bring the example of macular generation, whether vision is changing, or mobility is changing – those are components that can be accommodated. But there needs to be some thought behind it. There is not a magic wand you can wave.

We didn’t plan this story beforehand, but it’s fantastic that Carolyn shared how her mom said, “Okay, you girls figure this out well.” What we see in families is that G1 (or whoever the aging party is, could be G2 or G3, I know some of you have multi-generational relationships) will assume that the other family members know what to do. That there’s osmotic transfer of knowledge, or there’s some kind of genetic of, “Hey this is how our family operates.” Where it’s not a formal articulated discussion but, “Oh, my wife will handle it.” Or, “Oh, my kids know what to do.” There really should be conversation around these things that might seem little but really impact quality of life in planning. Or families, or individuals, will let the health care system decide. And this is a really tough one, because they’re assuming that what’s going to happen in the hospital is not only going to be in their best interest but going to be what they want. There’s not a level of substituted judgment there, it’s really what does the hospital see that is best and then that’s what’s going to happen. Michelle, I’m going to ask if you’d share about what goes on in a hospital with respect to advanced directives and do not resuscitate orders

Michelle: If you’re familiar with a “do not resuscitate” that people might have in their facilities or at home, that is not valid in a hospital setting. As soon as you enter a hospital setting, you’re going to be considered “full code” and that you’re wanting aggressive care. Because, otherwise why are you at a hospital? It is the highest technology medical care that can be provided. Again, if you enter the hospital it is assumed you want aggressive care, all treatments, full code, full steam ahead. If you have somebody who has chronic illness with advanced directives, then that’s another point to have a good conversation. What does this mean exactly? If something changes, do you want to go to the hospital? Because there is a good chance that a lot of these things that your advanced care planning is saying you don’t want, you might end up having. I have met with many families over the years where that exact thing happens. I’m seeing them in the ICU or I’m meeting with their family. They’re having all the things that their advance directives said they did not want to have. What I talk about with families – if I’m lucky enough to meet with them before a crisis – is to say, what happens in a hospital is the doctors are going to listen to the person in the room who is talking the loudest.

Therefore, that’s the most important issue – have these conversations with your family. Figure out who’s going to be in your hospital room, who is comfortable speaking up to the doctor, who is comfortable speaking with other family members. Does this person really understand your wishes? Another good conversation to have is when people say things like, “I don’t want to go to the hospital?” But people are unaware of what to do when there is a crisis. “I don’t know what else I am supposed to do.” Or, “What am I supposed to do if mom does this, even though she says she wants comfort care?” Soon, that’s going to lead to other options. It does get complicated, but that’s where people like Pyxis, or people with medical backgrounds, do have a lot of other choices that may not be as familiar with people in the community.

Mindy: I think one of the things that shocks people the most, and we love attorneys, I don’t mean to offend anybody that’s on the webinar, but hospitals don’t recognize the Advanced Directives, the HIPPA forms, or sometimes the Medical Power of Attorney forms that attorney’s draft of behalf of their clients. Making sure that you know the local hospital requirements is key.

It is important that the agent who is the Medical Power of Attorney understands the local hospital’s requirements. And that the agent knows how to exercise their rights on the patient/client/family member’s behalf is going to be critical. It is absolutely mind-boggling to me how much emphasis and expertise is derived on ensuring that the government does not dispose of someone’s estate. How those wishes are able to be documented and honored. But the health system, and I’m not saying that doctors are bad actors, but that the health system gets to make decisions on your behalf. It seems very paradoxical to me that the folks that want control in one space, are happy to relinquish control in the other space. Which says to me that we need to educate them more on what that control looks like and how to enable it.

Carolyn: Michelle I have a story related to your comment that doctors listen to the person in the room. I had a neighbor who needed a ride for a cardiac test and I was available. The doctors came back and told me, Ms. so-and-so needs to have bypass surgery. They proceeded to tell me all the details. I interrupted and said, “I’m just the neighbor, I just gave her a ride. They continued and said, “This is what we need to do.” I repeated, I am just the neighbor, I don’t have HIPPA, I don’t have anything! Michelle, they didn’t seem to care and implied, “We have to tell someone, and you’re the person in the room.”

Michelle: Yes! Thank you for that story because that is exactly what happens. Working in hospitals all over the county, being in palliative care is almost the only time that advanced directives come up. We ask, “Let’s review them.” But, palliative care is often not consulted until the end of life. So even if you have fantastic advanced care directives you must make sure they made it to the hospital chart. Even if they are in the hospital and in the chart, are they in the electronic medical record? And if they made it that far it is simply just not what the doctors focus on. Their focus is on the patient right in front of them. It is as if they are thinking, “This is what I see. This is what I can try to do.” Unless there is a palliative consult.

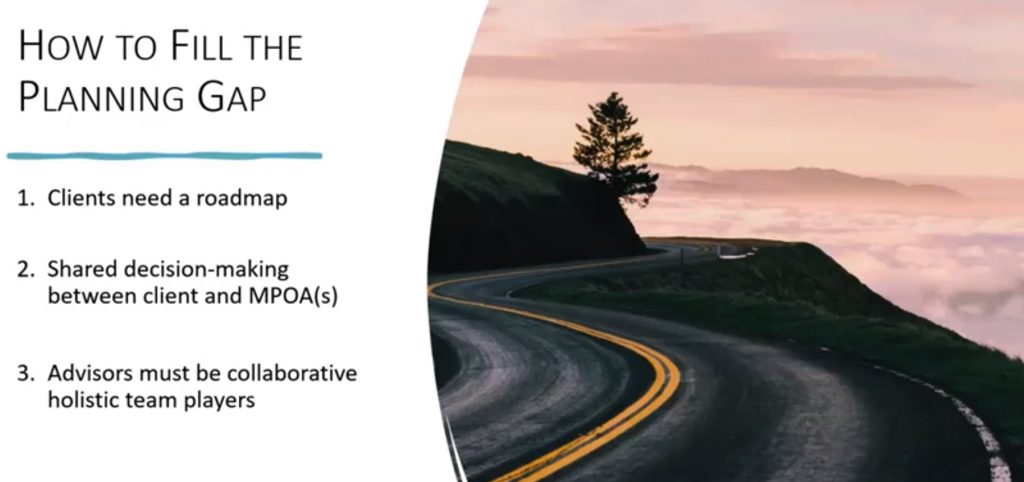

What we bring to the table at this point is how to close this gap. I would say very strongly that clients need a roadmap. Their advisors need to be able to pull together. Then talk through the options and how to navigate the options. There needs to be shared decision making between the client and whomever they’ve named as their first, second or third agent for their Medical Power of Attorney. That way, there is an empowered person in the room to be able to speak on behalf of those clients/patients. Then, in that moment, there is clarity about what to do if and what happens when. Being able to circle the wagons with the advisors and make sure that the decision makers are empowered and understand the landscape about whatever diagnosed chronic disease is going to be extremely important to help make this an effective program.

Celeste: Yes, thank you Mindy. I have an example a little different from Carolyn’s regarding a situation with an industry colleague and her mother. Her mom had financially prepared in case there was an event. They are an affluent family, so wealth was not an issue. Her mother had all the advisors necessary to do the planning. Therefore, estate and tax planning was complete. The problem was that all that planning had been taken care of at different points in time. Her estate planning attorney had some information and the tax planning attorney had different information. It didn’t really mesh when it came down to an actual event occurring. No one had ever talked about exactly what they were going to do at that point in time. Her mother had developed a condition that required very specialized care. She was out of state and the rest of the family could not participate in coordinating her care. Our colleague had to leave a very successful career in Dallas. There was no one who really knew how to bring all the pieces together. It had been done in so many silos. I am going back to your point Michelle, that there needs to be collaboration in place. She thought it would be a few months to take care of the coordination and that she would be able to return to her job in Dallas. Well, 18 months later she was still coordinating her mother’s care, was still out of state and had left her career. A few months later her mother passed away. It has now been about two and a half years and she is back in Dallas. She is still trying to get her life back and restart her career. There is this collateral damage – if you want to call it that. From a family perspective, whoever ends up taking on the burden of care will have their entire life affected. In our later conversations with her, she was unaware that there were folks like your organization who could have put this all together. But, there had never been that conversation. This is a different story than Carolyn’s family. Carolyn’s mother was prepared and there was time to have those conversations. In the situation with our colleague, it happened so quickly that nobody was able to plan for it. Had there been a collaborative roadmap, this could have played out very differently for our colleague.

Michelle: Yes, you bring up a great point Celeste. It is always good when you’re working through a plan to have a test drive moment. You can’t test drive dying right, but you can at least know who needs to be in the room (it could be Zoom) to decide what happens.

It might be the empowered family members and the quarterback of the advisory team. Or all the advisory team and the client. Or however the dynamics work, there should be a, “What do we do here? How does this overlap? What should we be considering?” Those are great points.

Speaking about care management, Celeste brings up this is a relatively new practice. Most of the care management history has been done within facilities. Being out in the field is something that we’ve only seen in the last 20 years. Therefore, it is not as pervasive as it could be. What care managers are meant to do, is look at a full landscape of options with respect to their client or to the patient. In order to know what needs to be done that will be viable given the particular characteristics or variables. For example, given someone’s medical condition, what are their environmental or housing options? Given someone’s mental health condition, what kinds of costs should be reviewed from the financial side? Looking at his holistically, we see this as a five aspect approach.

- Medical issues

- Environmental or accessibility issues

- Psycho-social

- Financial

- Legal

Psycho-social can be mental health, or it could also be socialization opportunities or personal culture. Such as their education level, religious background, types of friends and family dynamics. There’s another side to that quality of life.

Then there are the financial and legal issues discussed at the beginning. Who is making decisions, how are those decisions made, and then how is all of that being paid for. I would strongly encourage that when you’re looking at this practice for your clients, that you look for an expert to guide the process. There are many approaches available. Some are more cottage style, some are more corporate style, some are using more social work background, some are using more clinical or nurse type background. There are a variety of practices. You definitely want to find a group that has a team player approach. This role is not meant to be a decision maker. This role is meant to be an advisor who supports and works with the team that’s already in place, as well as with the client, to initiate and execute what their wishes are. I would also argue that this is a local type of work – health care, housing, those kinds of things, that we discussed are all locally driven. Even with the advent of telemedicine, you’re going to want acute care at a facility. So you want advice from folks that know the lay of the land at a local level. I don’t believe it is something you are going to find from a national, global, or even a regional approach. You really need to have boots on the ground that are locally able to advise their client on the options.

We’ve tossed around the word palliative quite a bit during the webinar. Let’s take a moment to do a deeper dive into this. Maybe this is something that you haven’t heard about. Michelle, would you take this part please?

Michelle: Sure. Palliative care is a buzzword and I believe many people have heard of it. It is a softer word than hospice. Palliative care is a medical benefit. I divide it into two parts:

1.) It clarifies care goals.

2.) Symptom management. That means if you have a disease, such as cancer, your cancer doctor is going to focus on what chemo to try, what radiation, what are the next steps. They may not be as focused on the side effects such as pain, depression, nausea or vomiting. Those things are symptoms. Palliative care focuses on the symptoms of any disease. Therefore, pain, depression, quality of life things, that is our focus and our specialty.

The other focus is clarifying goals of care. We initiate and encourage these conversations. The two stories Carolyn and Celeste shared are excellent examples. There’s so many different options depending on the specific situation. We help clarify what’s important to the patient and what are the realistic options. That is palliative care. We can also help people make decisions and help them define the questions for their doctor when harsh treatments are recommended.

Palliative care is meant to be alongside curative care. Hospice care is when you are done with treatments and you are accepting the fact that your illness will probably end life soon. Palliative care is only for serious illness, but it is meant to be alongside your aggressive care. While you are seeing your oncologist you can have palliative care. While you’re seeing a heart specialist for heart failure, you can have palliative care. With Alzheimer’s palliative care should be brought in right away. Unfortunately in our current system, palliative care is often brought in towards the end of life. Really it is brought in when hospice is needed, but palliative care is meant to be alongside aggressive treatment.

How do I access it? You can self-refer by calling a local palliative care company. To qualify, the person just has to have a serious illness such as cancer, dementia or ALS. It is not meant for pain management for a hurt knee or arthritis. It must be a serious illness. Currently it is a medicare benefit and is covered by most insurance companies.

Palliative care did begin in hospitals. All of our big hospital systems do have palliative care teams. They are consulted by one of the specialists. Again, unfortunately often the consultation is not until the end of life as we’ve said many times. This is where we would bring in your advanced directives as review.

How does it work in the community? To be honest, it is new in the community. There’s quite a few companies now that are saying they have a palliative program. Some are stronger than others. For the sake of time, I’m going to leave it there. But you can definitely ask me specific questions at the end.

The value of palliative care is that we are focused on comfort care, symptom management and decision making. Back to you Mindy.

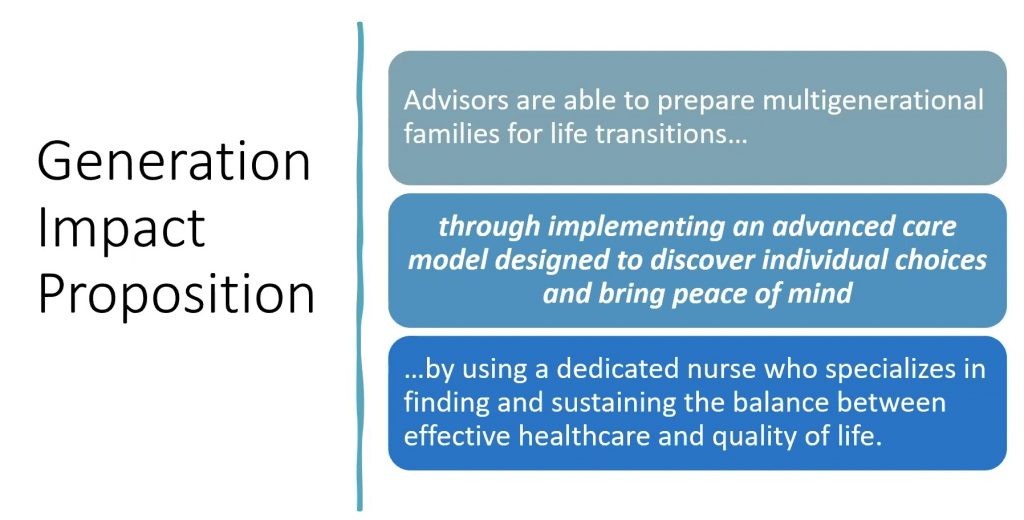

Mindy: As the slide says:

We advocate for what we call the “Generational Impact Proposition.” We want to empower advisors to prepare their multi-generational families for life transitions. Through implementing an advanced care model which will help elucidate those individual choices and bring peace of mind to the client and their family. This would be accomplished by using dedicated clinical staff that specializes in negotiating those conversations and figuring out the balance between healthcare delivery and quality of life.

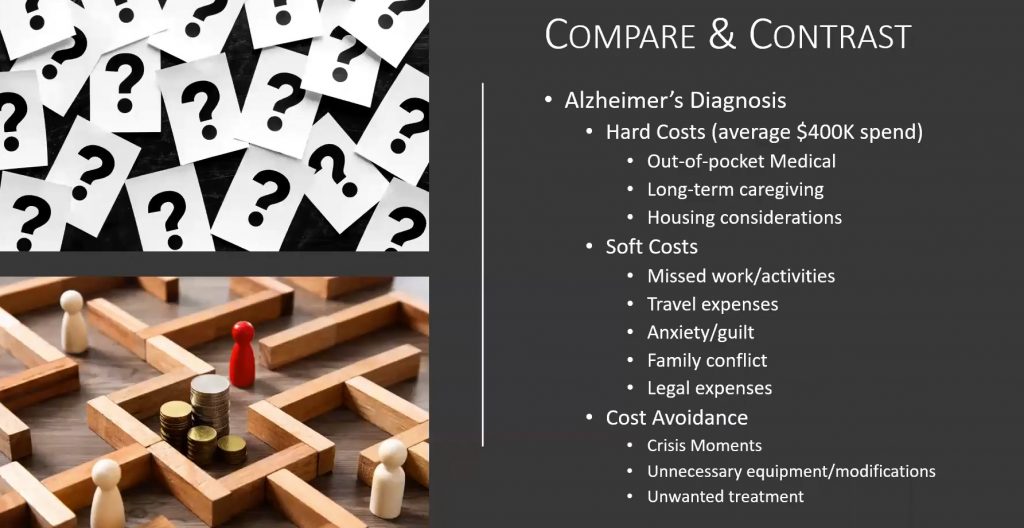

Now, this is a scenario to share a bit more about what Celeste had introduced earlier regarding the impacts of living with chronic conditions and this extended life transition. When we’re looking at an Alzheimer’s diagnosis, you can expect to spend at least four hundred thousand dollars in hard costs. This is beyond what medicare covers and would be an out-of-pocket expense. As well as long-term care. Whether it be facilities or caregiving in the home and then looking at housing considerations. Housing considerations have more to do with remodeling and accessibility than it does with care facilities. But those kinds of factors you must consider. Whether you’re looking at caregivers in the home with remodeling and making accommodations, or whether you’re looking at long-term care facilities. It’s quite a chunk of change to provide this care. It could be for an extended period of time.

Soft costs that should be considered are missed work and activities for the next generation or for the caregiver that typically coordinates this. Travel expenses, what happens to their headspace from an anxiety or guilt perspective. Dealing with family conflict, which unfortunately in these families can escalate into legal expenses in deciding what is best and what best could mean. You see the pieces on the slide jockeying for position? Sometimes the question comes up of what are people really caring about? Are they caring about the individual that has the illness, or are they caring about what’s in the middle of the board (money)?

Cost avoidance is something that care managers should help with in those crisis moments and mitigating additional problems or challenges. Also evaluating unnecessary medical care, equipment or modifications. It is really about navigating the space and knowing the options that are going to help when you’re making these kinds of decisions and purchases. And making sure that you’re getting what you want, as well as what you need.

Michelle: Just one other thought relating to this slide. Most of the advanced directives that I’ve seen are actually very general. What is difficult is that families expect it will be an exact book to follow when they are faced with these decisions at the moment. To be honest, in the medical field they are not that helpful because there’s a lot of gray. Most advanced directives state, “I do not want aggressive measures if there’s no hope for a cure.” So let’s take Alzheimer’s. Personally, I have very specific wishes that I know comes along with Alzheimer’s that I’ve directed to my family. I’ve never seen them in most advanced care planning. This is something that, as a disease, if it’s in the family, there are some very specific things to talk about. To your points about unwanted treatment, unnecessary equipment, most people I meet with Alzheimer’s in late stages might be on 25 medications. I believe that’s something they would have wanted to stop five years earlier. I wonder if that is a discussion they ever had? These are issues that can be addressed in advanced care planning that are usually overlooked.

Mindy: Thank you. What we say is: it is definitely time to act. Everyone. Advisors for themselves, as well as their clients. You need to build a forward-looking care plan. There are DYI tools available. Age Your Way, The Conversation Project and Five Wishes are ones that are readily accessible on Amazon and online. They will help you work through the thought process. What we have found with our client demographic is that they’re nice ideas that don’t get done unless we get engaged to help walk through these conversations. Especially when it comes to conversations between family members. We would also say strongly that you need to engage a care manager so that people really understand what their options are and not make assumptions within families. As Michelle was just talking about, what is and is not an aggressive treatment. One example that she gave was a recent client. There’s not a little bit of CPR – either we’re in or we’re out. We really need to understand, what does that mean? And then, what are the actions, effects and consequences? These conversations aren’t always fun, but the outcome of giving the gift of peace, certainty and knowledge to your family and to your clients is really where it is.

With that, we are happy to take any questions.

Todd: Mindy, Michelle, thank you. Terrific presentation. You can see why we’ve been doing these presentations for years. Mindy is only one of two people that we’ve brought back for a second visit because we think her information is so valuable. So many of us avoid it, we don’t want to deal with it. I’ve heard many many times the idea that two or three years too early is better than two or three months too late.

Mindy, if you can give us some specific ways to get us, our advisor community, and our clients to think about this. You mentioned the idea of a fire drill. Is that something that you have found to be successful in dealing with people? Let’s pretend mom or dad develop Alzheimer’s to the point where they can’t communicate their wishes coherently. How do we start that conversation? How does your company, as care managers, come into the picture? We haven’t discussed this and it is not meant to be an infomercial, but you have very valuable services with tremendous experience behind you. So how do we introduce a topic and how do we introduce you?

Mindy: The best thing about you Todd, is that when I say we’ll take questions, I don’t need 20 at the same time. I’m just going to do my very best to get through those and if I’ve missed one you come back to me. I would say, most of the estate planning folks that I know, the advisors that we work with, have really strong relationships with their clients. They are seeing them on a regular basis. Whether it is an annual meeting or something that gets refreshed every third year. You can add this to the agenda: What have you talked about with respect to your health care decisions? I know many great attorneys that will spend a lot of time on trusts and trying to figure out how we’re dealing with post-death issues. But they’re not spending any time dealing with the pre-death, aside from that an advanced director medical attorney is included in your package. It is at this point that I recommend expanding the conversation. That can be the point where we come in to help have those conversations. I think the first conversation needs to be with the clients as to what would you want in these broad-based scenarios. Then that gets documented and included in the plan. Then having the conversation to empower whomever the medical power of attorney is would be the next step. At that point the family is brought in. At least there would be a consensus. It is a concentric ring that expands.

Michelle has been a great educator for this. That is basic. That is when you’re healthy. That is today. Have the conversation today with the clients, or with yourself. Ask, what do I need to do to describe my deeper advanced care and empower my medical power of attorney? Those are the two things everyone needs to do. However this also needs to be amped up when there becomes this condition, or when there is a diagnosis. I would encourage people to engage a care manager and talk more in this preventative space. Usually we get called when the diagnosis happens. That is where you know there needs to be more “what if.” The medical practices do a fantastic job. Your cancer doctor, your heart disease doctor, your neurologist will do a great job of talking about disease progression. Most clients and their families honestly get so overwhelmed with the medical choices when they receive a diagnosis (that nobody really wants.) Processing on how it impacts the rest of their life doesn’t happen for some time, if at all. That is where we need to be brought in to walk through the issues.

Todd: Rebecca, do we have some questions in the queue?

Rebecca: Yes, one of them is “Don’t their doctors talk to them about advanced directives and do not resuscitate orders?”

Mindy: Michelle, would you take that one please?

Michele: Unfortunately, these are 20 to 30 minutes minimum, but I would say they are closer to an hour. How many times have you spent an hour with your doctor? You are going in to get your hypertension looked at, or your test results. That is the point of your appointment. The answer is no, these are not usually discussions held in most doctor appointments

Mindy: Michele, would you say that is the same in the concierge practices too?

Michelle: Correct, even in concierge practices this is not usually discussed. I work with a lot of these physicians and many are my friends. I even worked with one who was a hospice and palliative care director for many years and she went back to primary care. I asked her, even with your background do you talk to them about end of life? Her average age patient right now is 89 years old. I said, “With your background, and now going back to primary care, do you have these conversations?” She said “No way, I don’t have time. It takes 20 minutes to explain their blood pressure medicine. Unfortunately, I just don’t.” It doesn’t happen very often. Of course, there are exceptions. But, in general, I would say not very often.

Todd: Rebecca, a couple more?

Rebecca: Someone was asking what an advanced care model is?

Mindy: Our approach is that we’re planning before the emergency. Advanced care for us is not what’s happening right now, but what could happen. What are the issues that lead from right now? To make sure that that is incorporated into the overall estate plan, as opposed to being something that’s separate and apart.

Rebecca: Thank you. Someone asked, what’s the average start time when someone should start the care plan planning? I know you mentioned it’s never too late, you should start now. Since you’ve answered that one, I’ll move on. The question is, how do you encourage your clients to have these discussions when they don’t feel that they need or want to have the hard conversations?

Mindy: What I encourage all advisors to be mindful of is that in this landscape of post COVID, or hopefully soon post COVID, there have been more and more conversations about health and quality of life in the last two years, than has been in the last three decades. Therefore, this is something that shouldn’t be a new topic. I believe everybody during the pandemic was absolutely shocked with how facilities locked down and shut down. There are more opportunities for conversation that advisors can initiate in which clients are not going to shut down. Even if the client thinks it doesn’t apply to them, they’re going to understand “what if.” It is completely reasonable, normal and good practice to say, “Have you thought further about this? Does your medical power of attorney know what’s going on? Are you ready to start having a deeper conversation?” In the deeper conversation, we advocate it be with somebody who has that clinical background to be able to spend the 20 to 60 minutes. Because people will have questions around how to navigate. Then, how do you empower your medical power of attorney?

Mindy: With these conversations, I have found people actually leave feeling better. I believe people fear going into it, but these conversations really will reduce stress, reduce chaos and perhaps encourage more conversation. I’ve found that even when I am talking to people at the very end of life these conversations are very helpful and people actually leave feeling better.

Rebecca: Thank you. We have another question that I think many on this call would like to hear the answer to. How is the ethical line advisors must consider in advising clients different from the legal line of competency? What should advisors look for in drawing that line?

Mindy: I’m not sure I understand exactly what the question is. I can tell you that what we strongly advocate for is that folks are able to determine and navigate their wishes when they’re healthy. And then what they think they might want to change after they’ve received a diagnosis. For example, my mother-in-law has COPD (chronic obstructive pulmonary disorder), heart disease and diabetes. When she was diagnosed with lymphoma two years ago, she was willing to do some treatments. But not all the treatments that the doctor recommended, due to all her other diagnoses. If she had made her care plan before she had the COPD, CHF (congestive heart failure), and diabetes diagnosis, she may have had a different approach. Having someone make those decisions, and of course we would prefer them to be able to be competent when making those decisions, is going to be key. It also helps alleviate the second guessing “what would mom or dad really want?” The angst and anxiety. I don’t know that I see an ethical line when you’re talking to somebody who does not want more treatment. Now, we would not be working with someone who has Alzheimers, or who has a dementia issue where we’re talking about changing a plan of care with that client alone. That would be a shared decision with their medical power of attorney because of those conditions. But it would be really great for that medical power of attorney to have had the conversation earlier.

Todd: Mindy we’re right at one o’clock, but I believe this is so valuable for those that want to stay on, I would suggest we keep on going and take questions from those who are interested.

One of the questions the attendee was trying to get at is, some of us, who are not lawyers, and we don’t have a legal responsibility or maybe even an ethical responsibility to address the issues. Perhaps the question is, “When was the last time you had this conversation with your legal advisors, your health caregivers, or your power of attorney?” Does a person who has a health care directive have the authority for that? You had a conversation with them, but do they even know they’re listed as a health care power of attorney?

Mindy: You bring up a great point Todd, and I appreciate you bringing more clarity on this. We are not attorneys either. We certainly don’t want to practice in that space. But I would argue that advisors are fiduciaries. So they should be trying to help and advocate for their clients and for their clients’ wishes. That goes across the spectrum. From my perspective, yes, include the following in the conversation, “Have you thought about this? Are you prepared for this? Is your family prepared for this? Do people know who they all are?” And all the rest of those kinds of things. I think that’s very meaningful and valuable.

Michelle: I would like to add that, in the hospital setting, everything that happens is under a doctor’s directive, a doctor’s order, or a nurse practitioner. It has to be a medical order for something to happen. That’s actually so different from an attorney, I mean, so there is overlap,of course. I was surprised when I entered this field that nothing happens without a doctor’s order and that’s how a hospital system works. We see in the news about the scary end of life situation on if care should be withdrawn. Those are sensational stories. These decisions happen daily in hospital settings everywhere. Unfortunately, a few of them make the news because of some chaotic situations, which is, again, why we are trying to avoid these situations by having conversations in advance.

Todd: Thanks to both of you. We really thank you for enlightening us on this difficult issue. Obviously it’s much more difficult after an event has occurred. Unfortunately it’s not a matter of if you’re going to have to have the conversation, it is when. Thank you Mindy and Michelle for bringing your expertise. On behalf of Carolyn and Celeste, we thank you for joining us.

Our next C&C Event will be in September. Thank you all, Have a good day.

Mindy: Thank you.

™

™