C3 Financial Partners’ September C&C (formerly titled Consume and Converse) event featured Jim Whiddon, author, Texas A&M professor, and CEO of The Old School.

“What will your legacy be?” Nothing is more important than our kids and grandkids. What values will we leave them? What wisdom will we impart? Watch the recording to learn ways to maximize your Return on Legacy™ and the life-changing impact you can have.

C3 hosts a periodic C&C event series to share ideas among professionals. We look forward to your review of our time with Jim and learning better ways to provide continuity of service to our clients.

ABOUT JIM

Originally from Amarillo, Texas – Jim was a member of the Corps of Cadets at Texas A&M, and also a graduate assistant coach for the Aggie basketball team. Jim is a Certified Financial Planner® practitioner and holds a Masters of Science degree in Financial Services.

Originally from Amarillo, Texas – Jim was a member of the Corps of Cadets at Texas A&M, and also a graduate assistant coach for the Aggie basketball team. Jim is a Certified Financial Planner® practitioner and holds a Masters of Science degree in Financial Services.

Whiddon founded JWA Financial Group, Inc. in Dallas, Texas, and served as CEO for 27 years before his firm was acquired in a 2013 merger. He is a two-time recipient of the “Aggie 100 Award” from The Mays Center for Entrepreneurship. His work has been quoted or seen in more than 350 publications and national media outlets – including Fortune Magazine, the Wall Street Journal, and CNBC. He has also been a FOX News Radio contributor.

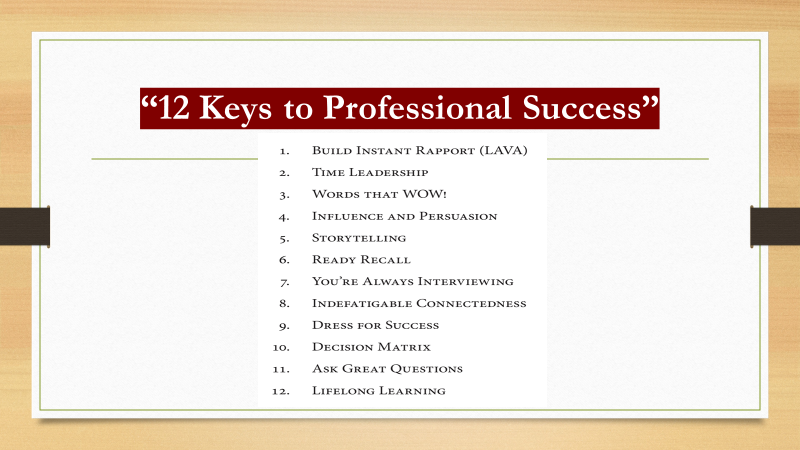

Whiddon started The Old School which instructs students on “The 12 Keys to Professional Success” which he teaches in the Financial Planning Program at Texas A&M. He is the author of five books, including his latest, “The Mentor” released in September 2019.

Jim enjoys traveling, music (guitar), reading, and any sport with a ball. He and his wife – also an Aggie – are active teachers in their faith community and have four children – classes of ’15, ’19, ’20, ’23.

Todd: Carolyn, Celeste, and I welcome you to this Zoom. We’ve got some poll questions that Jim will put out there in a minute, but before I introduce Jim formally, I’d like to play a short video that he’s responsible for putting together.

https://www.youtube.com/watch?v=yrYXbV-OkCs

That’s Jim Whiddon, who has multiple roles in his life currently. Jim is originally from Amarillo and was a member of the A&M Corps of Cadets. He is a graduate assistant coach of the A&M basketball team. Jim is also a certified financial planner. He holds a master’s of science degree in financial services.

Jim founded JWA Financial Group in Dallas, he served as CEO for 27 years before he merged his firm with another organization in 2013. He is a two-time recipient of the Aggie 100 award from the McFerrin Center for Entrepreneurship and his work has been quoted

in more than 350 publications and national media outlets, including Fortune Magazine, the Wall Street Journal and CNBC. Jim has been a Fox contributor. I heard an hour-long radio interview and it was very, very, well done. He started The Old School concept with instructions to his students to have 12 keys to professional success. Jim teaches financial planning at Texas A&M. He has written a book called The Old School Advantage, which today is a reminder to be prepared and throw back to the old ways before we had Zoom technology to deal with.

The Old School Advantage book was released two years ago and is a very, very good book. Taking the practical ideas that he put forth in The Old School into a fiction about a student at A&M – wait – we don’t know it’s A&M, it is a hidden school and not named outright, but subtle hints. In addition to being a professor at A&M in the financial planning program, he also enjoys traveling, guitar, music, reading, sports, anything with a ball he says. He and his wife, who also happens to be an Aggie, are active teachers in their faith community and have four children, from the Aggie classes 15, 19, 20, and 23. Could you have guessed?

We are so pleased with his book that we bought it and have gone through it with Jim. He has been a tremendous resource for us. For the first three people that email us after the presentation, we will give you an autographed copy, which I think you’ll find a tremendous tool. We refer to it constantly and some of the things that Jim has shared with us. We go back and look at it frequently. Jim has helped us become much more clear and, more importantly, provided additional clarity for our clients. Jim, before you start the presentation, “What Will Your Legacy Be?”

I want to share a quick personal story that happened last night. Nobody on the call knows this is happening, but I wanted to let you know my grandson is nine years old and his parents are both very bright and active, they do a lot of things like skiing and traveling. I was trying to find a legacy that I could provide to him. I decided a few months ago to teach him chess. He picked it up immediately, and within two days, was beating me. His father is very bright and effective at anything that has to do with math. Yesterday afternoon my daughter texted me and said, “Sam asked if he can take a chess class; well played Big Pa!” It was a great feeling, and I couldn’t help but think about your presentation today and the impact of legacy in the many different ways that we can impact the next generation and even the generation afterwards. With that, Jim, glad to have you here. Thanks for sharing with us.

Jim: Thank you Todd, it’s so good to be here. You know I was just thinking as you were narrating that video (sorry we couldn’t get the audio to work), I may actually replace the audio with your beautiful voice. I’ve always told you you should go into broadcasting; you would love it so much.

As you mentioned, the title of this presentation is, “What Will Your Legacy Be?” I’m excited to present this material to you. I’ve had an opportunity to consult with advisors since I sold my practice in 2013, and the delightful opportunity and challenge, to be here, what I call the center of the universe, in College Station, Texas, where A&M is and to try to get these young minds headed in the right direction. It is a real privilege to be able to do that, and to be with you here today as well. I’m looking forward to sharing some thoughts that I think will at least be thought-provoking, that is my hope.

The first thing I want to do are a couple of poll questions that I think will be informative. I know probably the majority of our participants today are financial advisors or in some way advising on financial issues. The first question is: What percentage of U.S. citizens do you think are using a financial advisor/planner?

No cheating.

The answer is 31%. As a financial advisor I think, “oh my, 7 out of 10 people that I see are not using one. That is a built-in market.”

The second poll question is: How much of Warren Buffett’s wealth came after he reached the traditional retirement age of 65. The answer is 97%.

I’m going to give you what I refer to as three super-client questions. In other words, they’re transcending questions to clients that are going to bring out information. Questions that are going to be hugely valuable from a financial standpoint, but also from an emotional and relationship-building standpoint. The first thing I want to talk about is what a legacy entails. I call these the three T’s, plus people. The first “T” is Treasure. That is the financial aspect that we’re all involved with as financial advisors.

The next “T” is Time. I just spent a week teaching the time value of money on a TI calculator in the Fundamentals of Financial Planning with my students at Texas A&M. But when I think of time, I also have this vision floating around in my head. It is the time value of time, in other words, the most valuable thing that we possess. What is it that we could do with our time and our legacy that would pour into the next generation?

So far, we have treasure, time, and the third “T” is Talents. What is it that we bring to the table, what is it that our clients bring to the table? You might know some talents they’ve even forgotten they possess.

Treasure, time, talents, and the last one is people. It’s relationships, the fourth aspect of what is a legacy is relationship – so three T’s, plus people. Treasure, time, talents, and relationships. If we think about treasure for just a moment, what do we use treasure for? Well, again, as a newfound professor, I’m big on giving our students things that they can remember. So, when I think of treasure, I think of: We are either going to use our treasure to live, to give, to owe, or to grow.

We’ve got expenses: We want to give to charitable causes, we’ve got bills, we’ve got to pay our debt, or we’re trying to grow our portfolio. So, treasure is made up of: to live, to give, to owe, and to grow.

Now, when we think about time – I love Greek, I love Latin, I don’t know why – I didn’t major in it, but I should have! Most of the time when we think about time, we think of the Greek word “Kronos.” That is essentially the marking of time, or chronology, or clock and calendar. These are the things we think of when we think about time, but I would suggest to you that the most important aspect of time would be another Greek word with a different meaning, and that is “Kairos” spelled with a “K.” K-A-I-R-O-S, kairos. What is kairos? Kairos speaks to the quality of time, it speaks to time being a gift, it speaks to an opportune moment, or a right season, if you will. So understanding the difference between marking time and using time or possessing time and using it as a gift, then that begs the question, “what is it time for?” I would ask you, as a financial professional, “what is it time for?” Or ask your clients – that’s a great question. What is it time for at this point in your life and this speaks to legacy.

We’ve talked about treasure, we’ve talked about time, and now let’s talk about what we use time for. We’ll look at this in a moment and see how it should be apportioned as we think about leaving a legacy. But obviously, we can spend time for leisure, we can spend it for work, family, ministry, or mentoring. Those tend to become more important as we go down the list.

The third aspect of building a legacy is talents. This can have to do with the talents you have in your job (your vocation) or it can also have to do with your gifts (your unique abilities or your “calling”). I have a definition for calling that I really like, I heard it but unfortunately I can’t remember who I heard it from. A calling is defined as: talents + opportunities + passions = calling. Rebecca would you click and put that equation up there so they can see it?

So, I ask you throughout this presentation to consider these. Admittedly, the questions get a little deep in terms of philosophy, but that’s on purpose because I’m hoping that you, as a participant on this particular presentation, will think about these things in terms of yourself and most importantly, or as importantly, pass these on to family, to kids, to grandkids, to clients, to their kids, and their grandkids.

We’ll talk a little bit more about that in just a moment, but I always love that definition of calling.

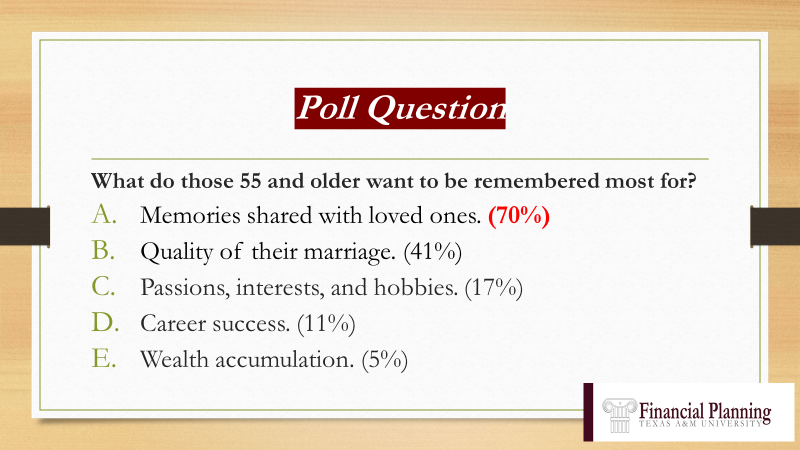

Let’s take a look at the next poll question. “What do those 55 and older want to be remembered for?” Take a look at the five options. So we’ll give you a few seconds to vote. “What do those 55 and older want to be remembered for?” Interesting to see how that’s coming in..

Easy for me to answer from my experience yesterday… It looks like 63%, or almost two thirds, are coming in at the top. Looking at the broader results from the survey, you can see, sure enough the answer is A: memories shared with loved ones, overwhelmingly, is what people over the age of 55 want to be remembered for.

These, of course, are in order: the quality of their marriage, their primary relationship: 41%. Passion, interests, hobbies; maybe a little surprisingly down at 17%. Career, success, and wealth accumulation barely register in the big picture. Wealth accumulation, when it really all boils down, people aren’t that consumed with it, no pun intended. Yet it’s still a big piece of legacy. It’s the one that we’ve chosen to primarily pour into, in terms of our own profession. Very important, but I want to see where we can move beyond the borders of helping with wealth accumulation, career success, and move into some of these other areas that are obviously so important based on the broader survey and even the smaller survey that we just did together.

So, let’s think about relationships. You can look at this, from top to bottom, in terms of concentric circles. You start out with community, move to friends, move closer to family, move closest to that significant other in your life, and then the creator…perhaps, your spiritual thoughts.

When I was an advisor, one of the questions I loved asking clients of every stripe, no matter where they came from geographically or what their wealth was: “What’s keeping you up at night?” I asked just to get an idea where they were, whether it was a new client opportunity, perhaps a prospect, or even somebody I had had as a client for 20 or 30 years. What’s keeping you up at night? And you know because of the location we were in, i.e an organization’s conference room, they would typically go to a money answer first. “Well I’m worried about the market, the economy, the presidential election, what’s happening in Europe” – whatever it might be, but I only had to ask maybe one more time, “What else is keeping you up at night?” And it typically always came down to simply kids and grandkids. Right? Now I realize it can be other things…health issues, things of that nature, but that seemed to always be the thread that ran through the answers to that question. I always found it very curious and of course, you know being the father of four children without grandkids yet, but you know – little children, little problems, big children, big problems. I think maybe some of you can relate to that. Relationships are really where our clients hearts are, again that survey question spoke to that a moment ago.

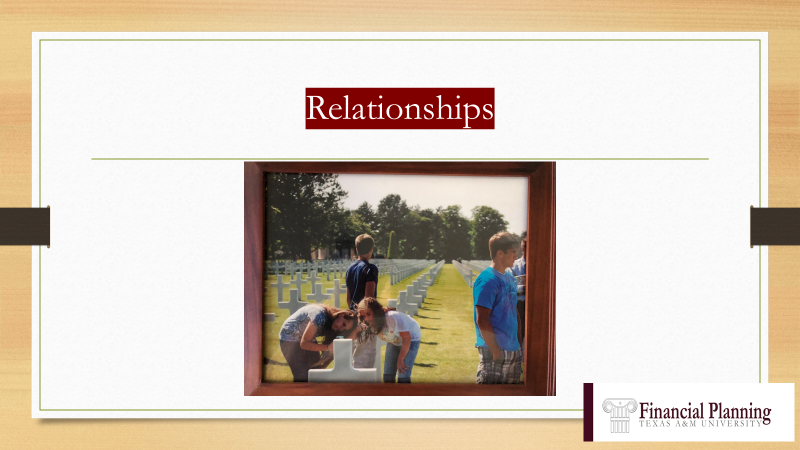

If you go to the next slide Rebecca, I want to show you a picture that means a lot to me. I’m not here to give you my life story, or focus on me or my family, but I’m hoping to give you a visual by showing you this picture. Maybe you can see it just over my left shoulder on the screen – it will remain in a prime place on my shelf for as long as I’m around. This photo was taken about 10 or 12 years ago, when we were in Northern France visiting Normandy in the cemetery near the beaches of Normandy. These are my four children, obviously they were younger then. It’s just fascinating because of what they are doing. Not because of what I’m doing, but because my youngest son is looking down the row of crosses. He’s currently a second lieutenant army officer based in Georgia and has always been a real historian on WWII battles. My oldest son, Jonathan, is looking down the other way at the rows of crosses. My two daughters are looking at something that has their attention on a particular cross. It was just such a poignant moment, such a beautiful day and it was such a meaningful day for me. That’s the picture that in my life really exemplifies and represents what my kids mean to me, and what it means to be able to teach them about history and about the sacrifices that have been made.

I show you this picture because I know in your mind right now, there is a photograph, a picture, a painting of something in nature that brings that same kind of emotional meaning to you. That’s why relationships are weighed so heavily, in my opinion, in a legacy consideration.

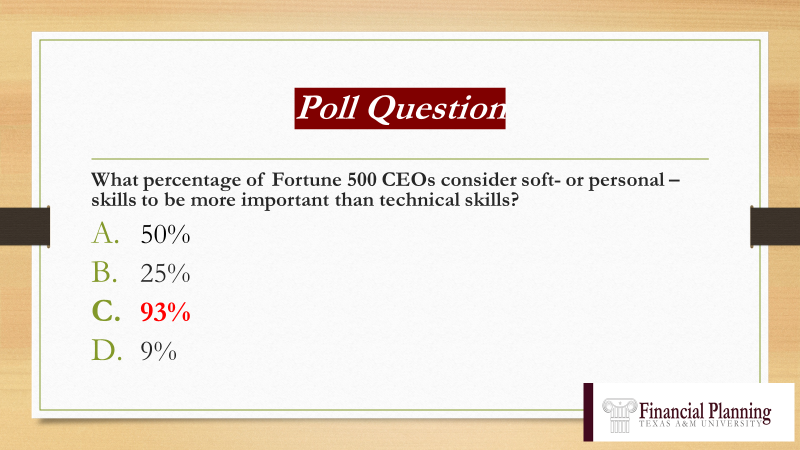

On that note, let’s go to the next poll question: How are we going to pour into the legacy of our children and our grandchildren? What percentage of Fortune 500 CEOs consider soft- or personal skills to be important.. This was done about seven or eight years ago.

Celeste: Jim, while the audience answers the poll, I want to interject. You shared with us a really important technique for starting conversations with people. We frequently start conversations with other folks – especially in networking events – what do you do for a living, or what industry are you in, and you taught us about LAVA. So, I don’t know if you want to just explain really quickly what that means. Because that’s been really important as we create relationships within our firm.

Jim: Yeah, absolutely I will do that. We’ll see the poll results here real quick. 25% is the poll answer. Well, believe it or not, the answer is 93% of the Fortune 500 CEOs. I think they interviewed 318 of the 500 at the time of the survey. Nine out of ten felt like, in this generation, soft skills were more important than technical skills.

Celeste, I’m going to come back to LAVA, on that answer, but one other statement here. I’m teaching kids at A&M. I am on the ground with students in college right now. When I was at the university 40 some odd years ago, we had an opportunity to take courses that spoke to the idea of communication and how we come across to older adults. There’s so much technical information that has accumulated over the last 40 years, that when kids major in accounting, they’re taking accounting in their first fall semester. There’s not a lot of time for courses that teach these skills, so I think that may be one of the reasons, or that we see these kinds of CEOs of Fortune 500 companies, you know hungry, even starving, for that kind of ability in their younger workers. So I found the poll to be a very interesting question.

To the next slide.

Celeste, to your point, I believe one of the ways you can leave a legacy is understanding how important these interpersonal communication, or soft skills — I like to call them critical skills– as you can see there in parentheses. How important these skills are in the LAVA conversation, I’ll give you a little bit more detail on that in a moment, is an example that you brought up of one of those social skills that is so valuable I believe in this day of dominant technology.

I put up an equation. It is I + K = W. Now I’m not a math guy, so don’t be impressed at all with that because all I’m trying to express is the idea that I think what CEOs are seeking in those soft skills is they’re looking for kids that are wise beyond their years. If you were to say to me after meeting one of my four children (and I get this compliment often and I love it) is, “you know that that kid is wise beyond their years.” As a parent, I don’t know that I could have a compliment much more meaningful to me than that one. And it by the way, it’s not said about all of them all the time, I can assure you, but when we get that kind of compliment, my wife and I are so proud. Because it speaks to wisdom, that’s really where I think there is a hole in our culture.

In the generation that is being brought up – our kids and our grandkids of wisdom and so this attempted a math equation here it’s simply intelligence I plus knowledge K. And by the way, our intelligence–our intellect, is pretty much set for us, through our DNA and what we inherit and are blessed with or not. But knowledge is something that we can’t accumulate, so we’re controlling the, if you will, if we’re looking at this as math. We add those together and then times experience (I + K = W x experience).

So, I tell our kids in the classroom, ”Look, we are trying to add 10 to 12 years of wisdom to you in four years of college.” If we can multiply your wisdom at a faster rate, we call it the speed to trust. In other words, if a young man or woman is wise beyond their years, then when they get into the business world, they’re going to be trusted at a more rapid pace. And why are they not trusted? Simply because they don’t have the experience–they don’t have the kronos if you’ll recall. But what we’re trying to do is give them the kairos by giving them a richer experience. Otherwise, we want that experience to be rich in terms of who they surround themselves with, what they’re learning, such as the LAVA technique that Celeste mentioned, which is coming next. But also those mentors that they’re surrounding themselves with.

Todd mentioned earlier that my latest book is actually called The Mentor. It’s a fictional book that talks about these concepts in a story form, so that perhaps it’s a little easier to digest by the younger generation. I love a couple of quick quotes here on the next slide. Really are very meaningful. Wisdom means simply knowing what matters. I don’t know who Brent Hanson is, but I love that definition. Wisdom means knowing what matters. Isn’t that a great definition?

The next one there is equally good when we think about legacy. Legacy is not leaving something for people, it’s leaving something in people. A gentleman named Peter Strobel said that.

Let’s transition and think about our kids and our grandkids. Remember going back to the conference room, “what’s keeping you up at night: my kids and my grandkids.” Well, here’s a picture of The Mentor and the program on the next slide.

The program within it, the professor–a fictional professor–is teaching a course called the 12 Keys to Professional Success, so you see where I’m going with this on the next slide. I’ll give you a few moments here to take in some of this.

Celeste, a moment ago, mentioned LAVA; yes it’s the key. Number one, they’re building instant rapport, so we asked the kids and again I want you to think about this in terms of not only yourself as a technique you know even Todd learned a new trick here, right? The old dogs can learn new tricks. I’m with you there, but anyway I asked him. I said, “if you could build instant rapport with anyone, at any time, anywhere, would that be a valuable skill?” So, I’m asking that to college students and I’ll ask that to you as a manager–as someone running a firm and someone working with clients who have kids, grandkids of your own. If you could teach them to build instant rapport anywhere, anytime, with anyone, would that be a valuable professional skill? Would that be something that would make someone come across wise beyond their years? Would it increase that speed to trust? And of course, that’s a rhetorical question as far as I’m concerned, and the answer is yes.

So LAVA is simply–just to give you a very quick rundown on it–LAVA is an acronym for Locations, Associations, Vocations, and Avocations. So locations, as Celeste mentioned a moment ago, the first question I ever ask anybody, I always ask this as soon as I meet them, I’ll ask them, “Hey are you from around this area?” Good chance they’re not and no matter where they tell me they’re from, it doesn’t matter–any location you put a pin on any place in the map on the entire globe–and I will be able to comment on that place. I’m old enough, I’ve been around long enough to know something about every continent, every town, every state and I can find something to talk about as soon as they tell me where they’re from.

Now I wish we could do this with each one of you who are on the program today or we’ll watch this a little bit later, but I tell you when you talk about somebody’s hometown, where they’re from, it brings in nostalgia. It brings in emotion, it brings in good memories. We tend to remember the good things about our past life, not the bad things generally. And so, it allows you to relate to someone literally instantly as soon as you make a comment about where they’re from and then that moves on to their association. So the A in LAVA is for associations. You can ask about family, or friends, or who do you know at this conference, or do you have family back in Fresno (if they’re from Fresno, for example) and so what this does is it brings in instead of asking about their vocation which is the third thing I always ask. Instead of creating that possible socio-economic separation or professional separation or lack of anything in common by saying, “hey what do you do?” at The Old School.

Todd mentioned earlier a company that I established. One of our mantras is, “It’s not just what you do, but it’s who you are that makes the difference.” That’s really what I want to know. I want to know who you are, where are you from, who do you know. Tell me about your upbringing, and these are not, we’re not asking direct personal questions… the technique actually avoids those direct personal questions, but by learning this about someone, you begin to become friends, you begin to relate to each other, then you can talk about vocations and then avocations, hobbies, and things like that.

Even though they weren’t that important on that survey earlier that we looked at, people still love to talk about what they do in their free time and what they do for fun. And so that’s an example of one key skill- interpersonal communication skill that we can teach to today’s college student, you can teach to your kids, your grandkids, and now begin to suggest some of these things to clients to build that rapport in your business relationship and/or personal relationship.

So you can see here I’m really dwelling on the relationships part of those four areas of a legacy, but that’s because that’s kind of an area where I love to focus and have had some enjoyment doing that.

I’ll pause here if you’d like to jump in because I think of the 12 items here and from your book for this audience, I think that’s probably the most important one to take away. The most important one that we’ve kept in our firm: the idea of a warm flowing conversation. And I think it’s just as important to focus on what you shouldn’t ask. You know we tend to ask are you married? Do you have children? You know, what do you do for a job? And the danger in that, you’ve explained to us before, but I think it’d be good for the audience to understand why it’s important not to ask some of the questions.

It’s just as important to focus on what you should be asking right now; and thank you, I’ll bring that out uh just a couple of comments there. You know I don’t ask people where they’re from, I ask if they’re from around this area because then they’re naturally going to probably tell me where they’re from. I suppose there’s some places that if you say I’m from that place, it might have some negative connotation? I don’t think so; I mean, we really can’t help where we’re from, but you know that’s kind of the way things are sometimes in our culture and so you want to try to avoid those kinds of things.

I asked do you have any family back in that hometown as opposed to saying are you married, do you have kids. I mean you know there’s things that happen in life… they could have lost a spouse to death, or be going through a difficult breakup, or you know, so you don’t want to bring those negative feelings up so you just ask very innocuous, open-ended questions. And if they want to go there, you’ll go there with them. If they don’t want to go there, then you know no harm done and you’re still on your way to building some rapport in some way. So yeah, the technique is talked about in more detail in the books that you’ve offered to give away, The Old School Advantage, and so I won’t dwell on it too much, but thank you for uh for those comments.

I would also throw in, obviously, I love them all because I wrote about them, but if I’m thinking about the very most important of those, I would say words. That while the words they use really tell the story about who they are in terms of their maturity, make sure they understand they’re always interviewing. There’s some funny words there on number eight: indefatigable connectedness. That’s really talking about how to connect and how to communicate, and one of the highlights of that is the handwritten note.

The art of the handwritten note, asking great questions. And number 12: lifelong learning, so let’s take 8 and 12. I’ve always told my clients, and I tell the students now, if they will send one handwritten note every workday for the rest of their lives, they cannot fail. So that means they can take off Saturday and Sunday if they want. If they were at one a day, they absolutely cannot fail in life. And number 12, if they’ll read one book a month, that they’re not required to read–nobody’s making them read it–and they can pick the genre one book a month, they’re gonna have a hard time failing. And if they read two books a month, they’re going to be a C level or they’re going to own their own business one day. That’s how important lifelong learning is. Warren Buffett, I mentioned him earlier in a poll question, he was at 500… he reads 500 pages a day, that’s well beyond my ability there. And I feel like I read a lot. Let’s go to the next poll question.

How many Americans or step parents / step children are part of some type of blended family? What do you think?

Well, we’re showing you, we got A again. A pretty bright audience here today, they’re right on it and showing the answer there please… It’s 100 million; that’s an amazing number when you think about it. Almost a third of all Americans have had some experience that has put them in this category. I can speak to this a little bit fortunately, or unfortunately; I’m using something bad that happened to our family, and we’ve made it into a good thing. So, the four children that you saw there, that’s a blended family. The two boys are mine from my first marriage. I lost my wife to cancer about 13 years ago when the boys were a little younger than they were there and then those are my stepdaughters. So a couple years after my wife passed away, I married her best friend, and it just happens that our four children actually grew up together not knowing that they were going to be siblings, but we’ve got pictures of them when they’re six months to four years old together playing and so it was really kind of a very unique situation, and and we were blessed to have that opportunity and continue to be.

But there are unique issues in stepfamilies you know, and this is where I kind of bring C3 in because they’ve taught me some things over the years about how they do planning for stepfamilies. So, if we’re thinking about relationships and how we build those and how we pour into those, I think we have to look at this because one out of three of your clients, and or in your family, perhaps you yourself are affected by things that happen throughout our lives that create relationships that are a little more difficult on the next slide.

Carolyn: I would just add that from our experience, the tools and techniques that we as advisors use, the trust, the partnerships, the gift of closely held business stock, that you now have these relationships that are just not family, but they’re also tied with financial assets. And so when I’m thinking about what you call those soft skills, I really like your word critical. I mean it’s when you’ve got so many different boundaries that are being crossed and sometimes perhaps there were good intentions in creating all those entities, but then the education of how to live inside those entities was probably not the time spent on it that families could have benefited from.

Jim: Yeah absolutely, excellent comments; and in fact, I want to speak to what you just said on our next slide. You can see there’s a term that I heard a while back and I’ve used it a lot – it’s when it comes to our children, whether it’s your stepchildren (not natural children), it’s this idea of treating them equally. I think it’s kind of a Western idea, maybe an American idea… treating them equally; but I add equally, but uniquely. And so, if you think of that equally, uniquely right, so financially, we think all right, if we’re giving a million dollars, they each get $250, 000 just to use simple math. Well, maybe they have an inheritance from their grandparents. Well, guess what, the grandparents, you know my boys have different grandparents than my girls and I call them my girls even though they’re technically my step-daughters. I just call them girls; we don’t, but we don’t ever use the word step, but there’s nothing wrong with using it just to identify that relationship, but that becomes an issue. The grandparents aren’t obligated to treat everyone the same, but they can treat them uniquely.

You know, the next one, I think you’ve alluded to this one Carolyn–businesses versus cash–so you know there are a couple of my four kids who have an interest in what I’m doing for a living. The other two will never be involved in anything that I do on the financial side of things, so you know, how does that work how- how do you deal with that recreational real estate I bring.

We’ve got a wonderful ranch at home out in Bonham, Texas; and I live further away now, so I don’t get up there as much. (Although I’m leaving in about three hours to go there for the big game in Dallas this weekend), but we’ve had that issue; what are we, you know, when we’re no longer here. I mean that was something that my boys and I owned and it was it was kind of in honor of their mother that we bought it and built it. Well, obviously, we want our new family to use that. Well, you know what happens to it? How’s it disposed of? How can we use insurance? I call it “the great equalizer.” And I know that you know this better than I do, that there are gaps that can be filled.

We can bring more equality and it gives us the freedom to make some decisions that will help them. In fact, I learned from Celeste recently, and I haven’t even thought about this, it makes perfect sense, but you know sometimes families break up with divorces and there’s a divorce decree and all this kind of thing. Well, you know there’s specialty financial instruments such as disability insurance of the father that is paying support for the children/stepchildren. There’s just so many tools that can be used from a financial point of view. Insurance to me is always, I started in that industry almost four decades ago, and it’s always been just so it’s a miracle whoever invented it back in England with the ships and the underwriting it was just an amazing thing and it comes into play here with with the work that you all do so well.

Todd: Jim, appreciate that. That’s a good place to pause for just a second and remind everybody that if they have a question for you, we’ll have a few minutes at the end to either put that in the Q&A or the chat room, and we’ll try to allow a few minutes at the end to address those questions.

Jim: And so we are on the home stretch. The video was talking about a relay race earlier, and I hope you’ll be able to maybe send that video out to the participants since we had that little tech issue. As we head down the home stretch here, I’d like to talk about, and I love this, it’s from a book called Lighting the Torch, and I’ve changed these questions a little bit to kind of fit you know this conversation, but I think they’re such powerful questions. I want to give them to you. We don’t have a lot of time to talk about them; maybe you have a question about them I can help you with, but I just want you to see these questions for just a moment so think of these. I call them “client super questions.” Here’s the first one: How would you describe a life that is complete? How would you describe a life that’s complete and think about that yourself. How would you answer that question? Here’s the second one, we’ll break these down a little bit more in just a second. The doctor has given you three to five years to live. They’re going to be healthy years, so I guess that’s the good part. It’s not gonna be terrible. What will you do with the time remaining? And then the third client super question, the doctor has given you one week to live. The question, what would remain undone? Oh that’s a boomerang! That’s a 180 from the other question, so let’s break those down. Go to the next slide and see this first one again… how would you describe a life that is complete? So think about this: whatever answer they give, the answer is going to give a full scope of their dreams and their aspirations.

Next please. There it is, the answer gives a full scope to dreams and aspirations the way I put it there in red they are going to take inventory of their lives.

That is a powerful thing to have a client take inventory of their life, so that’s question one

Let’s go to question two and unpack that one just for a bit all right here it is again the doctor’s giving you three to five years or it’s not going to be too difficult physically, but what will you do with the remaining time the time there’s remaining all right go to the next the answers go deeper they revolve around family and other relationships or life streams that have been postponed or neglected so you see what’s happening here. The first question is to outline what your best life looks like and now we’re going deeper and saying what have you postponed or neglected if you could click one more time I think I have one more comment yeah in my own words this is the second chance question and then the third question again reviewing it the doctor is giving you one week to live what would remain undone.

Answer shows how well the client is living and what is what truly matters to them and here’s how I would put it it shows future regrets and a chance to avoid them now we’ve gone through that quickly, but I can assure you if you go in the direction of those again what I’m calling super question you are going to have conversations that open up opportunities for you to meet their needs and opportunities for them to leave a much richer legacy because of the things that are going to come out at that point I’m going to skip the next slide I just had it in here in case we had time and let’s go uh to this last quote and then I’ll take some questions I love this who are we or who we are we are all the link to the past and to the present and a bridge to the future tim kimmel says I’ll put that very well.

Past, present, and future. Alright Todd, I’d be happy to open it up to any questions.

Todd: Great, as we’re gathering the poll questions, Jim, you might touch on your daily blog – which I thoroughly enjoy this morning – it was about road trips and getting out of a car and things to do to avoid the aches and pains of driving. After driving an hour and a half from east Texas this morning I couldn’t help but think of those as I crawled out of the car!

Jim: It is not so much a blog, as it is a daily excerpt that I send out – it’s not really my words. I practice what I preach in terms of reading. I’m reading a little bit less right now simply because I’m writing. If anybody on the call has ever written a book, you know how encompassing that can be. My daily pieces are really bringing together excerpts of the many books that I read. As you mentioned Todd, today’s was about taking a long trip and the posture you should have when you drive. I’m driving four and a half hours a little later today. I thought that was a timely one for me and shared it. But if anybody would like to receive it, please can give them my email and put them on the list.

Todd: Another thought occurred to me when I watched your video with the batons was the adage of the comparison to a football player – working with a quarterback instead of the receiver.

Jim: Right

Todd: That might resonate with a lot of folks right now. Especially with your football behind you.

Jim: Yes, that is an Aggie football signed by Jackie Sherrill. I’ve got a story about when I just walked in his office unannounced one day, but I’ll save that for another time.

As the quarterback for our clients’ financial lives, we want to put the ball in the best possible spot where they can catch it. They might not have the skill to catch it if we don’t make a good toss. Why not make it a perfect toss? Then, hopefully, some of these questions we have been talking about today – plus the idea of pouring legacy into the next generation – maybe it will help your clients turn and run down the field a little further, rather than if they had to reach back for the ball.

Todd: And the extension of the analogy that I’ve always felt was appropriate was that most financial coaches, or other coaches, spend their time working with the quarterback. If they did that and ignored the receiver, it does not matter how good the throw was if the receiver wasn’t prepared to catch it and do something with it once he/she got it. Then all the training with the first generation would be naught, if the second and third generations were not prepared to take the legacy and do something effective with it.

Jim: Absolutely, I’ll comment on that. The critical skills have the additional advantage of preparing them for life situations. It is not just a matter of making sure they’re using good words, or telling good stories, or they’re reading, those are all transformative activities. All 12 of those keys transform the kids into being better than who they might have been. That’s the idea behind it.

Carolyn: Jim, I’m curious, when you look at different generations, how have you seen the use of technology – the cell phones, the iPads? Enhancing or distracting from the ability to use those critical skills?

Jim: You know what’s interesting, I love my iPad. I do all my reading on it because it allows me to highlight in different colors. So, The Old School Advantage towards the back of that book when we get into the key about lifelong learning, I have a little code where different colors mean different things if you’d like to use it.

The irony is here – I’m a guy entering my seventh decade of life and I love that reading technology. However my students who are 19 to 22 (I see on Tuesday and Thursday) do not like reading on electronic devices at all! When I hand out The Mentor at the first of the semester – they all want the hard copy! Nobody opts for the digital copy. I feel like that is because they have become so inundated and so distracted that when they read, they want to be able to concentrate. I have the self-discipline to forget about the texts and the emails while I’m reading on my iPad. They maybe do not, so that’s a little bit of an ironic twist that maybe is unexpected. I asked my publisher a few years ago when digital books were becoming so popular and she told me that about 49% of all books were digital. Two years later I asked her again, expecting that number to have gone up. She told me, instead, that it was down to about 24%! It had gone in the opposite direction. In other words, the public had voted – they had tried digital books and they were going back to hard copy. That is not my opinion, but that’s what is happening. It is good for those of us that are selling hard copies.

Todd: As we are winding down, Rebecca, do we have any questions that have come in?

Rebecca: Yes, we have a couple. The first is, “What are the most important skills to pass on to your kids or grandkids?”

Jim: Lifelong learning. Definitely.

A warm-up conversation. By the way, I called it LAVA because the idea is to warm up a conversation and get it flowing.

I think storytelling is a lost art, so if you can give your kids and grandkids the building blocks of the words and asking great questions and then the storytelling, then those three (learning, warm up conversation, and storytelling) are connected skills. If you can communicate, you can do anything. It doesn’t matter what your degree is in. It doesn’t matter. Those CEOs of Fortune 500 companies are screaming for people that can communicate without using the word “like” three times in every sentence. I know that’s a little harsh, but that’s the reality of it.

Rebecca: We have one more question. Could you recommend some books for clients?

Jim: In fact, I can.

Todd: Besides The Mentor! [laughing]

Jim: Yes, besides the Old School Advantage and The Mentor. Todd, I sent Rebecca a slide with a long list. When I had a practice, we had a client book club and it extended for a while. There are about a hundred books on the list.

I put a red check mark above those that I believe pour into this topic of leaving a legacy. Yes, two of those are my books, but that’s what I wrote them for. You can be the judge. However there are a lot of books that are checked that I know are good, so you don’t have to speculate on whether they’re good enough. There is one in particular that I love to pass on to get kids and grandkids involved, called The Ultimate Gift. That is a great gift to give.

Todd: That actually was turning into a movie and it was a great, great message.

Jim: Yes. There’s a starter kit that’ll keep you busy for a while.

Todd: That’s great, we will share that well.

Jim, thanks very much for your time, for your wisdom, and your input. As I have said, we’ve benefited over the years, and we continue to benefit. Carolyn, in particular, has been good at reviewing your key ideas, images, and concepts. We appreciate those gifts that keep on giving for us.

Our next C&C presentation is November 16 with Catherine Sanderson, who is a professor at Amherst. She is a researcher who talks about the impact of aging, not necessarily physical aging. I’ve heard her speak, and I’ve had conversations with her. She is very, very good. Catherine has written a book called The Positive Shift, and we’ll have some copies of that as well. She is very good and as entertaining an instructor as Jim has been for us today.

We thank everybody for tuning in; and remember, the first three that respond after we close the call will get the book. Unfortunately, it does not apply for people who are watching it from the recorded version. Jim, Carolyn, Celeste, and I thank you again for joining us.

You all should be careful. Stay safe, and we’ll see you next time.

Bye, thank you.

™

™