In his epic novel “The Godfather,” Mario Puzo wrote, “It’s all personal, every bit of business.”

In his epic novel “The Godfather,” Mario Puzo wrote, “It’s all personal, every bit of business.”

Entrepreneurs and owners of privately-held businesses may engage in ventures that are a bit more on the up-and-up than that at the center of Puzo’s novel, but they can all relate to this sentiment. For them, there is very little that separates their business from their personal life (and vice versa).

However, these same business owners often forget that this close relationship applies not solely to the daily goings on of their operations, but also extends to their planning as well. Amid the hustle of launching, expanding, and steering a business, owners often relegate estate planning to a lower priority, exposing themselves to unpredictability, potential disagreements and events from one side of the business/personal divide impacting the other.

An all-encompassing estate plan protects both the personal and business, acting as a blueprint, directing a business through transitions, protecting its future, and conserving the legacy an entrepreneur has diligently built.

At C3 Financial Partners we work with business owners and their advisors to help create personal and business planning that covers every aspect of a business owner’s life.

Challenges in Estate Planning for Business Owners

Business owners grapple with unique obstacles in estate planning, stemming both from the intricacies of their businesses and their deep connections to their ventures. Among these challenges are:

- Valuation of Business Interests: An entrepreneur’s business will likely be the most important asset in their estate, so having an accurate and up-to-date valuation of the business will be key to planning. However, assessing the fair market value of a business is intricate, necessitating specialized knowledge and an evaluation of myriad factors, including financial health, industry shifts, and both tangible and intangible assets.

- Liquidity: A primary focus in personal estate planning is ensuring there is sufficient liquidity at death to cover any taxes, debts, or other expenditures that arise. For business owners, there is a mirror process that must occur to ensure a business has sufficient liquidity to cover any financial obligations a death may create as well as any financial stress resulting from operational interruptions. Combining the two can create unique complications.

- Succession Planning in Family Businesses: Family businesses create their own, unique set of issues as family interests must be balanced with business needs. This requires delicate handling, especially when not all heirs are involved currently in the business or will not be involved going forward.

- Tax Ramifications of Business Transfers: Ownership transitions, whether during life or posthumously, can activate significant tax liabilities. Strategic planning is essential to mitigate these taxes and to adhere to tax laws.

At C3 Financial Partners, we work with business owners and their advisors to identify key challenges that need to be addressed to create a thorough plan covering both their personal estate and business.

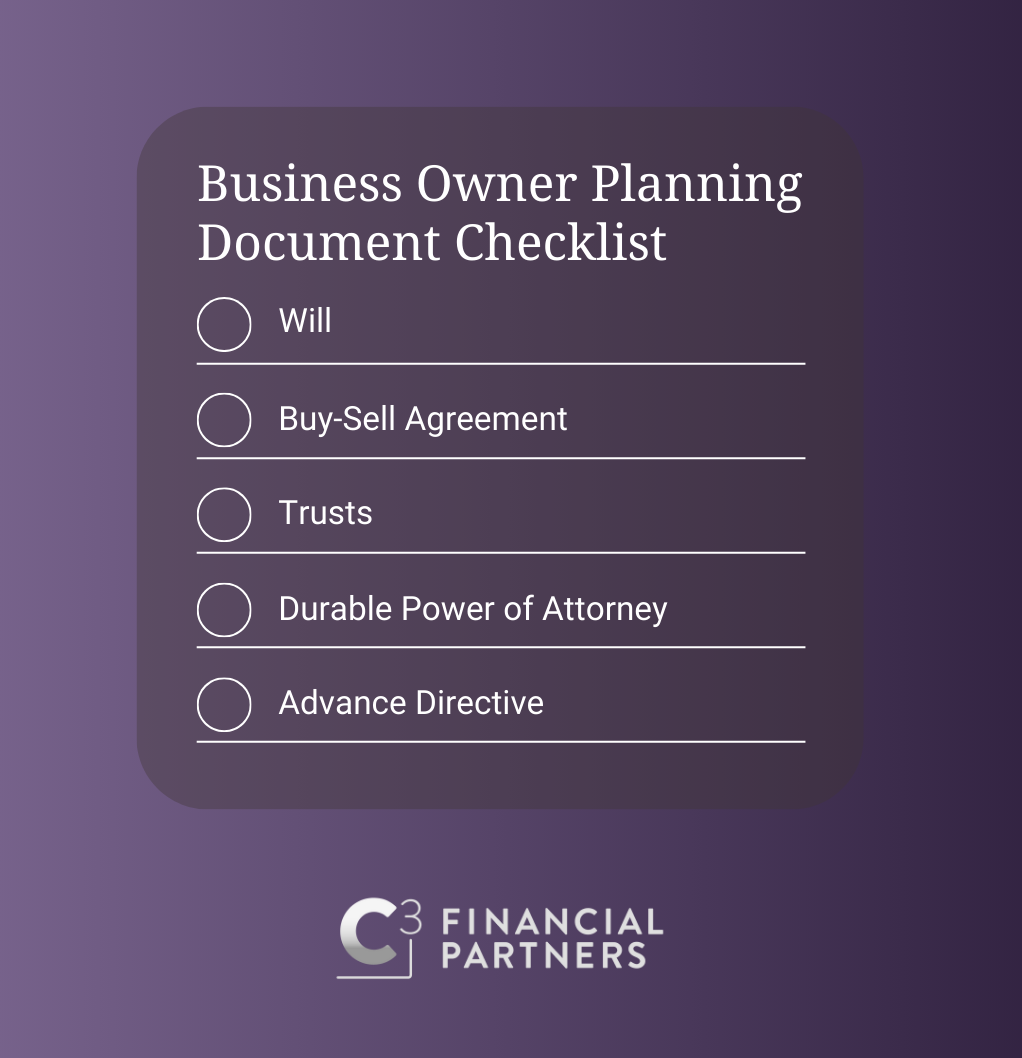

Vital Estate Planning Documents for Business Owners

A well-rounded estate plan for business proprietors should encompass various critical documents, including:

- Will: A will specifies how to distribute assets, nominates an executor for an estate, and appoints guardians for any minor children.

- Buy-Sell Agreement: This document details the procedure for selling or transferring business ownership in the event of a partner’s death or incapacity, averting disputes, and facilitating business continuity.

- Trusts: Trusts offer a mechanism to hold and manage assets for beneficiaries, especially beneficial for family businesses, ensuring that ownership stays within the family while enabling professional management.

- Durable Power of Attorney: This legal instrument authorizes someone to act on your behalf if you become incapacitated, ensuring uninterrupted business operations.

- Advance Directive: Through a living will or health care proxy, you can articulate your medical treatment preferences in case of incapacity, providing clarity and respect for your healthcare decisions.

Incorporating Life Insurance in Estate and Business Planning

The fundamental aspect of how life insurance works, providing liquidity at a time when it is most needed, means it can play a pivotal role in the planning for a business owner and help address some of the challenges outlined above.

For personal estate plans, life insurance offers a means to provide financial security for a family, ensuring that your legacy endures without financial burden. For your family, the liquidity provided by life insurance can help pay any liabilities that arise from your passing, including any estate taxes.

For a business owner, this liquidity can help in additional ways. For example, it can provide the funds necessary for business partners to fulfill their obligations under a buy-sell agreement, ensuring the deceased’s family sees the fruits of an entrepreneur’s work. In a family-owned business, this liquidity can be used for estate equalization, providing a legacy to those heirs who are not going to be part of the business going forward.

As mentioned above, in a business context, life insurance becomes instrumental in funding buy-sell agreements, ensuring that funds are available for the purchase of a deceased partner’s interest, thereby preserving business continuity and stability. Furthermore, life insurance can provide stability in the form of revenue replacement, helping to offset any financial interruptions caused by the loss of a key team member.

Ask for Help

Estate planning is almost always a complicated endeavor, but being the owner of a closely-held business adds another layer of complexity that needs to be accounted for in a fulsome plan. Engaging with skilled professionals, such as estate planning attorneys, tax advisors, and valuation specialists, is paramount to forge a comprehensive plan tailored to your unique situation.

At C3 Financial Partners, we look forward to helping our clients gain clarity in their goals and objectives, confidence that they are making the right decisions, and coordinating with their other advisors.

Securities offered through Valmark Securities, Inc. member FINRA, SIPC. Investment advisory products and services offered through Valmark Advisers, Inc., an SEC Registered Investment Advisor. Representatives may transact business, which includes offering products and services and/or responding to inquiries, only in state(s) in which they are properly registered and/or licensed. C3 Financial Partners is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

™

™