Late-in-life marriages can bring joy, companionship, and, in many situations, another chance at love. Conversely, a late-in-life divorce might mean a dramatic shift for the future financial position of both parties. Both situations come with unique financial and estate planning challenges. Matters related to life insurance, retirement plans, accumulated wealth, estate planning, and future medical expenses need to be addressed for both groups.

At C3 Financial Partners, we collaborate with clients and their advisors on planning for those couples tying the knot or going their separate ways after age 50.

Clarity

The Happy Couple

When deciding to tie the knot later in life, it is essential to address various concerns to ensure a secure and harmonious future together. One party could be bringing more assets or more family members to the union, so financial disparities and family obligations must be addressed.

Life Insurance

Review Existing Policies

Start by evaluating existing life insurance policies. Determine whether they still serve their intended purposes or if adjustments are necessary. It may be that coverage should be increased, if available, to provide financial security for at least one of the spouses and their dependents.

Joint Policies

If additional coverage is needed, a determination should be made as to whether a new policy on one of the spouses or a joint, second-to-die policy, if available, makes more sense.

Retirement Plans

Beneficiary Designations

Update the beneficiaries on retirement accounts, such as IRAs and 401(k)s, to reflect a new spouse. This ensures that assets pass smoothly at death.

Funding

Evaluate if each spouse can benefit from increasing funding to a retirement account, or, if one party is not enrolled in a plan, setting one up to create some financial independence.

Inheritance and Estate Planning

Wills and Trusts

Create or update wills and trusts to ensure assets are distributed according to the wishes of both spouses. Not only do provisions for both partners need to be included but it is likely that any children from previous relationships should be addressed.

Prenuptial or Postnuptial Agreements

Consider a prenuptial or postnuptial agreement to clarify financial rights and responsibilities, protect separate assets, and ensure a fair division of property in case of divorce or death.

Estate Taxes

Consult an estate planning attorney to understand potential estate tax implications, especially if the new couple has substantial combined assets. Explore strategies to minimize estate taxes and maximize joint and individual legacies.

Long-Term Care and Critical Illness

Long-Term Care Insurance

Consider purchasing long-term care insurance to protect assets from the prohibitive costs of nursing homes or in-home care. This can help preserve financial well-being in case one or both spouses require long-term care in the future.

Critical Illness Coverage

Explore critical illness insurance coverage that can provide a lump sum payment upon diagnosis of a serious illness. This can help cover medical expenses and maintain quality of life during challenging times.

Increasingly, those purchasing long-term care and critical illness coverage are going to do so cost-effectively in a hybrid arrangement. Instead of purchasing standalone policies, both coverages can be provided by low-cost riders on cash value life insurance policy. These riders permit the advancement of a policy’s death benefit to pay for this care.

Saying “I do” should kick off a couple’s new life together and come after having at least initially addressed these planning areas. C3 Financial Partners can assist in the unique planning needs for those over 50 who are getting married.

Confidence

The Unhappy Couple

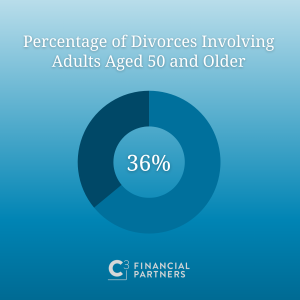

While the incidence of divorce has decreased among individuals in their 20s and 30s, it has seen a notable rise among those aged 50 and above, showing a doubling between 1990 and 2010, followed by a more recent stabilization. While divorce remains more prevalent among younger people, with approximately two-thirds of cases within the under-50 demographic, this shift is still noteworthy. In 1990, only 8.7% of all divorces in the United States involved adults aged 50 and older, whereas by 2019, this percentage had grown to 36%.

This changing landscape presents distinct challenges from both logistical and emotional perspectives, as highlighted by researchers and psychologists. Older adults who decide to separate may have more significant financial assets intertwined, particularly if they married at an early age. Additionally, their shared social connections, spanning decades within religious communities, community organizations, and neighborhood friendships, can further complicate the process. Moreover, the impact on their children, whether they are still youths, teenagers, or adults themselves, varies and can be emotionally taxing.

Financial ramifications are also a significant concern, with women aged 50 and older experiencing a substantial 45% decline in their standard of living, while for men, the decline is 21%. Another study, which involved interviews with 66 individuals who divorced at 50 or older, identified financial worries and loneliness as the top concerns expressed by participants.

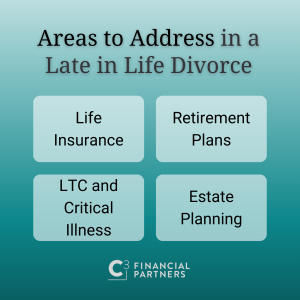

At C3 Financial Partners, we understand that divorce is never easy, but when it happens later in life, it can come with a unique set of challenges. There are steps to take to mitigate the financial complexities from a ‘gray divorce.’

Reassessing Life Insurance

When divorcing later in life, financial obligations may shift significantly. It is essential to review life insurance policies to ensure they align with your new circumstances. Some steps are like those recommended for later in life marriages such as updating beneficiaries and reviewing for adequate coverage. Unique to divorce, there may be situations where second-to-die policies may be divided and ownership reassessed, especially if held in trust.

Managing Retirement Plans

Divorce can impact retirement plans, including pensions, 401(k)s, and IRAs. It is likely that any divorce settlement will call for the division of retirement plans and/or assets. It is critical each party reevaluate if steps should be taken to increase saving to meet retirement income needs.

Alimony may come into consideration as a funding source for retirement savings or, if the payments continue into retirement, as an income supplement.

Inheritance and Estate Planning

Divorce can have a significant impact on estate planning and inheritance and could be financially detrimental to the ex-spouse who might have planned on inheriting family wealth from the family of their former spouse. Trusts, wills, and powers of attorney will all need to be reviewed to reflect the new wishes of each party. Particularly important is making sure wherever a beneficiary is listed, that the beneficiary is not the ex-spouse, unless required in the divorce settlement.

Long-Term Care and Critical Illness Planning

Being on your own means being responsible for your own future medical expenses. Addressing the increasing likelihood of requiring future care is critical. As noted earlier, by purchasing standalone or hybrid coverage, much of the expense related to long term care and critical illness can be met.

An additional consideration for a divorcing couple is whether the spouse with greater assets should purchase long-term care and critical illness coverage on their ex-spouse. This is to keep these expenses, as well as the responsibility for care, from falling onto the shoulders of adult children.

While much of the planning to undertake for a later-in-life divorce is like those getting married later-in-life, the devil is in the details.

C3 Financial Partners works with clients as part of a team of specialized advisors to address the nuances involved with each situation.

Coordination

As with any financial, estate planning and life insurance matters, it is essential to collaborate with experienced financial professionals, including the planning specialists at C3 Financial Partners, to tailor the strategies to individual circumstances and goals. By leveraging these planning opportunities, couples over age 50 who are getting married and those getting divorced will be much happier having dealt with financial challenges before they arise.

At C3 Financial Partners, we look forward to helping our clients gain clarity in their goals and objectives, confidence that they are making the right decisions, and providing coordination with their other advisors.

Securities offered through Valmark Securities, Inc. member FINRA, SIPC. Investment advisory products and services offered through Valmark Advisers, Inc., an SEC Registered Investment Advisor. Representatives may transact business, which includes offering products and services and/or responding to inquiries, only in state(s) in which they are properly registered and/or licensed. C3 Financial Partners is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

The material contained in the newsletter is for informational purposes only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. The information provided has been derived from sources believed to be reliable, but is not guaranteed as to accuracy and does not purport to be a complete analysis of the material discussed.

™

™