Life insurance is often purchased for a specific purpose, crossed off the financial “to-do” list, and tucked away. Although simple in concept, a life insurance policy can be a complex financial instrument. Like other assets, it needs to be monitored to be certain that it is still appropriate for defined goals and performing according to expectations.

Life insurance is often purchased for a specific purpose, crossed off the financial “to-do” list, and tucked away. Although simple in concept, a life insurance policy can be a complex financial instrument. Like other assets, it needs to be monitored to be certain that it is still appropriate for defined goals and performing according to expectations.

Current Assumption Universal Life policy (CAUL) scenarios are generally presented to clients using the interest rate in effect at the time the policy is purchased. These illustrations assume the interest rate stays constant for the life of the contract. For example, in the 1980s, illustrations typically projected a fixed annual rate of return between 10% and 12%. In 2021, they are closer to 3%.

Double-Edged Sword of Declining Interest Rates

Today, many CAULs are at risk due to years of historically low interest rates. Under closer review, it becomes clear that life insurance policy interest rates have actually been declining for decades. This long-term decline in interest rates has created what we call a “double-edged sword” for CAUL.

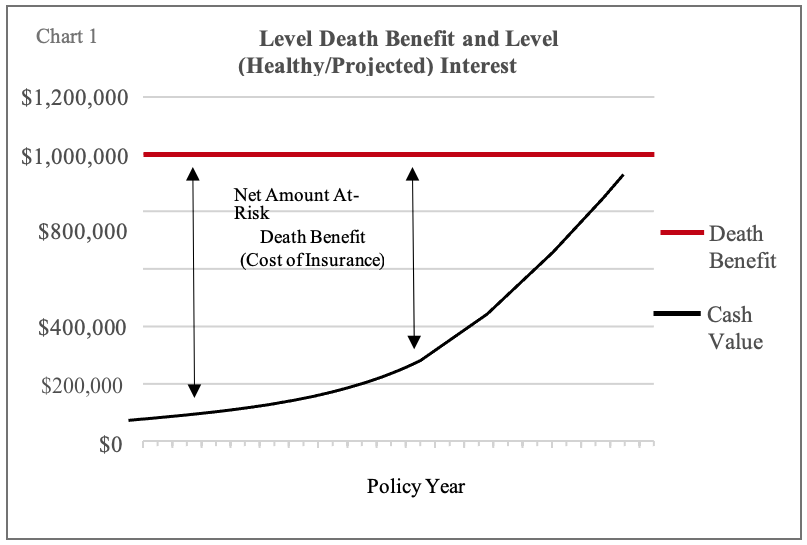

Premiums paid into CAULs are placed into a policy cash value account from which mortality and policy charges are deducted and interest earned is credited. Each year, mortality charges are recalculated based on the current age of the insured and the “net amount at risk.”

Net amount at risk is defined as a policy’s death benefit minus the policy’s cash value (see Chart 1). As their bond and mortgage portfolios’ earnings have declined, carriers have had no choice but to decrease their interest crediting rates.

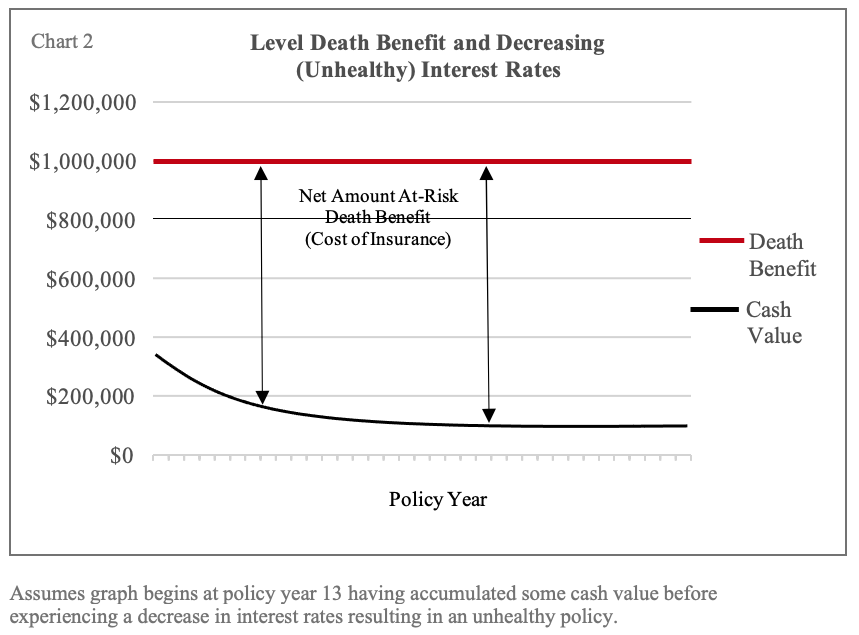

This is how the double-edged sword is created: cash values decline due to less interest being credited to the policy, while simultaneously, mortality charges increase due to a combination of the increased age of the insured and the increased net amount at risk (see Chart 2).

If the cash value is insufficient to cover the expenses, the life insurance policy will terminate (die) unless additional premiums are paid, or the death benefit is reduced.

A Real-Life Example of Life Insurance

Recently, an advisor asked us to review the following universal life policy.

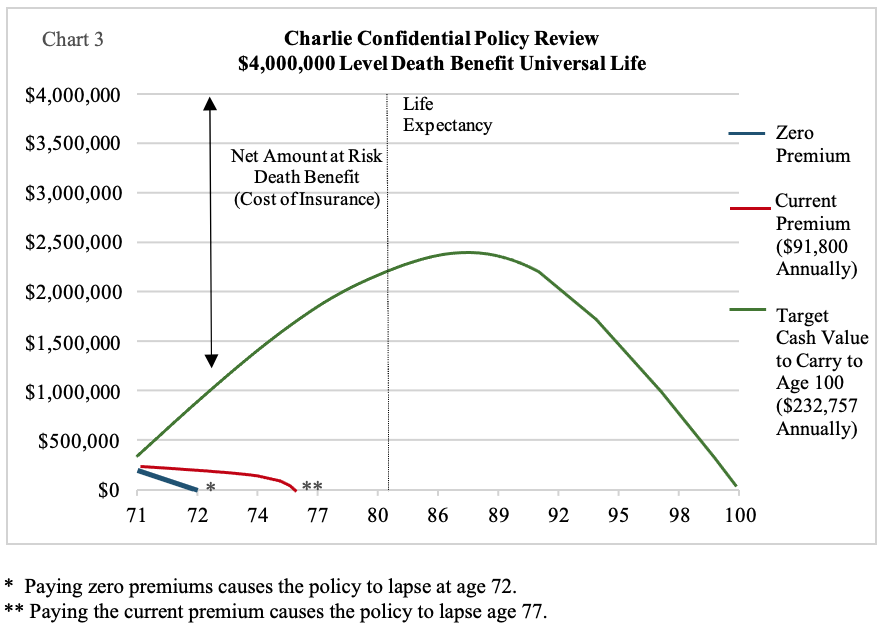

In 2010, a husband (age 62, standard non-smoker) purchased a CAUL policy to provide financial security for his spouse. The policy, with a $4 million death benefit and an annual premium of $91,800, is illustrated.

By 2020, the policy’s crediting interest rate was 4% (the policy’s minimum guaranteed interest rate). The net amount at risk was $3,742,000 ($4 million death benefit less $258,000 in cash value). Assuming the 4% interest rate continued, the policy was projected to perform as follows (see Chart 3):

- If no further premiums were paid, the policy was projected to lapse in the 10th policy year (insured’s age 72).

- If the current premium of $91,800 was continued, the policy was projected to lapse in the 15th year of the policy (insured’s age 77). Note, the insured’s life expectancy is approximately age 82.

- If the policy were to be in-force to age 100, as originally designed, annual premiums would need to increase to $232,757.

Where From Here?

In addition to reporting on the financial rating of the client’s insurance carrier and its role in shaping the situation, we reviewed the policy projections with the advisor and explained that his client had the following options:

- Continue to monitor the life insurance policy and keep it ‘as is’ while recognizing that it might lapse (die) before the client.

- Keep the policy and increase the premiums and/or reduce the face amount.

- Surrender the policy for its current cash value.

- Investigate the secondary (life settlement) market for a possible sale.

If the client’s original goal of financial security for his spouse is still important, he can also consider replacing the policy.

Key Message: Current information gives clients the clarity to move forward with their planning decisions.

Estate Planning Is a Process:

Checklist for Regular Review

In our conversations with clients, as with the life insurance review, we emphasize that creating an estate plan is not an isolated event that is completed and then set aside until needed. It is a process that, for maximum effectiveness, requires regular review. Family events, changes in tax laws, and financial windfalls are only a few of the reasons estate plans should be reviewed in detail on a regular basis.

Each component of an estate plan has features that should be periodically examined, including life insurance. Here is a checklist of reasons to review your coverage.

| Purpose | Income, debt repayment, buy-sell planning, estate taxes, philanthropy |

| Underwriting | Improved health or lifestyle changes, increases in longevity |

| Taxes | Federal estate and income tax changes/increases |

| Policy Changes | Borrowing or withdrawing from a policy, assignment to creditors |

| Policy | Owner and beneficiary review |

| Credit Quality | Carrier’s financial ratings |

| Crediting Rates | Request an in-force ledger against original projections |

| Independence | Verify whether the insurance professional is an independent or a captive agent |

™

™