As the old saying goes, you can’t take it with you. While this saying is usually brought up to justify imprudent spending, many of us prefer for the wealth we accumulate to secure our legacy. A process for planning is a proven and necessary formula for success in this regard.

Greater longevity is adding to the complexity of the wealth planning process. As life expectancies increase, insurance models and financial strategies need to adapt to new circumstances—and they need to be flexible enough to handle changing circumstances over the course of a longer life. Below, we discuss the process of strategic wealth planning, and how to help ensure that you meet your goals.

Longevity and the Life Stages of a Wealth Holder

People are living longer. The percentage of Americans 65 or older increased from 8% to 12% between 1950 and 2000; and by the middle of this century, that demographic is expected to make up nearly 100 million people in the United States.

These trends mean that strategic wealth planning must take an eye toward the long term. As Cicely Maton, an advisor at the Planning Center, said, “The longer we’re living, the more likely we’re going to be having transitions.”

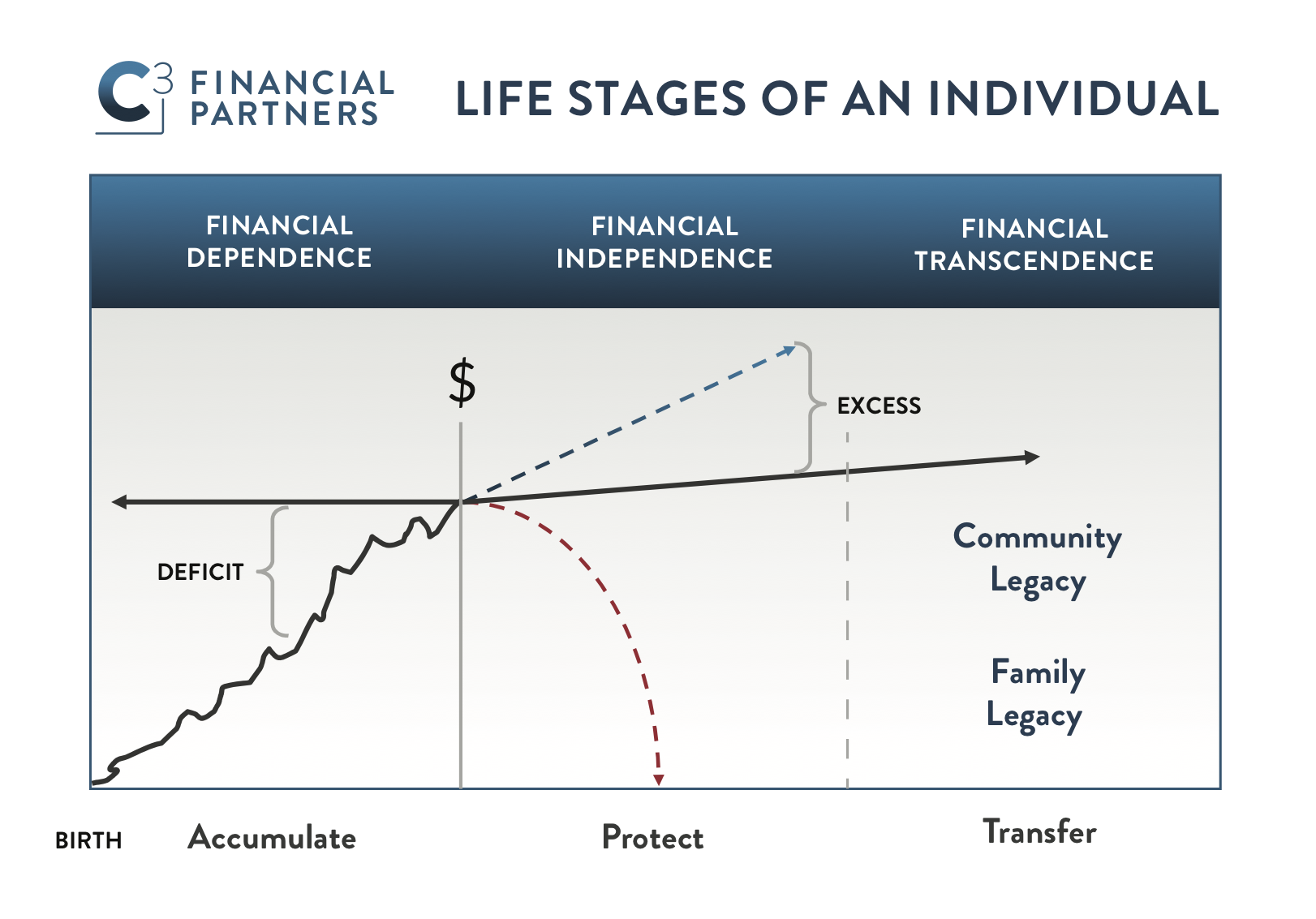

Where do you identify yourself in your wealth planning trajectory? There are three key life stages to wealth planning: Accumulate; Protect; and Transfer. Where do you stand?

Where do you identify yourself in your wealth planning trajectory? There are three key life stages to wealth planning: Accumulate; Protect; and Transfer. Where do you stand?

As we live longer, it is increasingly important to identify what stage of wealth planning we are in, and to communicate that candidly to our advisors.

This frame of reference may help wealth holders and their advisors to quickly get on the same page. As changes occur to health, family, financial situations, tax laws, etc., this framework for timely communication becomes even more important.

Accumulation Phase: At birth, we all begin the process of accumulating assets. For some it occurs quickly through work, investment and/or inheritance. Others may take a slower path, replete with peaks and valleys, good years and not-so-good years. If you continue to feel that there is a “gap” between where you are (financial dependence), and where you want to be (financial independence) you may identify as being in the accumulation phase. For some, this phase lasts a lifetime.

Protect Phase: You may, at some point during your lifetime, identify as being “financially independent” or as having “financial freedom.” With this stage often comes the desire to “protect” what has been accumulated and not create a deficit that would return you to the accumulation phase.

Transfer Phase: The third and final stage is when your wealth is transferred to the “someone” or “something” we care about. This process may begin during our lifetime and take the form of personal gifts and donations to the community. Or, it may be delayed until our death. But it will happen at some point, whether you are prepared for it or not.

Discuss Your Plan Today

The thing is, there’s always a plan. If you don’t do explicit wealth transfer planning during your lifetime, the government already has one in place for you when you die. The wealth you leave behind will be divided between your family and, possibly the government, in the form of taxes. But you can choose to have control over when and to whom your wealth is transferred. Proper planning secures your choices and helps ensure that your wishes are followed. Stated another way, the wealth transfer planning process begins with identifying the gap between where you are and where you want to be, and then having a plan to close that gap. In order to do that, you need to be able to identify what stage of wealth you’re in. Only then can your advisory team help you close the gap.

Creating a Strategic Wealth Plan: “Why” Before “How”

What is your current life stage? Is this where you want to be? Are there gaps you would like to close? Perhaps this is the first time you are formalizing a strategic wealth plan. Or maybe you’re revising an existing plan to adapt to new circumstances. Either way, deciding what stage you are in is ultimately up to you, not your advisor or anyone else.

The key is, there are no set milestones for when a wealth holder moves from one stage to the next. Deciding what stage you are in is up to you, not your advisor or anyone else. With clarity on where you are, your team can begin to coordinate and provide feedback/information/ideas, and to design a process for you to make “wise choices” with confidence.

Next, focus on articulating your “why” (what goals are most important to you). With a clear definition of your “why,” your advisory team is best positioned to provide the “how” (options) for your review. Ultimately, this should be a process for you to make “wise choices” with confidence.

Assembling an advisory team that has your best interest at heart is key! With your permission, your team can openly coordinate to bring forward the best ideas for achieving your goals.

As a reminder, your wealth transfer planning is not an event; it is a process. Life is ever-changing. Our health, family situations, and the laws that govern our wealth are evolving. Building in flexibility and options is key. So, as circumstances change, you have the freedom to make new decisions.

Conclusion

Start with identifying your current life stage, reflect on your “why” before looking at options, and build/communicate with your advisory team. Clarity ● Confidence ● Coordination – The 3Cs!

™

™