Divorce can be upsetting and overwhelming. Even an amicable divorce can cause financial challenges when you consider the cost of establishing and maintaining two individual households. There are a lot of moving parts during and after a divorce, and life insurance tends to be an afterthought.

For couples going through a divorce, life insurance can help protect the assets accumulated over the course of a marriage. While every divorce will have a different set of financial challenges, life insurance can be a crucial component of a divorce settlement.

C3 Financial Partners works with advisors and their clients who are faced with decisions regarding existing life insurance policies and the need for new coverage resulting from a divorce.

Clarity

A division of assets and property is a primary focus of a divorce action. Life insurance is one of those assets, and it tends to be one of the largest unmanaged and least understood assets. Working through life insurance as part of a divorce does require some effort, as decisions need to be made about cash value, if it exists, who the beneficiaries will be going forward, and who will pay for the policy, among other things.

A division of assets and property is a primary focus of a divorce action. Life insurance is one of those assets, and it tends to be one of the largest unmanaged and least understood assets. Working through life insurance as part of a divorce does require some effort, as decisions need to be made about cash value, if it exists, who the beneficiaries will be going forward, and who will pay for the policy, among other things.

There are several possible options regarding life insurance in a divorce:

- Policies can voluntarily remain in effect to provide financial insurance for children or a spouse.

- Policies can be cashed out and the cash value, if it is considered a marital asset, can be divided among both spouses.

- A policy may be required to remain in force as part of a settlement if ordered by the courts. It can be considered part of alimony or child support.

- A new policy may be issued to replace an existing policy because it more aligns with the needs of both sides going forward. For example, a whole life policy may be replaced with a term policy because coverage only needs to be in place for a specified amount of time, usually until children turn either 18 or 21.

- An existing cash value policy may be split into two policies.

- Term policies may be converted to permanent single life or a survivorship policy.

- The value of an existing policy could be realized from a life settlement.

- Ownership of policies may be transferred from one spouse to the other for various reasons. It might be to ensure premiums continue to be paid, for example.

In most situations, it makes sense to bring together a team of advisors, including an attorney, financial specialist, and a life insurance professional from C3 Financial Partners, to determine the best options for each unique situation.

Confidence

Married couples often purchase life insurance to cover existing or anticipated debts or other financial responsibilities. Even when a couple decides to separate, these obligations may remain. That’s why existing life insurance considerations can be an important component of a divorce.

When involved in a divorce proceeding, one of the first steps to take is to make an inventory of all current insurance policies. How existing policies are handled will be determined by each person’s current and future life insurance needs as well as any court-mandated coverage.

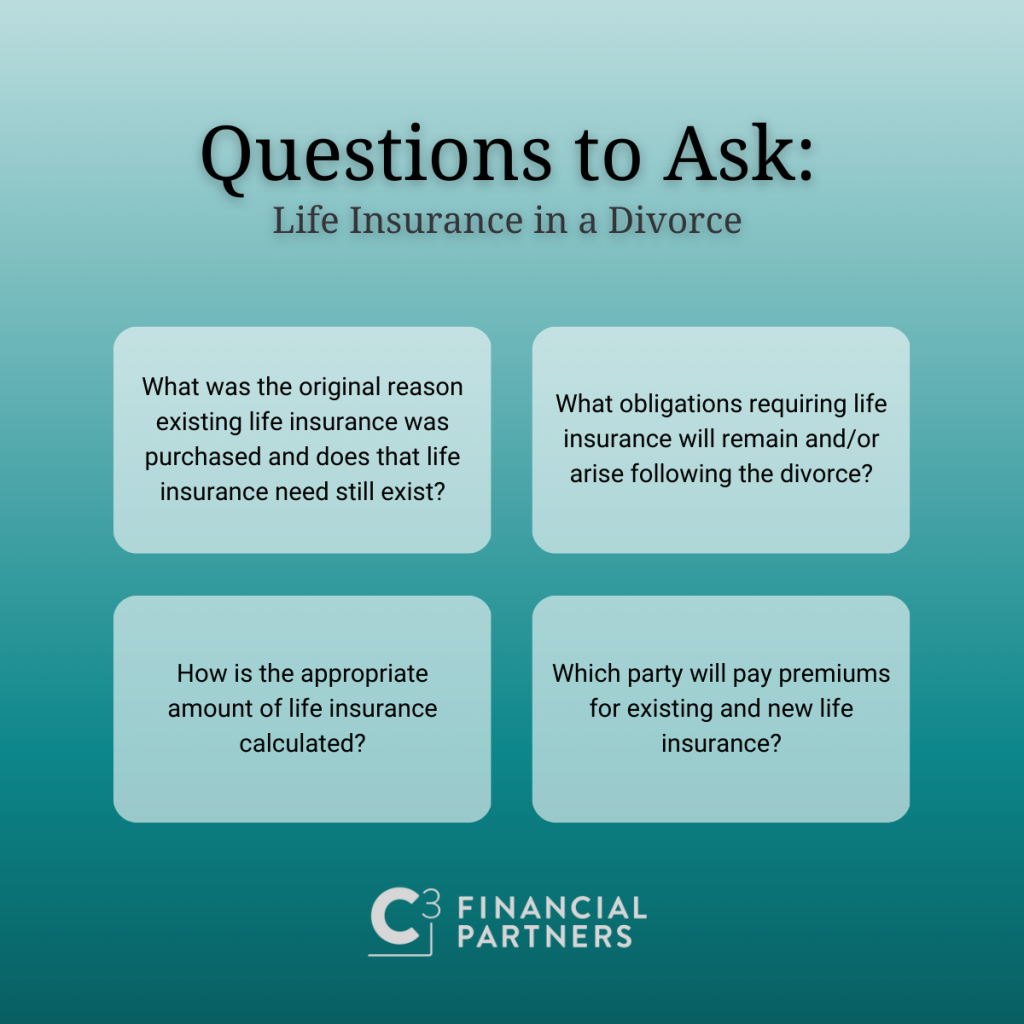

The life insurance specialists at C3 Financial Partners help clients and their advisors answer these questions in determining the future purpose of existing and new policies in the context of divorce:

- What was the original reason existing life insurance was purchased and does that need still exist?

- What obligations requiring life insurance will remain and/or arise following the divorce?

- How is the appropriate amount of life insurance calculated?

- Which party will pay premiums for existing and new life insurance?

While marital assets are often split equally between the two parties, a court might determine that one spouse must make monthly alimony or child support payments to the other. These payments will ensure that the children are provided for, and the dependent spouse is appropriately compensated after the divorce.

Generally, if there is a child support or alimony obligation, the court will require the spouse paying the support to have life insurance in place. If the spouse making payments already has a policy such as a group life insurance policy, the opposing attorney may require them to keep it.

If they don’t have a policy, they may have to purchase life insurance to ensure there’s still financial support if they die.

One consideration often ignored during divorce proceedings is future long-term care costs. If an ex-spouse incurs considerable long-term care (LTC) or disability costs in the future, the financial responsibility may fall to the former couple’s children. In addressing this concern, paying for either a standalone LTC or disability policy, or including a LTC or disability rider on a life insurance policy, for an ex-spouse may be financially prudent to protect adult children from taking on this liability.

One consideration often ignored during divorce proceedings is future long-term care costs. If an ex-spouse incurs considerable long-term care (LTC) or disability costs in the future, the financial responsibility may fall to the former couple’s children. In addressing this concern, paying for either a standalone LTC or disability policy, or including a LTC or disability rider on a life insurance policy, for an ex-spouse may be financially prudent to protect adult children from taking on this liability.

There is even the ability to purchase a unique individual disability policy that continues support payments should the insured spouse responsible for such payments become disabled.

Also, where there are existing term policies and permanent ongoing coverage is needed or mandated, the term policies should be reviewed for any conversion provisions. It could be that, with no medical underwriting, the existing term policies can be converted for cash value life insurance designed to last the lifetime of either party.

For life insurance policies that are no longer needed, instead of surrendering those policies, there may be a way to recognize significant monetary value from them. In some situations, a life settlement can provide immediate payment for permanent cash value and term policies.

When a divorce occurs, many advisors trust the team at C3 Financial Partners to simplify the management of the life insurance process and to identify and implement any appropriate life insurance solutions.

Coordination

Once ex-spouses part ways, many previous obligations may remain and some new ones will likely arise, making divorces a financially and emotionally complex ordeal. C3 Financial Partners can assist in organizing existing policies and seeking out the most efficient life insurance strategies for new coverage. We look forward to helping our clients and their advisors gain clarity in their goals and objectives, confidence that they are making the right decisions, and coordination with other advisors.

Valmark Securities supervises all life settlements like a security transaction and its’ registered representatives act as brokers on the transaction and may receive a fee from the purchaser. Once a policy is transferred, the policy owner has no control over subsequent transfers and may be required to disclosure additional information later. If a continued need for coverage exists, the policy owner should consider the availability, adequacy and cost of the comparable coverage. A life settlement transaction may require an extended period to complete and result in higher costs and fees due to their complexity. Policy owners considering the need for cash should consider other less costly alternatives. A life settlement may affect the insured’s ability to obtain insurance in the future and the seller’s eligibility for certain public assistance programs. When an individual decides to sell their policy, they must provide complete access to their medical history, and other personal information.

Securities offered through Valmark Securities, Inc., member FINRA, SIPC. Investment Advisory Services offered through Valmark Advisers, Inc. a Registered Investment Advisor, 130 Springside Drive, Suite 300, Akron, Ohio 44333-2431, 1.800.765.5201. C3 Financial Partners, LLC is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

™

™